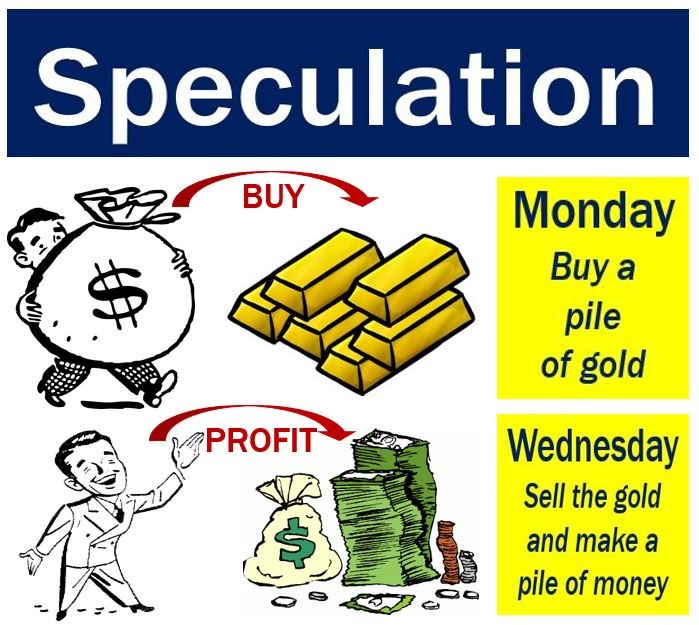

Speculative options trading, a thrilling yet perilous endeavor in the financial realm, has captivated the minds of investors seeking exponential returns on their investments. It entails the purchase or sale of derivative contracts known as options, granting the holder the right, but not the obligation, to buy or sell an underlying security at a predetermined price on or before a specific date. This intricate dance of risk and reward has the potential to yield substantial profits, but it also carries the inherent danger of significant losses.

Image: punjiguide.com

Delving into the History and Anatomy of Options Trading

The origins of options trading can be traced back to the 17th century, when budding merchants and traders sought ways to mitigate risks associated with unpredictable market fluctuations. Amsterdam, the epicenter of global trade at the time, witnessed the emergence of the first recorded options contract in 1612. These early contracts, known as ‘puts’ and ‘calls,’ provided buyers with the option to sell or buy a specific commodity at a predetermined price within a stipulated time frame.

Options contracts, the cornerstone of speculative options trading, come in two primary forms: calls and puts. Call options bestow upon the holder the right to buy an underlying asset at a strike price on or before a specified date. Conversely, put options provide the holder the right to sell the underlying asset at a strike price on or before a specified date. These contracts grant the buyer the flexibility to capitalize on favorable market moves without the obligation to exercise their rights.

Understanding the Mechanics of Speculative Options Trading

Speculative options trading involves a plethora of strategies, each carefully crafted to harness market movements and maximize profit potential. One such strategy is buying a call option when bullish on a particular stock. By purchasing a call option, the trader anticipates that the stock price will rise above the strike price, thus enabling them to exercise their right to buy the stock at a lower price and potentially reap profits from its appreciation.

Conversely, a bearish stance on a stock may prompt a trader to purchase a put option. In this scenario, the trader expects the stock price to decline below the strike price, allowing them to exercise their right to sell the stock at a higher price and capitalize on its depreciation. However, it is crucial to remember that options trading carries inherent risks, and losses can occur even with well-conceived strategies.

Weighing the Pros and Cons of Speculative Options Trading

Venturing into speculative options trading offers investors the tantalizing prospect of exponential returns. However, it is imperative to proceed with caution, fully cognizant of the attendant risks. Options trading is a double-edged sword, with the potential for substantial gains balanced by the risk of significant losses.

Among the advantages of speculative options trading, the ability to leverage market movements stands out. Options provide investors with the opportunity to magnify profits from favorable market trends. Additionally, options trading offers greater flexibility compared to traditional stock trading. Options contracts afford traders the option to buy or sell the underlying asset at a predetermined price, regardless of the prevailing market conditions.

However, the inherent risks associated with options trading cannot be overstated. The speculative nature of options contracts exposes traders to the possibility of losing their entire investment. Market volatility can wreak havoc on options positions, leading to rapid and substantial losses. Moreover, options trading requires a comprehensive understanding of the financial markets and a robust risk management strategy to navigate the inherent complexities.

Image: easytradingstrategy.com

Speculative Options Trading

:max_bytes(150000):strip_icc()/TipsforAnsweringSeries7OptionsQuestions1_2-5b9977d443234ce5978494004c287af9.png)

Image: www.hotzxgirl.com

Conclusion

Speculative options trading presents investors with a potent tool for harnessing market movements and potentially amassing substantial profits. However, it is imperative to approach this endeavor with a clear understanding of the inherent risks involved. Thorough research, a prudent risk management strategy, and an unwavering discipline are essential to navigate the complexities of options trading and increase the likelihood of success in this high-stakes arena of fortune and risk.