In the treacherous waters of financial markets, investors constantly seek ways to safeguard their investments and ride out the waves of uncertainty. One such lifeline is the collar in options trading, a strategic tool that provides a protective cushion against potential losses.

Image: www.optionsanimal.com

Deciphering the Collar: A Hybrid of Protection and Potential Gains

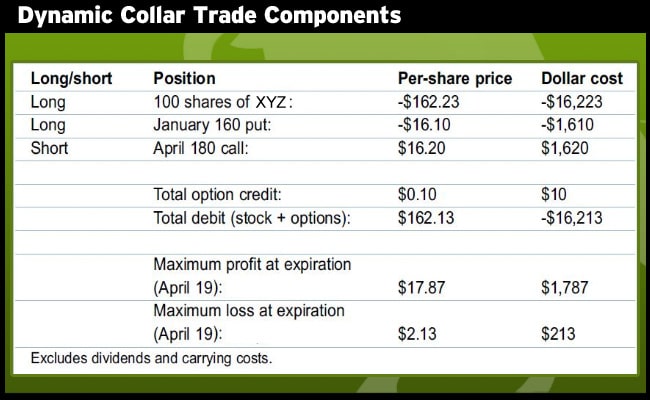

A collar is a sophisticated options strategy devised to protect against significant losses while allowing for potential upward gains. It combines two options: a protective put option and a covered call option. The put option acts as a safety net, setting a minimum price for the underlying asset, while the call option grants the holder the right to sell the asset at a higher price, thereby capping potential gains.

Navigating the Elements of a Collar Strategy

To construct a collar, investors first purchase a put option with a strike price lower than the current market price of the underlying asset. This put option establishes a floor beneath which the asset’s value cannot fall, effectively protecting against sharp declines.

Simultaneously, they sell a call option with a strike price higher than the current market price. The sale of this call option generates a premium that can partially or fully offset the cost of purchasing the put option. However, it also limits the potential upside of the investment, since if the asset’s price breaches the call option’s strike price, the investor will be obligated to sell the asset at that price.

The Defensive Power of Collars in Volatile Markets

Collars are particularly valuable in volatile markets, where sharp price drops or surges can wreak havoc on investment portfolios. By putting a floor on the asset’s price, collars provide peace of mind, ensuring that even if the market takes a nosedive, investors can recover a substantial portion of their investment.

In addition, the premiums generated from selling the call option can provide a cushion against potential losses. Even if the asset’s price falls, investors can still retain some profits from the premium. This risk mitigation makes collars an attractive option for risk-averse investors or those with long-term investment horizons.

Image: wealthfit.com

The Role of Expert Insights and Actionable Tips

Harnessing the wisdom of experienced options traders can significantly enhance the effectiveness of your collar trading strategy. Seek advice from reputable brokers or financial advisors to determine the optimal strike prices and expiration dates for your collar based on your risk tolerance and investment goals.

Moreover, staying abreast of market trends and economic indicators can help you make informed decisions about when to implement or unwind a collar strategy. By actively monitoring market conditions and consulting with trusted sources, you can fine-tune your approach and maximize the potential benefits of collar trading.

What Is A Collar In Options Trading

Conclusion: Embracing Collars as a Protective Bulwark

In the ever-changing landscape of financial markets, the collar in options trading emerges as an indispensable tool for investors seeking protection against downside risks while preserving upside potential. By carefully balancing the protective and speculative components of options contracts, collars provide a robust defense against volatility, empowering investors to navigate market turbulence with confidence. Whether you are a seasoned trader or a novice seeking stability, the collar merits exploration as a key element of a well-rounded investment strategy.