In the fast-paced and exhilarating world of financial markets, futures options trading has emerged as a powerful tool for investors seeking to manage risk, capitalize on price movements, and amplify their returns. Futures options are derivatives that grant holders the right, but not the obligation, to buy or sell an underlying asset at a specified price on a predetermined date. Understanding futures options trading volume is crucial for investors, as it provides insights into market sentiment, liquidity, and potential trading opportunities.

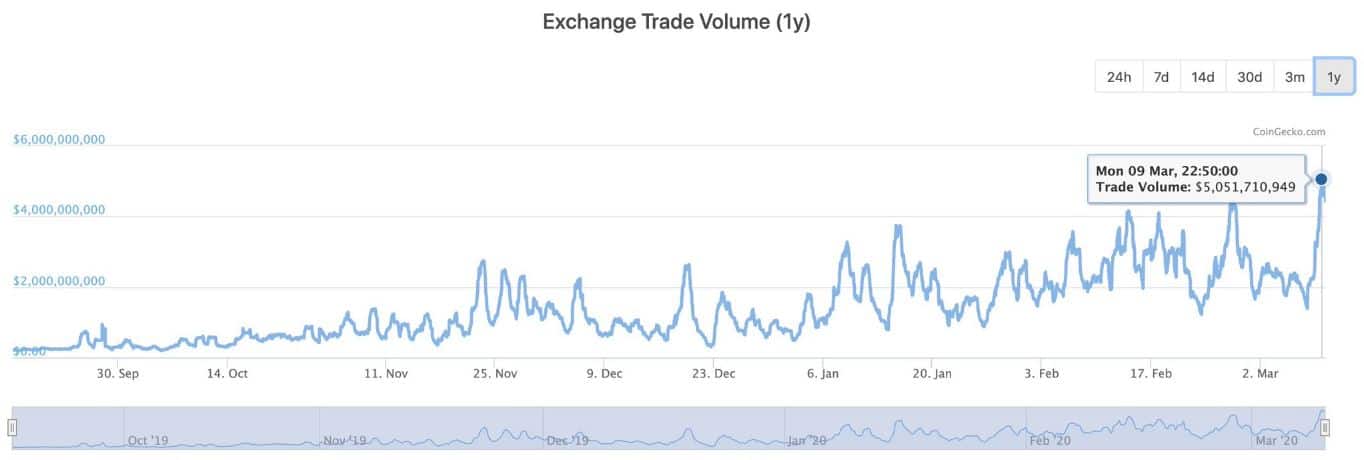

Image: cryptopotato.com

The Significance of Futures Options Trading Volume

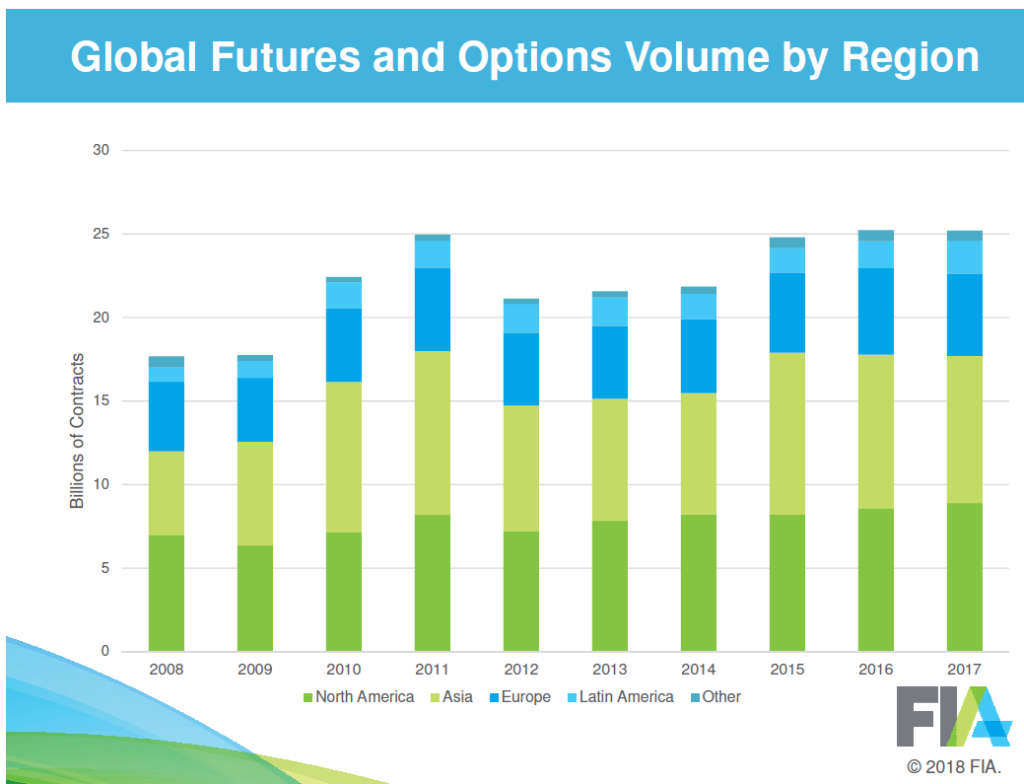

Futures options trading volume represents the total number of futures options contracts that have been traded on a particular exchange within a given time frame, usually a trading day or a month. It serves as a key indicator of market liquidity, which refers to the ease with which an asset can be bought or sold without significantly impacting its price. High trading volume indicates a liquid market with numerous buyers and sellers, facilitating smoother transactions and tighter bid-ask spreads. Conversely, low trading volume may result in wider spreads and execution delays.

Historical Evolution of Futures Options Trading

The concept of futures trading originated in the 18th century with the Chicago Board of Trade, where farmers used futures contracts to lock in prices and mitigate risk in their agricultural commodities. The introduction of options to futures contracts in the 20th century further enhanced the flexibility and versatility of derivatives trading. Today, futures options are traded on a wide range of underlying assets, including stocks, bonds, currencies, and commodities, on various exchanges worldwide.

Types of Futures Options Contracts

Futures options can be categorized into two main types: calls and puts. Call options grant the holder the right to buy the underlying asset at the strike price on or before the expiration date. Conversely, put options convey the right to sell the underlying asset at the strike price within the same timeframe. The strike price represents the agreed-upon price at which the holder can exercise the option.

Image: seekingalpha.com

Applications of Futures Options Trading

Futures options are employed by investors for a spectrum of purposes, including:

• Hedging Risk: Futures options enable investors to reduce portfolio volatility by locking in prices or taking offsetting positions.

• Income Generation: Options can be sold or bought to generate income from premium payments, known as options premiums.

• Leverage and Speculation: Options amplify market exposure, enabling traders to amplify their potential returns while also increasing their risk exposure.

Factors Influencing Futures Options Trading Volume

Various factors influence futures options trading volume, including:

• Market Volatility: Increased market volatility often leads to higher demand for options as investors seek to hedge their risk and capitalize on rapid price fluctuations.

• Economic News and Events: Major economic news and events, such as central bank announcements or economic data releases, can significantly impact trading volume in options linked to relevant assets.

• Seasonal Factors: Certain industries or sectors may experience seasonal trends in trading volume, such as increased options trading activity prior to major earnings announcements.

Tracking and Interpreting Futures Options Trading Volume

To effectively monitor futures options trading volume, traders and investors can utilize various resources and tools, including:

• Volume Indicators: Technical analysis tools, such as the Volume Indicator and On-Balance Volume, provide visual representations of trading volume and its relationship to price movements.

• Market Data Platforms: Financial news platforms and data providers often display real-time futures options trading volume data for different exchanges and underlying assets.

• Charting Software: Advanced charting software allows for detailed analysis of volume trends, including moving averages and volume profiles, to identify potential trading patterns.

Futures Options Trading Volume

Image: www.tradethetechnicals.com

Conclusion

Futures options trading volume serves as a crucial barometer for understanding market liquidity, volatility, and trading opportunities. By monitoring volume trends, traders and investors can gain valuable insights into market sentiment, adjust their strategies accordingly, and potentially enhance their risk-adjusted returns in the ever-evolving financial landscape. Whether navigating volatile markets or seeking strategic income generation, a comprehensive understanding of futures options trading volume empowers investors to make informed decisions, navigate market complexities, and pursue their financial aspirations.