Introduction:

Image: marketxls.com

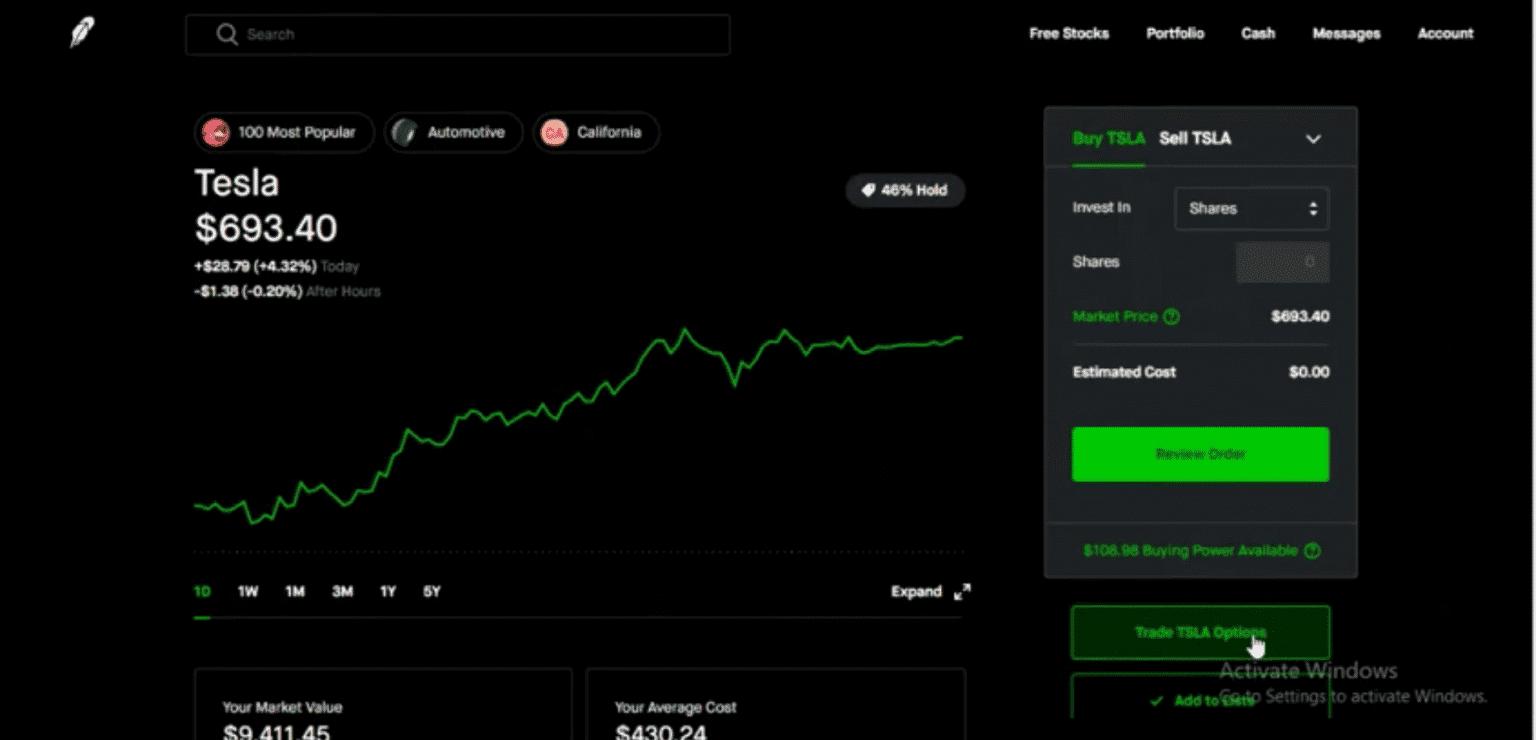

In the bustling financial landscape, options trading has emerged as a powerful tool for investors seeking to enhance their portfolios and navigate market volatility. Robinhood, a groundbreaking trading platform, has made options trading accessible to a wider demographic, democratizing the once exclusive domain of Wall Street. This comprehensive guide will delve into the intricate world of options trading on Robinhood, empowering you with the knowledge and strategies to harness its potential.

Understanding Options Trading on Robinhood:

An option is a contract that grants the buyer the right, but not the obligation, to buy or sell an underlying asset, such as a stock or index, at a specified price within a predetermined time frame. On Robinhood, you can trade both call options, which give you the right to buy, and put options, which give you the right to sell. These options can be valuable tools for managing risk, generating income, or speculating on price movements.

Foundational Concepts:

To fully grasp options trading, it’s crucial to understand a few key concepts:

-

Strike Price: This is the predetermined price at which you can buy or sell the underlying asset with the option contract.

-

Expiration Date: This determines the end of the option contract’s validity. Options expire weekly or monthly, so it’s essential to choose an expiration date that aligns with your investment strategy.

-

Premium: This is the price you pay to purchase the option contract, and it reflects the market’s assessment of the option’s value.

Types of Options Strategies:

Robinhood offers various options strategies that cater to different investment goals. Here are some of the most common:

-

Covered Call: This strategy involves selling a call option against a stock you already own. It limits your potential upside but generates income from the premium received.

-

Cash-Secured Put: Similar to a covered call, this strategy involves selling a put option while holding cash to cover the potential obligation to buy the underlying asset. It provides downside protection while earning income from the premium.

-

Bull Call Spread: This strategy involves buying a call option at a lower strike price and selling a call option at a higher strike price. It limits potential losses and maximizes gains if the underlying asset rises in value.

Benefits of Trading Options on Robinhood:

-

Accessibility: Robinhood makes options trading accessible to a broader audience, empowering investors with limited capital to participate in this sophisticated market.

-

User-Friendly Interface: Robinhood’s user-friendly platform simplifies options trading, making it approachable for both experienced investors and novices.

-

Educational Resources: Robinhood offers comprehensive educational resources on options trading, enabling investors to gain the knowledge and confidence necessary for successful trading.

Risks of Options Trading:

It’s important to acknowledge that options trading carries inherent risks.

-

Unlimited Risk: Unlike stock trading, options trading involves unlimited risk. Losses can exceed the premium paid for the contract.

-

Time Decay: Options contracts lose value as they approach their expiration date, regardless of the underlying asset’s performance.

-

Complexity: Options trading can be complex, and it’s crucial to understand the underlying concepts before engaging in this market.

Getting Started with Options Trading on Robinhood:

-

Open an Account: Create a Robinhood account and fund it with the capital you’re willing to invest.

-

Educate Yourself: Familiarize yourself with options trading concepts through Robinhood’s educational resources or external sources.

-

Start Small: Begin with small-sized trades to minimize potential losses while gaining experience.

-

Consider a Brokerage Service: If you prefer personalized guidance and support, consider working with a brokerage service that specializes in options trading.

Conclusion:

Options trading on Robinhood can empower investors with a powerful tool to enhance their portfolios, manage risk, and generate income. By understanding the foundational concepts, types of strategies, and inherent risks, you can unlock the potential of this sophisticated market. Remember to proceed with caution, educate yourself thoroughly, and consider working with a brokerage service if necessary. Embracing options trading with knowledge and prudence can pave the way for financial success and pave the way for financial success and pave the way for financial success and

Image: fity.club

What Is Trading Options On Robinhood