Trading options is a fascinating but often complex world. Unlike stocks, where you simply buy or sell shares, options involve a contract that gives you the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. Navigating this terrain requires a thorough understanding of the rules that govern options trading.

Image: www.ino.com

Defining Options and Their Significance

An option contract is an agreement between two parties: the buyer and the seller. The buyer pays a premium to the seller for the right to buy (in the case of a call option) or sell (in the case of a put option) the underlying asset at a predetermined price known as the strike price. The contract also has an expiration date, after which the option becomes worthless.

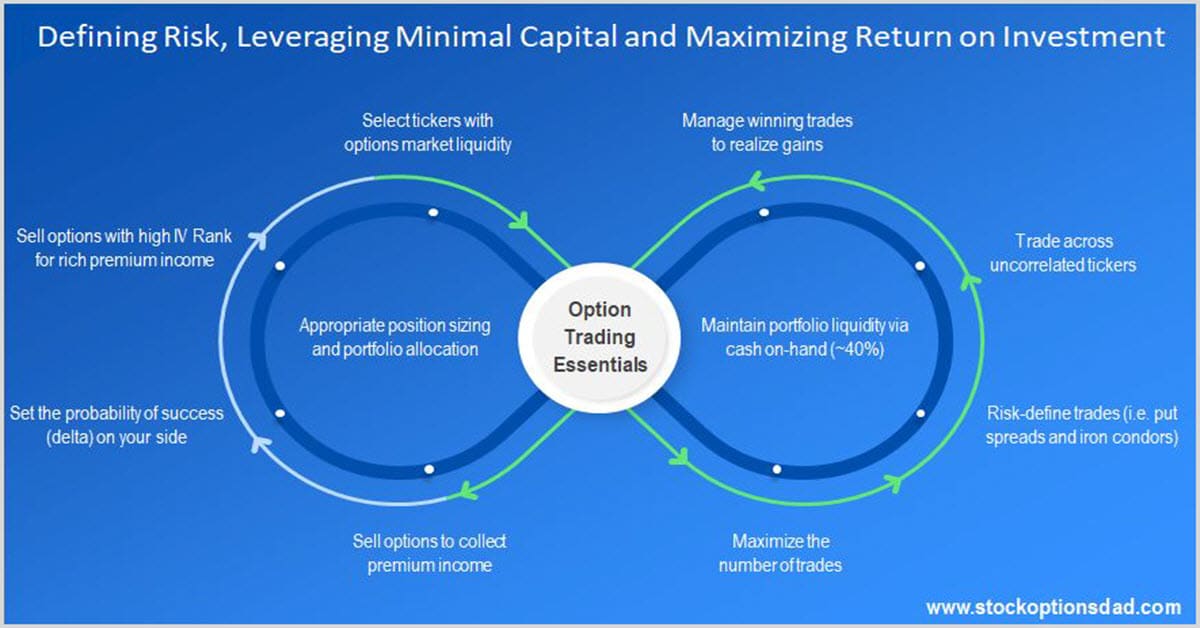

Options trading plays a crucial role in financial markets, providing investors with various strategies for managing risk, speculating on price movements, and generating income. They offer a wide range of flexibility, allowing investors to tailor their trades to their specific risk appetite and financial goals.

Key Rules of Options Trading

- Understand the Two Types of Options:

- Call Option: Grants the right to buy the underlying asset at the strike price.

- Put Option: Gives the right to sell the underlying asset at the strike price.

- Expiration Date and Exercise:

- Options have a limited lifespan and expire on a predefined date.

- The buyer can exercise the option any time before the expiration date at the strike price.

- Strike Price and In/Out of the Money:

- The strike price is the price that determines whether an option is “in the money” or “out of the money.”

- An option is in the money when the market price of the underlying asset is higher (for call options) or lower (for put options) than the strike price. Otherwise, it is out of the money.

- Option Premium and Intrinsic Value:

- Option premium is the price paid by the buyer to the seller for the contract.

- Intrinsic value is the difference between the current market price and the strike price, representing the potential profit if exercised immediately.

- Assignment and Settlement:

- If an in-the-money option is exercised, the buyer has the right to demand that the seller delivers (call option) or takes (put option) the underlying asset.

- Settlement typically occurs two business days after exercise via physical delivery or cash equivalent.

- Early Exercise and Margin Requirements:

- Options can generally be exercised before the expiration date, but early exercise is not always beneficial.

- Trading options on margin requires meeting specific net worth and income requirements.

- Market Volatility and Leverage:

- Options prices are heavily influenced by market volatility, which measures the rate of price changes.

- Options offer leverage, meaning they magnify the potential profits and losses.

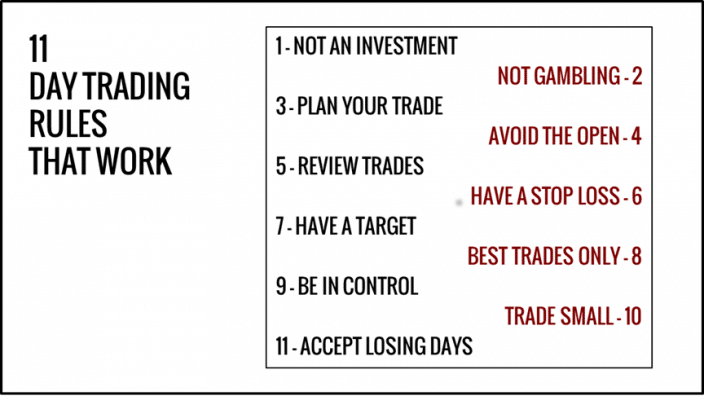

Additional Considerations for Successful Options Trading

- Educate Yourself: Thoroughly understand the risks and rewards involved in options trading before entering the market.

- Choose a Reputable Broker: Select a broker who provides reliable trading platforms, low commissions, and educational resources.

- Manage Risk Effectively: Use stop-loss orders to limit potential losses and consider hedging strategies to reduce overall risk.

- Monitor Your Positions: Track your open positions closely and adjust your strategy as market conditions change.

- Seek Professional Advice: If navigating the options market proves overwhelming, consider seeking guidance from a financial advisor.

Image: scuba-dawgs.com

Trading Options Rules

Image: scallywagandvagabond.com

Conclusion

Understanding the rules of options trading is essential for investors seeking to harness the opportunities this market offers. By familiarizing yourself with these guidelines, you can increase your chances of success and navigate the complexities of this dynamic financial landscape. Remember, educating yourself, managing your risks, and staying informed are key ingredients for thriving in the world of options trading.