Introduction

In the realm of options trading, the collar strategy emerges as a pragmatic approach designed to mitigate risks and enhance returns. Whether you are a seasoned trader or just starting to explore the world of options, understanding the nuances of the collar strategy can prove invaluable. Prepare to embark on a comprehensive journey into the intricacies of this versatile trading technique.

Image: www.dalalstreetwinners.com

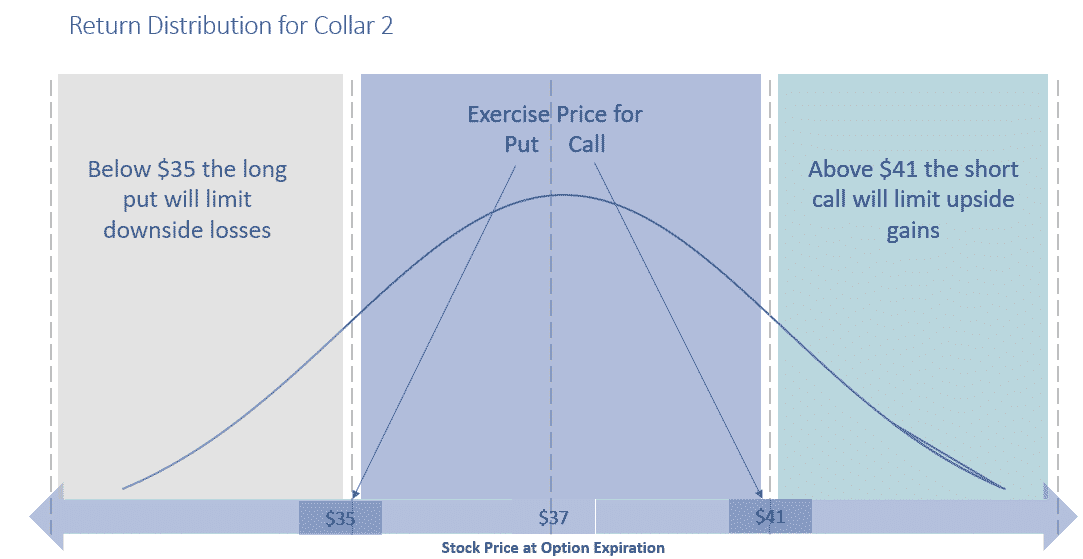

The collar strategy, an ingenious combination of a protective put option and a covered call option, effectively limits both potential losses and potential gains. By employing this strategy, traders can safeguard their portfolios against market downturns while still capturing potential profits in the event of an upswing.

Overview of the Collar Strategy

Components of the Collar Strategy

The collar strategy, as mentioned earlier, comprises two distinct options contracts: a protective put option and a covered call option.

- Protective Put Option: This option grants the trader the right, but not the obligation, to sell a specific number of shares at a predetermined strike price. It acts as a safety net, protecting the trader from substantial losses if the stock price falls below the strike price.

- Covered Call Option: Unlike the protective put option, the covered call option grants the buyer the right to purchase a specific number of shares at a predetermined strike price. Traders sell covered call options when they own the underlying stock, effectively capping their potential gains on the stock’s appreciation.

Mechanics of the Strategy

The collar strategy is executed by simultaneously selling a covered call option and buying a protective put option. The strike price of the protective put option is typically set below the current market price of the stock, while the strike price of the covered call option is set above the current market price. The net premium received from selling the covered call option helps offset the cost of purchasing the protective put option, thereby reducing the overall trading cost.

Image: www.strike.money

Benefits and Applications

The collar strategy finds its niche in various trading scenarios. It is particularly suitable for investors seeking to:

- Reduce downside risk: The protective put option provides a buffer against potential losses in the event of a market downturn, ensuring that losses are capped at a predetermined level.

- Enhance returns: The covered call option allows traders to generate income from selling the option premium, potentially enhancing overall returns without exposing themselves to uncapped gains.

- Manage volatility: The collar strategy can help mitigate portfolio volatility by reducing both the downside risk and the upside potential.

Tips and Expert Advice

Expert Insights

- Consider the stock’s price movement history: Analyze the historical volatility and price trends of the underlying stock to determine appropriate strike prices for the options contracts.

- Evaluate the time premium: Time premium, which constitutes a portion of the option’s price, represents the value of the option’s time until expiration. Traders should consider the time premium in relation to the potential profit and loss scenarios.

- Monitor market conditions: Staying abreast of market news, economic data, and industry-specific events can help traders make informed decisions about adjusting their collar strategy positions.

Additional Tips

- Start with small positions: Initially, trade with small positions to gain experience and confidence in the collar strategy.

- Seek professional guidance: If necessary, consult with a financial advisor or experienced options trader to understand the complexities and potential risks of the collar strategy.

- Practice patience and discipline: Option trading, including the collar strategy, requires patience and discipline. Avoid making impulsive trades and stick to a predefined trading plan

Frequently Asked Questions

Q: What are the key risks associated with the collar strategy?

A: The collar strategy involves the risk of losing the net premium paid for the options contracts if the stock price remains within the range defined by the strike prices.

Q: Can the collar strategy be customized?

A: Yes, traders can adjust the strike prices, expiration dates, and the number of contracts to customize the collar strategy based on their risk tolerance and profit objectives.

Q: Is the collar strategy suitable for all market conditions?

A: The collar strategy is typically effective in range-bound or mildly volatile markets. In highly volatile markets, it may not be as effective in mitigating risks or enhancing returns.

The Collar Strategy Explained Online Option Trading Guidethe Options Guide

Image: optionstradingiq.com

Conclusion

The collar strategy stands as a valuable tool in the arsenal of options traders. By simultaneously employing a protective put option and a covered call option, traders can limit their downside risk while capturing potential gains. Understanding the intricacies of the collar strategy, its components, and the tips provided in this guide can empower traders to harness its benefits and navigate the complexities of the options market.

Are you eager to delve deeper into the world of the collar strategy? Explore additional resources, engage in online forums, and connect with experienced traders to broaden your knowledge and enhance your trading skills.