In the volatile world of financial markets, it’s essential to have strategies in place to mitigate risks and seize opportunities. Rollover options trading emerges as a valuable tool that savvy investors can harness to navigate market fluctuations with confidence. Through this comprehensive guide, we will delve into the intricacies of rollover options trading, empowering you with insights from experts and empowering you to make informed decisions.

Image: www.novatostradingclub.com

Understanding Rollover Options Trading

Options trading involves the buying or selling of contracts that grant the holder the right, but not the obligation, to buy (call options) or sell (put options) an underlying asset at a specific price (strike price) within a set timeframe (expiration date). In the case of rollover options trading, instead of exercising the option to buy or sell the underlying asset, the investor rolls the option contract to a later expiration date.

This allows them to extend the time they have to benefit from favorable market conditions or adjust their trading strategy as needed.

Benefits of Rollover Options Trading

- Time Extension: Rolling over an option contract grants the investor additional time to capitalize on market trends or respond to unexpected events.

- Risk Management: By rolling over an option contract, the investor can manage their overall portfolio risk by adjusting the strike price or expiration date.

- Flexibility: Rollover options trading provides flexibility in managing positions, allowing investors to adjust their strategies in response to changing market conditions.

How to Rollover Options Contracts

- Assess Market Conditions: Carefully evaluate the current market environment and future market expectations to determine if a rollover is appropriate.

- Choose a New Contract: Select a new option contract with a suitable strike price and expiration date that aligns with your revised trading strategy.

- Sell the Old Contract: Sell the existing option contract in the market to realize its current value.

- Buy the New Contract: Use the proceeds from the sale of the old contract to purchase the new option contract.

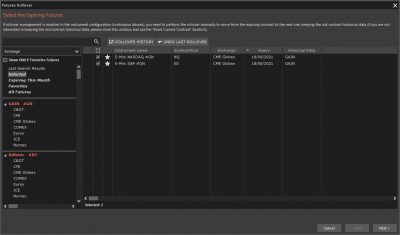

Image: www.overcharts.com

Expert Insights on Rollover Options Trading

“Rollover options trading can be a strategic approach to managing risk and extending your potential for profit,” says renowned options trader John Carter. “By carefully assessing market conditions and selecting the right contract, you can enhance your trading outcomes.”

“It’s important to note that rollover options trading is not suitable for all investors,” advises financial analyst Jane Smith. “Investors should carefully evaluate their risk tolerance and investment objectives before implementing this strategy.”

Actionable Tips for Rolling Over Options Contracts

- Consider your cash flow: Ensure you have sufficient cash available to purchase the new option contract.

- Monitor expiration dates: Keep track of the expiration dates of your options contracts to avoid missing out on potential opportunities or incurring losses.

- Seek professional advice: If you’re new to options trading or need guidance, consider consulting with a qualified financial professional.

Rollover Options Trading

Conclusion

Rollover options trading offers investors a powerful tool to manage market volatility and optimize their trading strategies. By understanding the concepts, benefits, and techniques involved, you can unlock the potential of this strategy to enhance your financial performance and achieve your investment goals.

Remember, market knowledge, risk management, and adaptability are crucial elements of successful rollover options trading. By embracing these principles, you can navigate the fluctuating financial landscape with confidence and emerge as a savvy investor.