In the labyrinthine realm of financial markets, a plethora of instruments beckon investors, each promising a unique path to financial gains. Among these instruments, call options stand out as a tantalizing tool that leverages the potential for exponential returns, yet also carries inherent risks. To delve into the depths of call option trading, we unravel its intricacies, reveal its nuances, and empower you to make informed decisions in this captivating world.

Image: www.onlinefinancialmarkets.com

Unveiling the Essence of Call Options

Simply put, a call option bestows upon its holder the right, but not the obligation, to purchase an underlying asset at a predetermined price, known as the strike price, on or before a specified expiration date. This privilege, however, comes at a cost, payable upfront as a premium. The premium reflects the market’s assessment of the probability of the underlying asset rising above the strike price, creating the opportunity for profit.

Exploring the Inner Workings of Call Options

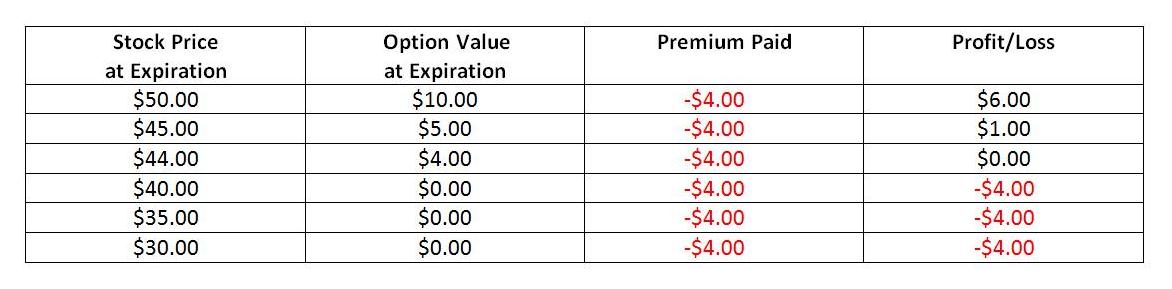

To illustrate the mechanics of call options, consider the following example:

- You purchase a call option on 100 shares of Apple stock with a strike price of $150, expiring in three months.

- The current market price of Apple stock is $145, and you pay a premium of $5 per share, totaling $500.

- If Apple’s stock price surges to $160 before expiration, you can exercise your right to purchase 100 shares at the strike price of $150, even though the market price is higher.

- You can then immediately sell those shares in the market at $160, earning a profit of $1,000 ($160 – $150) per share, minus the premium paid.

Unleashing the Potential of Call Options

The primary allure of call options lies in their potential for amplified returns. If the underlying asset’s price rises dramatically, the value of the call option can skyrocket, multiplying your initial investment. This leverage can be a potent force for investors seeking exponential growth, but it also magnifies potential losses.

Image: followthemoney.com

Navigating the Risks Associated with Call Options

While call options offer the allure of vast rewards, they also carry inherent risks. If the underlying asset’s price falls below the strike price, the option becomes worthless, and the premium paid is lost. Additionally, time decay can erode the value of call options as expiration approaches, regardless of the underlying asset’s price performance.

Factors Influencing Call Option Premiums

Understanding the factors that influence call option premiums is crucial for savvy traders. These factors include:

- The price of the underlying asset: Higher asset prices generally result in higher premiums.

- Volatility: Increased volatility enhances the probability of price fluctuations, leading to higher premiums.

- Time to expiration: Longer times to expiration provide more opportunities for the asset’s price to move, increasing the premium.

- Interest rates: Higher interest rates tend to reduce call option premiums because they increase the cost of carrying the underlying asset.

Navigating the Purchase and Sale of Call Options

To purchase a call option, you enter into an agreement with an “option writer,” who assumes the obligation to sell the underlying asset to you if you choose to exercise your right. Conversely, to sell a call option, you become the “option writer,” granting the purchaser the right to buy the asset from you. The intricate dance between buyers and sellers in the options market creates a dynamic and often lucrative environment.

Real-World Applications of Call Option Trading

Call options extend beyond theoretical concepts, offering practical applications in various investment strategies:

- Speculation: Traders can speculate on the future price movements of assets, aiming to profit from price increases.

- Hedging: Investors can use call options to mitigate potential losses on other investments or portfolios.

- Income generation: Selling call options can generate premiums, providing an income stream.

What Is Call Option Trading

Conclusion

Call option trading presents a captivating yet challenging arena for investors seeking exponential returns. By understanding the intricacies of this instrument, balancing its potential rewards against inherent risks, and navigating market dynamics astutely, you can harness the power of call options to enhance your investment strategies. We encourage you to continue exploring this vast and ever-evolving world of financial instruments, empowering yourself with the knowledge and skills to make informed decisions and navigate the complexities of the market with confidence.