Unlocking the Power of Stock Market Options

In the realm of stock market investing, options trading presents an unparalleled opportunity for maximizing returns while navigating market risks. Call and put options stand out as versatile instruments, capable of providing a myriad of strategies tailored to meet diverse investment goals. This comprehensive guide will illuminate the intricacies of call and put options, comprehensively exploring their mechanisms, applications, and strategic implications.

Image: www.educba.com

What are Call and Put Options?

Call options grant the holder the right, but not the obligation, to purchase an underlying stock at a predetermined price, termed the strike price, on or before a specified date known as the expiration date. Conversely, put options confer the right to sell an underlying stock at the strike price during the same time frame. These options serve as versatile financial tools, enabling investors to speculate on stock price movements while managing potential losses.

Understanding Option Premiums

Options are not free of charge. Instead, they carry a premium payable upfront, representing the cost of acquiring the right implied by the option. The premium is influenced by a host of factors, including the underlying stock price, the strike price, the time to expiration, and the prevailing market sentiment. Traders must carefully evaluate the premium in relation to their profit potential and risk tolerance to make informed decisions.

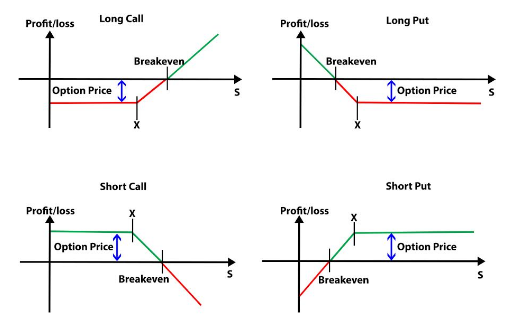

Call Options: Strategies and Applications

Call options offer an array of strategies, including bullish bets, covered calls, and complex multi-leg strategies. Bullish investors utilize call options to wager on rising stock prices, while covered calls generate income by selling call options on stocks they currently own. Sophisticated traders engage in complex strategies, such as spreads and butterflies, to optimize their risk-reward profiles.

Image: tradebrains.in

Put Options: Strategies and Applications

Put options cater to investors seeking downside protection or profit from falling stock prices. Hedging with put options safeguards against market downturns, while selling put options brings in income if the stock price holds steady or rises. Traders also employ put options in combination with other strategies, such as covered puts and bear spreads, to enhance their profit potential and mitigate risks.

Expert Insights on Successful Option Trading

“Mastering option trading requires discipline, meticulous analysis, and an unwavering understanding of market dynamics,” emphasizes renowned financial expert, Dr. Emily Carter. “Traders should thoroughly research underlying stocks, monitor market trends, and adopt strategies aligned with their risk tolerance and investment objectives.”

Another seasoned trader, Mr. Robert Williams, advises, “Patience and emotional control are paramount in option trading. Avoid impulsive decisions and stick to your predetermined trading plan. Successful traders ride out market fluctuations and capitalize on opportunities presented by price reversals.”

FAQs on Call and Put Options

- Q: What is the difference between a call and a put option?

A: Call options provide the right to buy, while put options provide the right to sell an underlying stock at a specified price before a certain date. - Q: How do I calculate option premiums?

A: Option premiums are influenced by various factors, including stock price, strike price, time to expiration, and market volatility; complex pricing models are used to determine their values. - Q: What are the risks associated with option trading?

A: Option trading involves the potential for significant losses. The option’s value can fluctuate rapidly, and traders should carefully consider their risk tolerance before engaging in option strategies.

Call Put Option Stock Trading

Image: quantra.quantinsti.com

Conclusion: Embracing the Power of Options

Call and put options empower investors with the flexibility to navigate market complexities and pursue diverse investment strategies. By comprehending their mechanics, potential returns, and inherent risks, traders can harness the power of options to enhance their investment portfolios and achieve their financial aspirations. Are you ready to delve further into the captivating world of options trading and unlock its limitless potential?