In today’s rapidly evolving financial market, options trading has emerged as a potent tool for investors seeking to enhance their portfolios. Among the diverse types of options, call and put options hold significant prominence, providing distinct strategies for profiting from market movements. This article delves into the intricate world of call and put options, examining their mechanics, applications, and the factors that shape their value.

Image: pediaa.com

Call Options

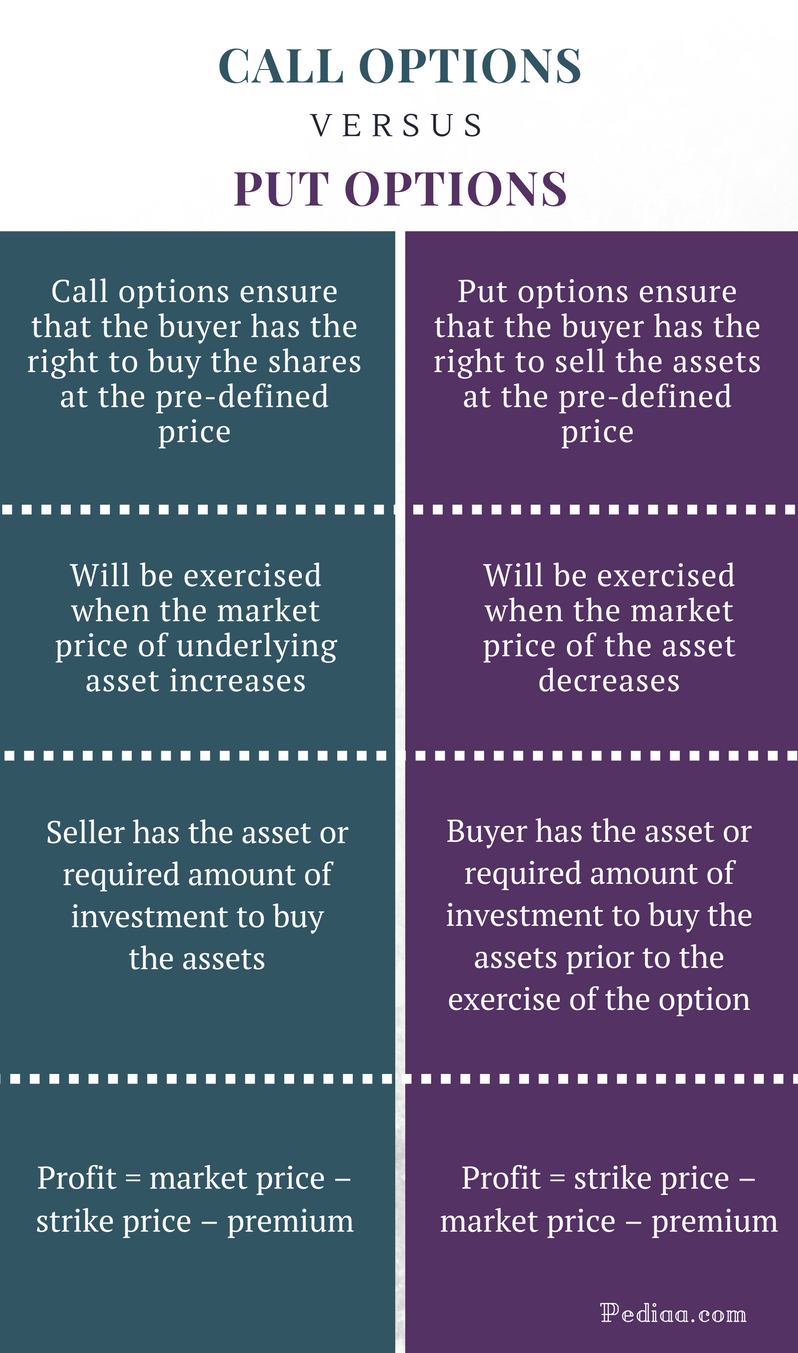

Definition: A call option grants the buyer the right, but not the obligation, to purchase an underlying asset at a predetermined price (strike price) by a specific date (expiration date).

When to Buy: Traders purchase call options when they anticipate an increase in the underlying asset’s price. By exercising the call option, they can secure the asset at the agreed strike price, potentially profiting from the price appreciation.

Put Options

Definition: A put option confers the right to sell an underlying asset at a set price on or before a specified date. Put options gain value when the underlying asset’s price declines.

When to Buy: Traders buy put options when they forecast a decrease in the underlying asset’s value. Exercising the put option allows them to sell the asset at the locked-in strike price, offsetting potential losses.

Understanding Option Pricing

The value of an option is influenced by several factors, including:

- Underlying asset price: The price of the underlying asset directly correlates with the option price.

- Strike price: The difference between the underlying asset price and the strike price determines the option’s profitability at expiration.

- Time to expiration: Options with longer time frames tend to carry a higher premium due to the increased likelihood of favorable market fluctuations.

- Volatility: Options are particularly sensitive to market volatility, with higher volatility increasing the option’s value.

Image: tradebrains.in

Strategies and Applications

Options trading offers investors a wide array of strategies, enabling them to customize their risk and return profiles. Some common strategies include:

- Covered calls: Selling a call option on an underlying security that the investor already owns.

- Cash-secured puts: Securing a put option with cash, allowing the investor to purchase the asset at a fixed price if the price falls.

- Iron condors: A combination of call and put options with different strike prices to profit from a narrow range in the underlying asset’s price.

Expert Tips and Advice

Seasoned options traders advocate for a disciplined approach, emphasizing the importance of:

- Understanding the underlying asset: Familiarizing oneself with the mechanics and risks associated with the asset.

- Managing risk: Utilizing techniques such as stop-loss orders and diversification to mitigate potential losses.

- Educating oneself: Continuously seeking knowledge and staying informed about market trends.

FAQ

What is the difference between an option and a stock?

A stock represents ownership in a company, while an option represents a contract giving the right but not the obligation to buy or sell an underlying asset.

Can I make money off options if the market goes down?

Yes, using put options, investors can profit from declines in the underlying asset’s price.

Is options trading risky?

Options trading carries substantial risk and is not suitable for all investors. Proper education and risk management are imperative.

Option Trading Call Vs Put

:max_bytes(150000):strip_icc()/Clipboard01-617b9d39bcc744d691fc612f569587e0.jpg)

Image: www.investopedia.com

Conclusion

Call and put options are powerful derivatives that provide investors with versatile trading strategies. By comprehending the mechanics of these options, discerning when to buy or sell, and employing prudent risk management techniques, traders can harness the potential of options trading to enhance their financial portfolios. Whether you are a seasoned investor or just starting your options trading journey, the insights presented in this article will equip you with the knowledge and wisdom to navigate this dynamic and rewarding market.

Are you intrigued by the world of options trading? Does the prospect of profiting from market movements excite you? Delve deeper into this captivating subject by exploring our comprehensive resource center on options trading, where you will unlock a wealth of information, expert advice, and trading strategies. Empower yourself with knowledge and join the ranks of successful options traders today!