In the fast-paced world of finance, understanding the intricacies of options trading can be crucial for profitability. Options Greek, a set of metrics used to quantify the risk and sensitivity of options, plays a vital role in decision-making for both professional and individual investors. This detailed guide delves into the concept of trading option Greek, explaining its significance and empowering you to leverage this knowledge for successful trading endeavors.

Image: tradingtuitions.com

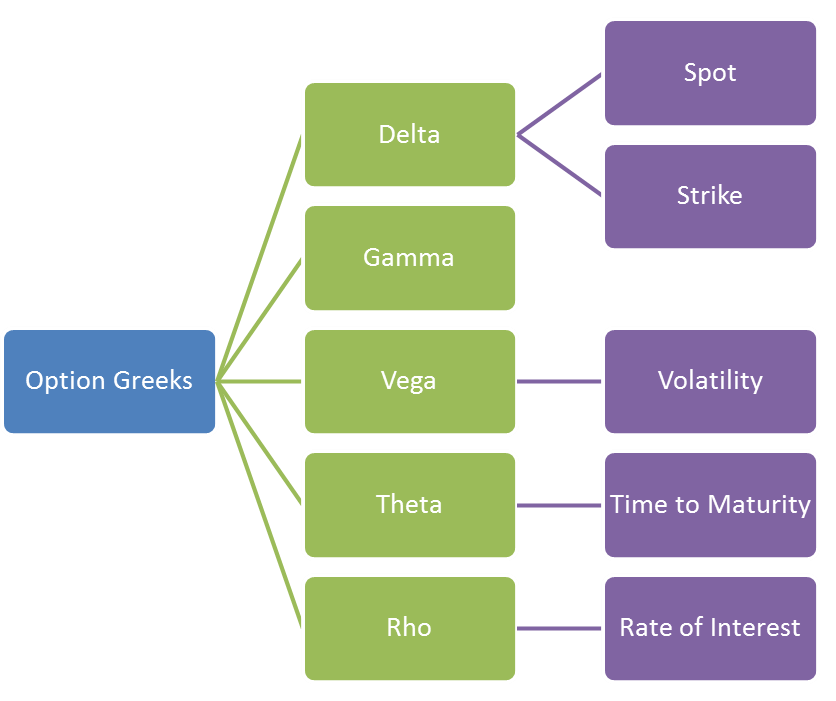

What is Option Greek?

Option Greek is a collection of metrics or measures that are used to assess the market risk associated with option contracts. These metrics quantify the various factors that can influence the value of an option, including the underlying asset’s price, time to expiration, implied volatility, and interest rates. By understanding how option Greek influence the value of an option, investors can make more informed decisions when trading options.

Why is Option Greek Important?

The significance of option Greek lies in their ability to provide investors with a comprehensive understanding of the risks and potential rewards associated with an option strategy. These metrics help investors make informed decisions regarding whether to enter or exit an options trade, as well as how to manage the risk exposure of their positions.

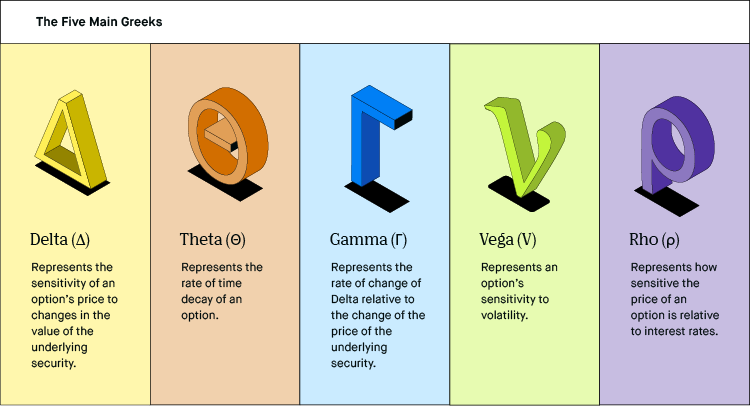

Delta: Measuring Price Sensitivity

Delta is the most commonly used Greek and measures the sensitivity of an option’s price to changes in the underlying asset’s price. A positive delta indicates that the option’s value will increase as the underlying asset’s price rises and vice versa. Understanding delta is crucial for evaluating the direction and magnitude of an option’s reaction to price fluctuations.

Image: www.ainfosolutions.com

Gamma: Assessing Delta’s Sensitivity

Gamma measures the sensitivity of delta to changes in the underlying asset’s price. It indicates how much delta will change for a given change in the underlying asset’s price. A positive gamma indicates that the delta will increase in magnitude as the underlying asset’s price rises and vice versa. Gamma is essential for understanding how the option’s price sensitivity changes over time.

Vega: Capturing Volatility Impact

Vega measures the sensitivity of an option’s price to changes in implied volatility. A positive vega indicates that the option’s value will increase with an increase in implied volatility and vice versa. Vega helps investors assess the potential impact of implied volatility fluctuations on the option’s value.

Theta: Tracking Time Decay

Theta measures the sensitivity of an option’s price to the passage of time. It indicates how much an option’s value will decrease as time passes. Theta is crucial for understanding the importance of time value in options trading and helps investors determine the optimal time frame for their trades.

Rho: Interest Rate Influence

Rho measures the sensitivity of an option’s price to changes in interest rates. A positive rho indicates that the option’s value will increase with an increase in interest rates and vice versa. Rho is crucial for understanding the impact of interest rates on the value of interest-rate-sensitive options, such as bond options.

Trading Option Greek Pdf

Utilizing Option Greek for Trading Strategies

By leveraging the insights provided by option Greek, investors can refine their trading strategies for enhanced profitability. For instance, they can use delta to determine the extent to which an option will hedge against price fluctuations in the underlying asset. Gamma can help investors capture delta’s sensitivity and the potential for exponential profit. Vega allows