Options trading, a sophisticated financial strategy, enables investors to delve into a world of opportunities and potential rewards. Among the myriad of options strategies, the collar strategy stands out as a versatile tool employed by investors seeking to strike a balance between risk and reward. This comprehensive guide will delve into the intricate details of the collar strategy, empowering you with the knowledge to harness its capabilities.

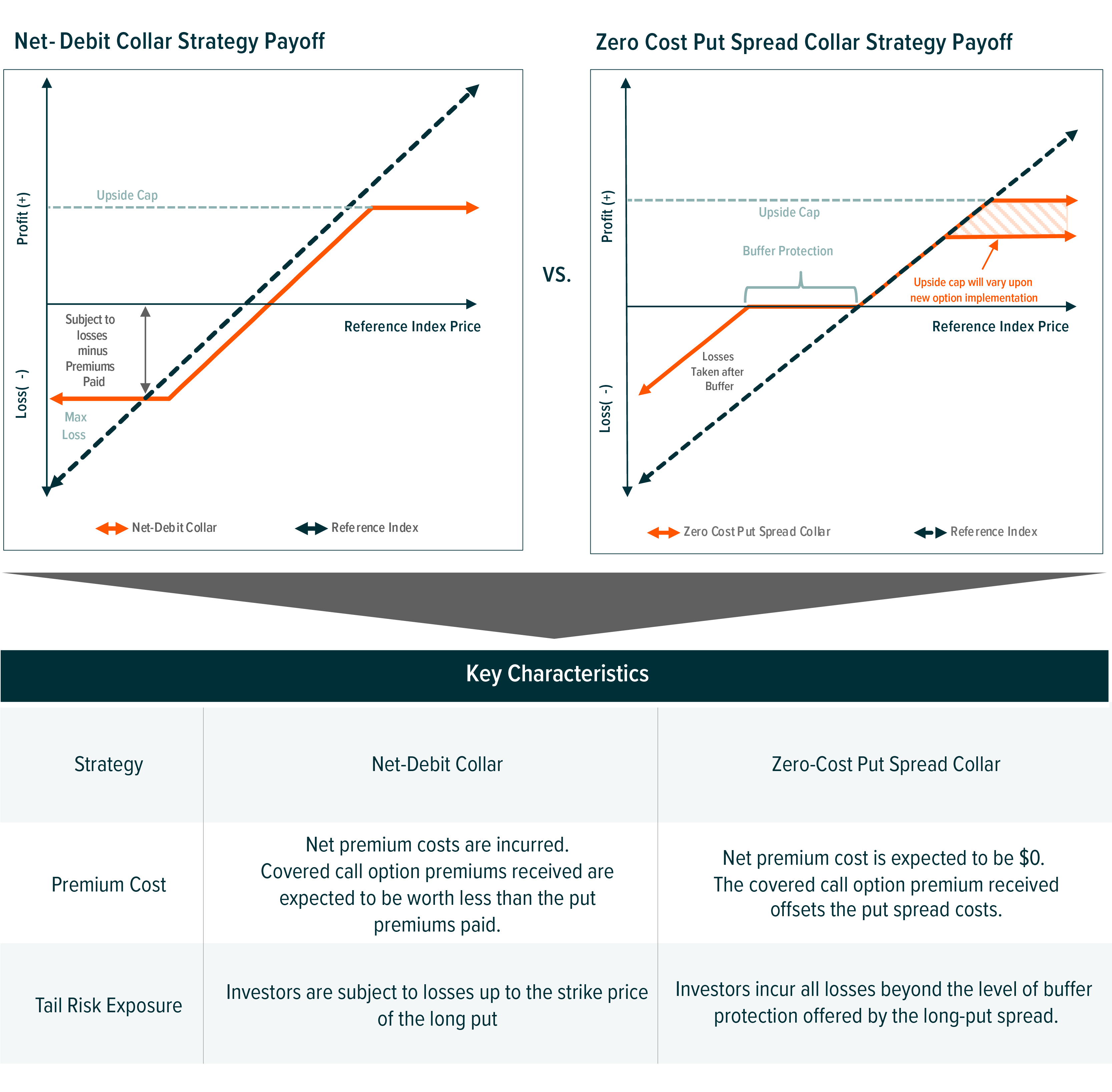

Image: www.globalxetfs.com

Unveiling the Collar Strategy: A Guardian Against Risk

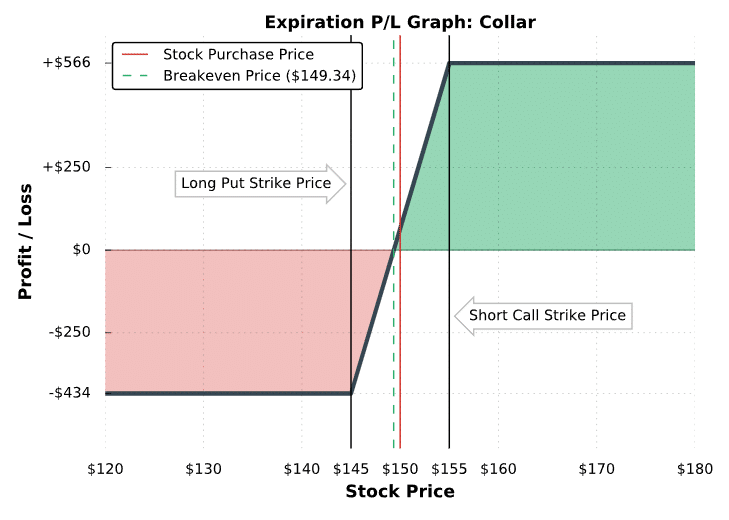

The collar strategy, true to its name, acts as a financial safeguard, protecting investors from potential losses while simultaneously creating opportunities for income generation. At its core, this strategy involves purchasing a protective put option while simultaneously selling a covered call option. This combination effectively creates a boundary or “collar” around the underlying asset’s price, mitigating downside risk while capping potential profits.

Mechanism of Action: Unraveling the Collar’s Inner Workings

The essence of the collar strategy lies in the strategic interplay between the put and call options employed. By purchasing a protective put option, investors secure a right to sell the underlying asset at a predetermined strike price, acting as an insurance policy against substantial losses. Simultaneously, the sale of a covered call option grants the right to another party to purchase the asset at a higher strike price, potentially generating income.

Constructing the Collar: Striking the Ideal Balance

Crafting an effective collar strategy hinges upon the judicious selection of both the put and call options. The strike price of the put option should be set below the current market price of the underlying asset, offering protection against potential downturns. Conversely, the strike price of the call option should be set above the current market price, maximizing income generation potential.

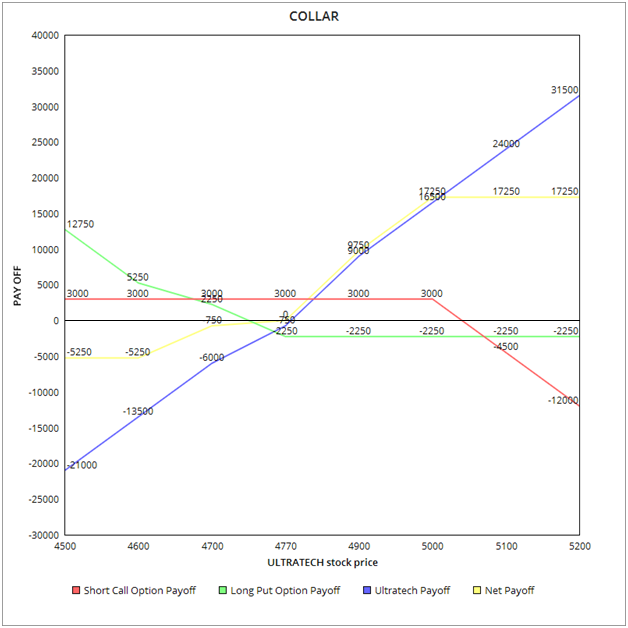

Image: www.chittorgarh.com

Collar Strategy in Action: Real-World Applications

The collar strategy finds myriad applications across the investment spectrum, serving diverse purposes. Consider the scenario of an investor holding a stock they believe will remain within a specific price range. Employing a collar strategy, they can shield themselves from significant losses while generating additional income through the sale of the call option.

Hedging Volatility: Taming Market Swings

In the face of volatile markets, the collar strategy shines as a potent hedging tool. By establishing both a floor and a ceiling for the underlying asset’s price, investors can limit their exposure to market fluctuations, mitigating the risks associated with substantial swings.

Tailoring the Collar: Considerations for Options Selection

The optimal strike prices and expiration dates for the put and call options within a collar strategy are not cast in stone. Investors must carefully evaluate their risk tolerance, investment objectives, and market outlook to determine the most suitable combination.

Market Trends and the Collar Strategy: A Dynamic Partnership

The collar strategy remains a vibrant and adaptable tool, constantly evolving in response to market dynamics. In periods of heightened volatility, investors may opt for tighter collars, narrowing the spread between the put and call strikes. Conversely, in calmer markets, wider collars may be employed, expanding the range of potential profit generation.

Collar Strategy In Options Trading

Image: www.projectfinance.com

Conclusion: Empowered Choices through the Collar Strategy

The collar strategy empowers investors with an invaluable risk management solution, enabling them to navigate the complexities of options trading with greater confidence. By harnessing the dynamic interplay of put and call options, investors can craft tailored strategies that align with their specific needs, shielding against losses and unlocking income-generating opportunities. As always, meticulous research, careful consideration, and diligent monitoring are paramount for maximizing the potential of this versatile strategy.