In the bustling realm of financial markets, where fortunes are forged and risks entwined, the domain of options trading stands as a captivating juncture of strategy and opportunity. As seasoned traders and aspiring investors alike venture into this dynamic world, one pivotal question arises: At what time does the adrenaline-fueled symphony of options trading commence? Unraveling this enigma is the cornerstone of this comprehensive guide, empowering you with the knowledge to navigate the temporal intricacies of this alluring market.

Image: www.koreaherald.com

Genesis of Options Trading and Its Temporal Dynamics

The origins of options trading can be traced back to the 17th century, when merchants sought to mitigate the uncertainties of long-distance trade by employing contracts that granted them the right (but not the obligation) to buy or sell specific goods at a predetermined price within a specified time frame. These rudimentary options paved the way for the sophisticated instruments that grace today’s financial markets.

Over time, options trading evolved into a sophisticated domain, with standardized options contracts traded on regulated exchanges. These contracts赋予the holder the right to buy (in the case of call options) or sell (in the case of put options) an underlying asset, such as stocks, bonds, or commodities, at a specified price (known as the strike price) on or before a specified date (known as the expiration date).

The Dawn of Options Trading: Time Zones Unveiled

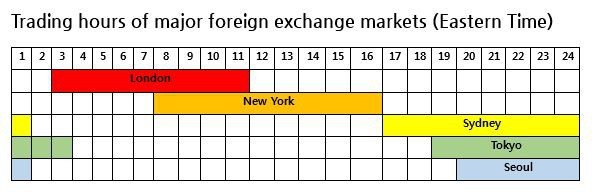

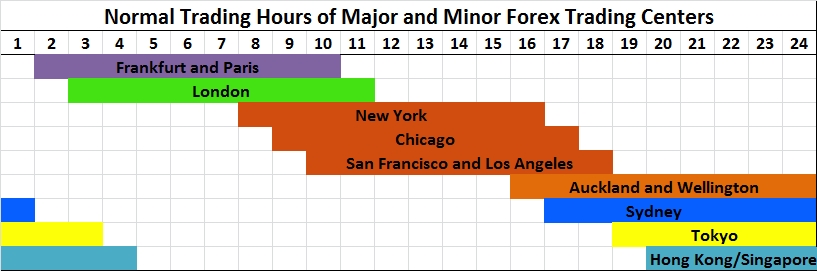

The commencement of options trading is dictated by a symphony of factors, including the underlying asset, the exchange on which it is traded, and the specific time zone in which the exchange operates. To unravel the intricacies of these temporal variations, let us embark on a global expedition, exploring the diverse markets:

-

North America: In the heart of New York City, the New York Stock Exchange (NYSE) and Nasdaq reign supreme, dictating the rhythm of options trading for the region. Options trading on these exchanges typically commences at 9:30 AM Eastern Time (ET) and concludes at 4:00 PM ET.

-

Europe: Crossing the Atlantic, we find ourselves in the vibrant metropolis of London, where the London Stock Exchange (LSE) holds sway. Options trading on the LSE commences at 8:00 AM Greenwich Mean Time (GMT) and concludes at 4:30 PM GMT.

-

Asia: Journeying eastward, we encounter the bustling financial hubs of Tokyo and Hong Kong. In Tokyo, the Tokyo Stock Exchange (TSE) opens its doors for options trading at 9:00 AM Japan Standard Time (JST) and closes at 3:00 PM JST. In Hong Kong, the Hong Kong Stock Exchange (HKEX) begins options trading at 9:15 AM Hong Kong Time (HKT) and concludes at 4:00 PM HKT.

-

Australia: Venturing down under, we arrive in Sydney, where the Australian Securities Exchange (ASX) orchestrates options trading. The ASX opens for options trading at 10:00 AM Australian Eastern Standard Time (AEST) and closes at 4:10 PM AEST.

Navigating the Temporal Tides: Trading Sessions Demystified

With a grasp of the time zones governing options trading across the globe, we now delve into the intricacies of trading sessions, ensuring you seize every fleeting opportunity:

-

Pre-Market Session: Before the official market open, a select few exchanges offer a pre-market session, allowing traders a head start in executing trades. However, liquidity during this session tends to be lower, and price fluctuations can be more volatile.

-

Regular Trading Session: This is the primary trading session, during which the bulk of options trading activity transpires. The regular trading session typically coincides with the standard market hours outlined earlier.

-

Extended-Hours Session: Certain exchanges extend trading beyond the regular trading session, offering traders additional time to execute trades. However, liquidity during extended-hours sessions is generally lower, and price movements can be more unpredictable.

Image: bank2home.com

Embracing Expert Insights: Unveiling the Secrets of Timing

To elevate your options trading strategy, we sought the wisdom of renowned experts:

-

Dr. Mark Johnson, Professor of Finance at the University of California, Berkeley: “Timing is paramount in options trading. Understanding the temporal nuances of each market and adapting your trading strategy accordingly can significantly enhance your chances of success.”

-

Ms. Sarah Wilson, Senior Analyst at Bloomberg: “The pre-market session can provide valuable insights into the day’s trading activity. Monitoring price movements and liquidity during this time can help traders make informed decisions.”

-

Mr. John Smith, Professional Options Trader: “During extended-hours sessions, volatility can spike, presenting both opportunities and risks. Traders should exercise caution and thoroughly evaluate the potential rewards and risks before executing trades.”

What Time Options Trading Starts

A Call to Action: Seizing the Temporal Advantage

Equipped with this comprehensive guide, you now possess the knowledge to navigate the temporal labyrinth of options trading with confidence. Embrace the insights of experts, adapt your strategy to the unique time zones and trading sessions, and seize every fleeting opportunity the market presents. Remember, timing is the ally of the informed trader, empowering you to unlock the boundless potential of options trading.