Introduction

Image: optionstradingiq.com

In the ever-evolving landscape of the financial markets, the ability to capitalize on earnings seasons has become an indispensable skill for investors seeking to enhance their returns. With the advent of options, traders now have a powerful tool at their disposal to trade these events strategically and potentially magnify their gains while managing their risk.

Understanding Earnings Trading with Options

Earnings trading with options involves using options contracts, which are financial instruments that grant the holder the right, but not the obligation, to buy or sell a specified asset at a predetermined price (strike price) on or before a specific date (expiration date). Options provide investors with two primary strategies for earnings trading: buying calls and selling puts.

Buying Calls for Upside Potential

Buying a call option confers the right to buy the underlying asset at the strike price on or before the expiration date. When traders anticipate a rise in the underlying’s price following an earnings report, they can purchase call options to capitalize on this potential upside. If the stock price does indeed surge, the call option will gain value, allowing the investor to sell it for a profit.

Selling Puts for Downside Protection

Selling a put option grants the obligation to buy the underlying asset at the strike price on or before the expiration date if the price falls below that level. This strategy is used when traders expect the underlying’s price to remain stable or decline following earnings. If the stock price holds its own or falls, the put option will expire worthless, resulting in a profit for the seller.

Expert Insights: Navigating Earnings with Options

“Properly assessing the significance of earnings reports is crucial,” advises market strategist Emily Jones. “Traders should analyze historical performance, gauge analyst sentiment, and monitor the company’s guidance to form informed decisions.”

Dr. Mark Evans, an options specialist, emphasizes the importance of managing risk. “Determine your risk tolerance and allocate capital accordingly. Options trading can amplify both gains and losses, so it’s essential to approach it with caution.”

Key Considerations for Successful Earnings Trading

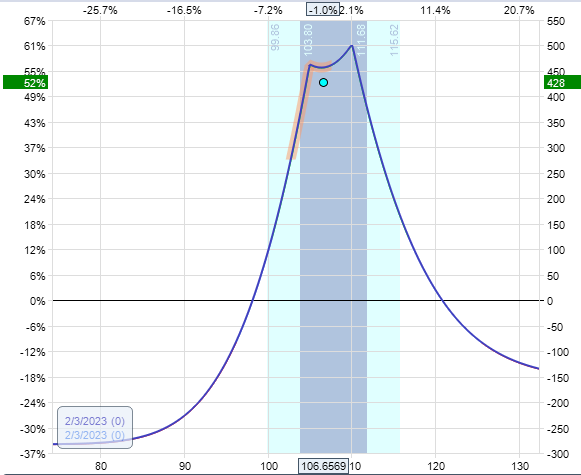

- Volatility Assessment: High volatility during earnings season provides opportunities for amplified returns, but it also carries increased risk.

- Implied Volatility: Options premiums reflect the market’s perception of future volatility. Higher implied volatility generally indicates higher potential returns.

- Timing: Precisely timing options trades is critical. Traders should carefully consider the company’s reporting schedule and market conditions.

- Risk Management: Implementing risk-management strategies is imperative. Use stop-loss orders, limit your position size, and consider hedging techniques.

Conclusion

Trading earnings with options can empower investors to seize opportunities and protect their portfolios during this pivotal period in the financial calendar. By understanding the underlying concepts, embracing expert insights, and adhering to sound risk-management principles, traders can navigate the earnings season with confidence, maximizing their potential for success. Remember, education, prudent decision-making, and emotional control are the cornerstones of effective options trading.

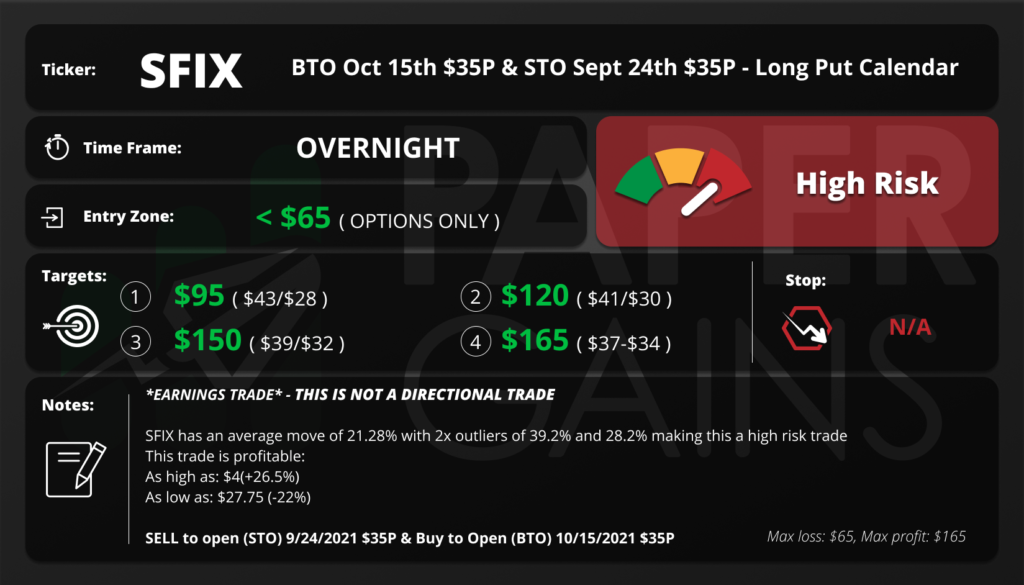

Image: www.papergains.com

Trading Earnings With Options