In the realm of finance, the excitement of option trading captivates traders’ hearts with its allure of speculative possibilities. These financial instruments, granting the right but not the obligation to buy or sell an underlying asset at a predetermined price on a specific expiration date, offer traders a chance to harness market fluctuations to their advantage. Yet, understanding when the trading day for these options commences is paramount to seizing these opportunities.

Image: app.jerawatcinta.com

Before delving into the intricacies of option trading, let us first venture back to a captivating moment that ignited my curiosity in this captivating domain. It was during an animated conversation with a seasoned trader, who spoke of the exhilaration and potential rewards that awaited those who ventured into the world of options. Intrigued, I couldn’t resist delving deeper into this fascinating realm, unraveling its intricacies and uncovering the opportune moment when option trading commenced each day.

The Dawn of Option Trading: Breaking the Dawn of Market Opportunities

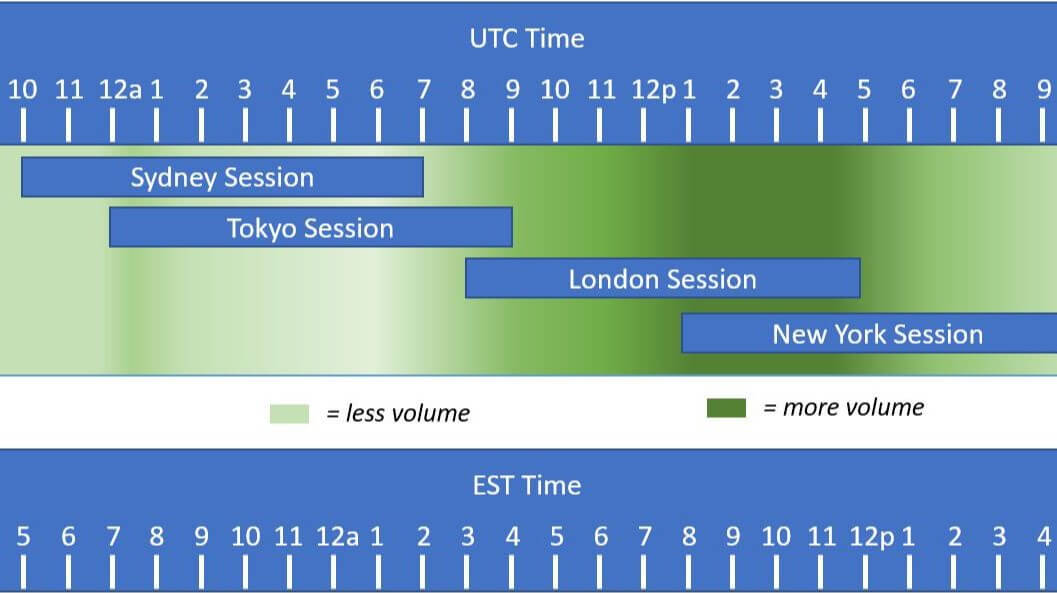

As the financial markets stir from their slumber, the opening bell signals the commencement of option trading, ushering in a flurry of activity and strategic maneuvers. In the United States, the standard opening time for options trading aligns with the commencement of the regular equity market trading hours, typically set at 9:30 AM Eastern Time (ET). This synchronized start ensures that traders possess ample time to evaluate market conditions, analyze trends, and formulate their trading strategies before the markets open. However, it’s worth noting that some exchanges may have varying opening hours for options trading, so it’s always advisable to check with the specific exchange you intend to trade on.

The initial moments of option trading are often characterized by heightened volatility, as traders swiftly react to overnight news and events that may have transpired while the markets were closed. This volatility can present both opportunities and challenges, as traders navigate the dynamic market landscape, seeking to capitalize on price movements while managing their risk exposure.

Decoding the Complexities of Option Contracts: A Journey into Financial Options

To fully grasp the essence of option trading, it’s imperative to delve into the fundamental building blocks of these financial instruments – option contracts. These contracts bestow upon their holders the right, but not the obligation, to buy or sell a specified underlying asset at a predetermined price, known as the strike price, on or before a predefined expiration date. This flexibility empowers traders to tailor their strategies to their unique risk tolerance and market outlook.

Options come in two primary flavors: calls and puts. Call options grant the holder the right to buy the underlying asset at the strike price, while put options confer the right to sell the underlying asset at the strike price. The interplay between the strike price, expiration date, and the underlying asset’s price dictates the value and potential profitability of an option contract.

Navigating the Maze of Option Trading Strategies: Unveiling the Trader’s Toolkit

The realm of option trading encompasses a myriad of strategies, each catering to specific market conditions and risk appetites. These strategies can be broadly classified into two categories: bullish strategies and bearish strategies. Bullish strategies, as the name suggests, are employed when traders anticipate an increase in the underlying asset’s price, while bearish strategies capitalize on anticipated price declines.

Among the most popular option trading strategies are covered calls, cash-secured puts, bull calls, and bear puts. Covered calls involve selling a call option while owning the underlying asset, while cash-secured puts entail selling a put option while possessing the necessary funds to purchase the underlying asset at the strike price. Bull calls and bear puts, on the other hand, involve buying call options or put options, respectively, in anticipation of favorable price movements.

Image: www.angelone.in

Expert Insights: Harnessing the Wisdom of Seasoned Traders

Venturing into the realm of option trading can be likened to traversing a labyrinth, where seasoned traders serve as invaluable guides, illuminating the path with their wisdom and experience. Here are a few expert tips to enhance your option trading journey:

- Mastering the Art of Risk Management: Embracing risk management as the cornerstone of your trading strategy is paramount. Options trading carries inherent risks, and a disciplined approach to risk management helps mitigate potential losses.

- Thorough Market Analysis: In-depth market analysis forms the bedrock of successful option trading. Diligently scrutinize market trends, economic data, and company-specific news to make informed trading decisions.

- Patience and Discipline: Option trading demands patience and unwavering discipline. Resist the allure of impulsive trades and adhere to your predetermined strategy.

Remember, option trading is a skill honed through experience and continuous learning. By embracing these expert insights, you can elevate your trading prowess and navigate the complexities of the options market with greater confidence.

Frequently Asked Questions: Illuminating the Path to Option Trading Mastery

- Q: What is the optimal time to enter an option trade?

A: The ideal time to enter an option trade depends on your trading strategy and market conditions. However, many traders prefer to execute trades shortly after the market opens, when liquidity is typically higher. - Q: How long do option contracts typically last?

A: Option contracts have varying expiration dates, ranging from weekly to monthly or even longer-term expirations. The expiration date is clearly stated in the option contract. - Q: What factors influence the price of an option contract?

A: Multiple factors influence the price of an option contract, including the strike price, time to expiration, volatility of the underlying asset, and market sentiment.

What Time Option Trading Start

https://youtube.com/watch?v=CpBvtNWDK3o

Conclusion: Embracing the Excitement and Potential of Option Trading

Option trading presents a captivating realm of opportunity, empowering traders to harness market fluctuations and potentially enhance their financial prospects. By comprehending the intricacies of option contracts, familiarizing yourself with the nuances of trading strategies, and gleaning insights from seasoned traders, you can embark on your option trading journey with confidence.

As you navigate the dynamic waters of the options market, remember that knowledge is your compass and discipline is your anchor. Embrace the learning curve, continually refine your strategies, and let the excitement of option trading fuel your financial aspirations.

Are you ready to delve into the exhilarating world of option trading? Share your thoughts and questions in the comments below. Let’s ignite a dialogue that further illuminates this fascinating financial domain.