The Tale of the Seasoned Investor

As an experienced options trader, I can vividly recall a moment when the power of implied volatility transformed my strategy. It was during an economic downturn when market volatility was soaring. Realizing the potential to capitalize on this volatility, I adopted a strategy that focused on trading options with high implied volatility. This pivotal move unlocked a new dimension in my trading approach, leading to substantial gains.

Image: alchetron.com

Implied Volatility: The Crystal Ball of Market Sentiment

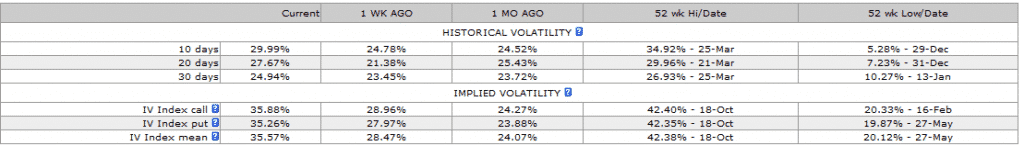

Implied volatility (IV) serves as a crucial indicator of market sentiment, reflecting the anticipated range of price fluctuations within a specific time frame. High IV indicates market uncertainty and heightened expectations of significant price movements. Consequently, options with high IV tend to be more expensive, as they incorporate a premium for this perceived volatility.

Unraveling the IV-Price Relationship

The relationship between IV and option prices is intricate. When IV is high, options tend to be costlier. This is because the market is pricing in a wider potential range of price outcomes, which necessitates a higher premium to compensate for the increased risk. Conversely, low IV translates into cheaper options, as the market anticipates price movements to be more constrained.

Timing the IV Curve

Trading options based on IV requires a keen understanding of the IV curve, which plots IV against time to maturity. Options with longer durations generally exhibit higher IV, as they are more exposed to potential price fluctuations over a more extended period. By monitoring the shape and movement of the IV curve, traders can identify opportunities to capitalize on changes in volatility expectations.

Image: www.optionstradingiq.com

Strategizing with IV

Several strategies can be employed to trade options based on IV:

- Buying high IV options: When IV is elevated, traders can purchase options with a high IV for the potential to profit from large price swings.

- Selling high IV options: When IV is excessive, traders can sell options with high IV to collect a premium that compensates for the potential price movements.

- Pairs trading: This strategy involves simultaneously buying and selling options with different IV levels to capitalize on the difference in volatility expectations.

Tips from the Trading Trenches

- Monitor the IV curve closely: Stay updated on the latest IV trends to identify potential trading opportunities.

- Consider the underlying asset’s fundamentals: Evaluate the underlying asset’s financial health and market dynamics to gauge the potential impact on volatility.

- Manage risk: Carefully assess the risk-reward profile of each trade and employ proper risk management techniques to mitigate potential losses.

FAQ: Unraveling Implied Volatility

-

Q: How is IV calculated?

A: IV is derived from option pricing models, typically using the Black-Scholes formula or similar methods. -

Q: What factors influence IV?

A: Historical volatility, current market sentiment, upcoming events, and economic conditions all impact IV. -

Q: Is high IV always a buy signal?

A: Not necessarily. While high IV often indicates potential volatility, traders should consider other factors before making a trading decision.

Trading Options Based On Implied Volatility

Conclusion: The Power of Implied Volatility

By harnessing the insights provided by implied volatility, traders can enhance their market understanding and unlock valuable trading opportunities. Whether it’s through purchasing high IV options, selling inflated IV options, or employing pairs trading strategies, the ability to interpret and leverage IV can empower investors to make well-informed decisions and maximize their returns.

Are you intrigued by the intricacies of IV and its potential impact on your trading strategy? Share your thoughts and experiences in the comments section below to engage in a captivating discussion on this fascinating aspect of options trading.