When it comes to the financial realm, understanding the mechanisms of option pricing is paramount. Whether you’re a seasoned investor or a novice seeking knowledge, the Black-Scholes model holds immense significance. This mathematical model lays the foundation for pricing options, powerful financial instruments that offer an array of opportunities and potential risks. Delving into the intricacies of option pricing can unlock a world of financial decision-making and pave the way for profitable trading endeavors.

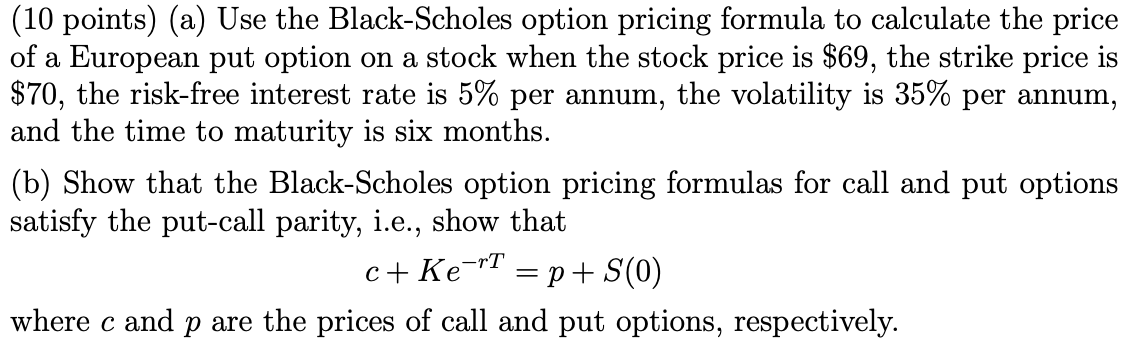

Image: www.chegg.com

To help you embark on this journey, we present a comprehensive guide to Black-Scholes option pricing and trading. We will meticulously delve into the concepts, history, and real-life applications of this foundational model. By the end of this article, you will possess a solid understanding of option pricing, empowering you to make informed trading decisions and navigate the ever-evolving financial landscape with confidence.

Fundamentals of Black-Scholes Model

The Black-Scholes model, conceived by Fisher Black and Myron Scholes in the 1970s, revolutionized the world of option pricing. This intricate yet elegant model mathematically calculates the theoretical value of an option contract. Utilizing a host of factors, including the underlying asset’s price, time to expiration, volatility, and risk-free interest rate, the Black-Scholes model unravels the intrinsic value embedded within an option.

The model’s versatility extends to both call options, which confer the right to buy an underlying asset, and put options, granting the right to sell. By incorporating reliable statistical assumptions and robust mathematical formulations, the Black-Scholes model delivers precise option prices, aiding traders in determining their inherent worth and making informed decisions.

Understanding Option Greeks: The Key Variables

Option Greeks are a set of intricate parameters that provide traders with valuable insights into an option’s behavior and sensitivity to various market dynamics. These Greeks, including Delta, Gamma, Theta, Vega, and Rho, each quantifies a specific aspect of an option’s characteristics, allowing traders to fine-tune their strategies with precision.

For instance, Delta measures the sensitivity of an option’s price to changes in the underlying asset’s price. Theta, on the other hand, gauges the impact of time decay on an option’s value. By comprehending the nuances of Option Greeks, traders can assess and manage risk, optimize their trading strategies, and enhance their potential for profitability.

Trading Options with Confidence

Mastering the art of option trading requires strategic planning, meticulous execution, and prudent risk management. Before embarking on this exhilarating journey, it’s imperative to possess a comprehensive understanding of the different types of options available, their specific attributes, and the nuances of each trading strategy. Thorough preparation and a solid educational foundation will prime you for success in the dynamic world of option trading.

One effective approach to honing your trading skills is to practice using paper trading platforms, which simulate real-world market conditions without the financial implications. This risk-free environment enables you to test trading strategies, refine your decision-making process, and cultivate a disciplined approach before venturing into actual trading.

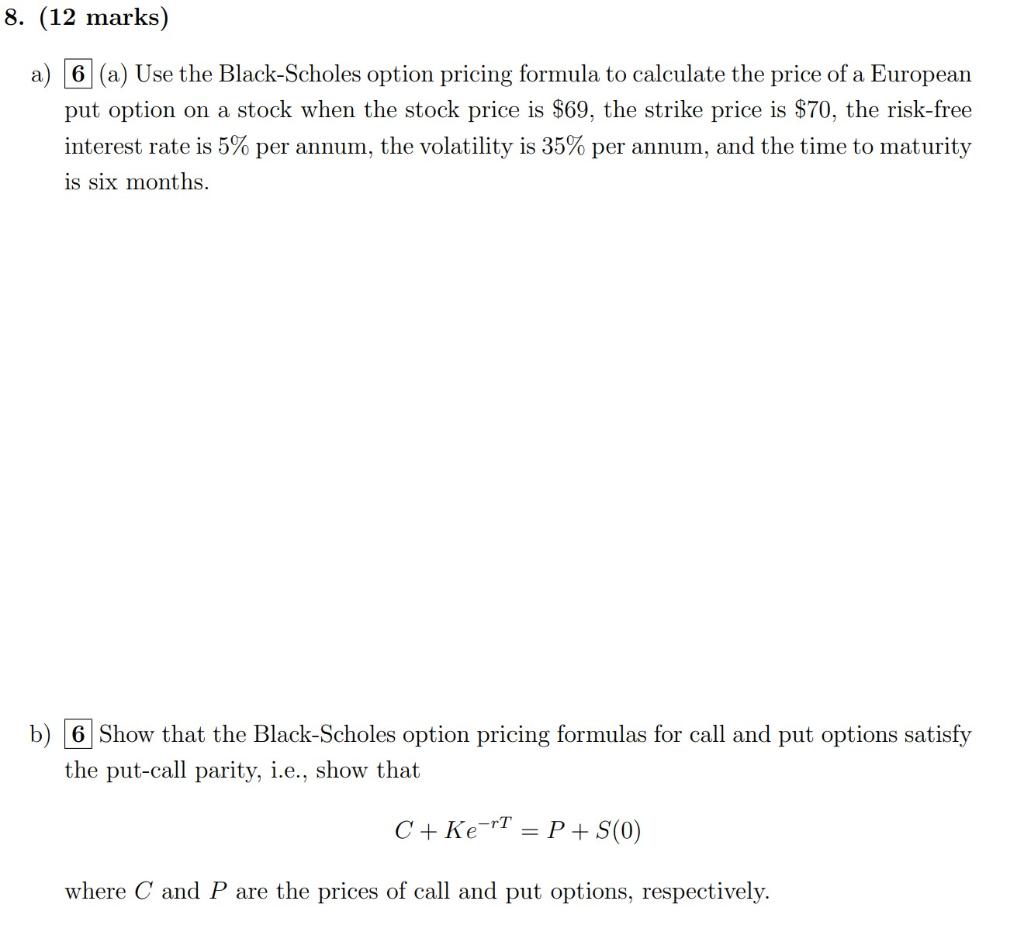

Image: www.chegg.com

Expert Tips for Option Trading Success

To navigate the complexities of option trading, consider these invaluable tips from seasoned experts.

- Thorough Research: Cultivate a deep understanding of the underlying asset’s history, market dynamics, and potential risks.

- Strategic Selection: Carefully select options that align with your trading strategy, risk tolerance, and investment objectives.

- Meticulous Entry and Exit: Execute trades at opportune moments based on predefined entry and exit points. Avoid chasing the market or making impulsive decisions.

- Disciplined Execution: Adhere to a well-defined trading plan that outlines your strategy, risk management parameters, and profit targets.

- Emotional Mastery: Maintain composure during market fluctuations. Resist making rash decisions driven by fear or greed.

- What is the difference between a call option and a put option?

A call option grants the buyer the right to buy an underlying asset at a predetermined price, while a put option grants the right to sell. - How long do option contracts last?

Expiration dates for options contracts vary, typically ranging from a few weeks to several months. - What factors affect option prices?

Option prices are influenced by the underlying asset’s price, time to expiration, volatility, risk-free interest rate, and other market conditions. - How can I minimize the risks associated with option trading?

Risk management strategies, such as selecting appropriate options, hedging, and setting well-defined profit targets, can help mitigate risks. - Is option trading suitable for all investors?

Option trading involves inherent risks and requires a strong understanding of financial markets. It is crucial to assess your risk tolerance and investment goals before engaging in option trading.

Frequently Asked Questions on Option Trading

Here are some common questions and their respective answers to further illuminate the world of options trading.

Basic Black-Scholes Option Pricing And Trading Pdf Download

Conclusion

Delving into the realm of option pricing and trading can be an enriching and potentially lucrative endeavor. Whether you are a seasoned investor seeking to refine your strategies or a novice aspiring to understand the fundamentals, this comprehensive guide has provided a strong foundation for your path forward. Remember, knowledge is power, and continuous learning is the key to staying ahead in the ever-evolving financial landscape.

The discussion on the Black-Scholes model, Option Greeks, expert tips, and frequently asked questions has equipped you with a wealth of information to propel your trading endeavors. However, it’s essential to note that this guide merely serves as a starting point. To deepen your knowledge and become a successful option trader, immerse yourself in further research, seek professional guidance, and practice your trading skills diligently.

And now, we ask you, the esteemed reader, a poignant question: Has this guide ignited within you a desire to explore the world of option pricing and trading? If so, let the journey begin! With dedication, persistence, and an unwavering quest for knowledge, you have the potential to conquer the financial markets and unlock the full power of options trading.