Introduction

In the bustling world of financial markets, options trading stands out as a powerful instrument that enables investors to navigate market volatility and hedge against potential risks. Understanding the dynamics of options trading volume and open interest is crucial for informed decision-making and maximizing potential returns. This comprehensive guide delves into the intricate workings of these key metrics, shedding light on their significance and practical applications.

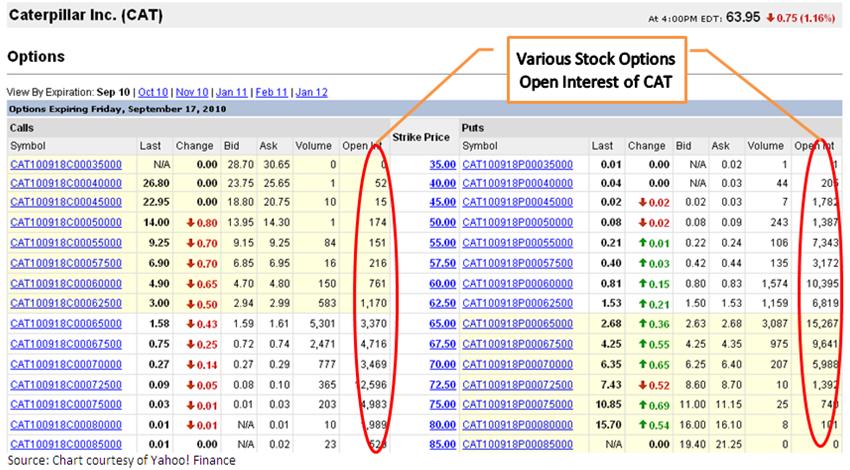

Image: www.trade-stock-option.com

Demystifying Options Trading: A Foundation

Options, often referred to as financial contracts, grant the holder the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a predetermined price (strike price) on or before a specified date (expiration date). By purchasing an option, traders can amplify their potential returns while simultaneously limiting their maximum loss to the premium paid upfront.

Volume, on the other hand, measures the number of option contracts traded during a specific period, reflecting market activity and trader interest in the underlying asset. Open interest, in contrast, represents the total number of outstanding option contracts that have not yet been exercised or closed out. By analyzing these metrics together, traders gain insights into market sentiment, potential price movements, and liquidity conditions.

Decoding Volume: A Measure of Market Sentiment

Option trading volume acts as a barometer of market sentiment, providing valuable clues about trader expectations and positioning. High volume indicates increased activity and generally suggests heightened interest in the underlying asset. A surge in volume ahead of an earnings announcement or economic data release, for example, signals anticipation of significant price movements. Conversely, low volume often indicates a lack of interest or consensus, potentially reflecting market uncertainty or consolidation.

Unveiling Open Interest: A Gauge of Outstanding Contracts

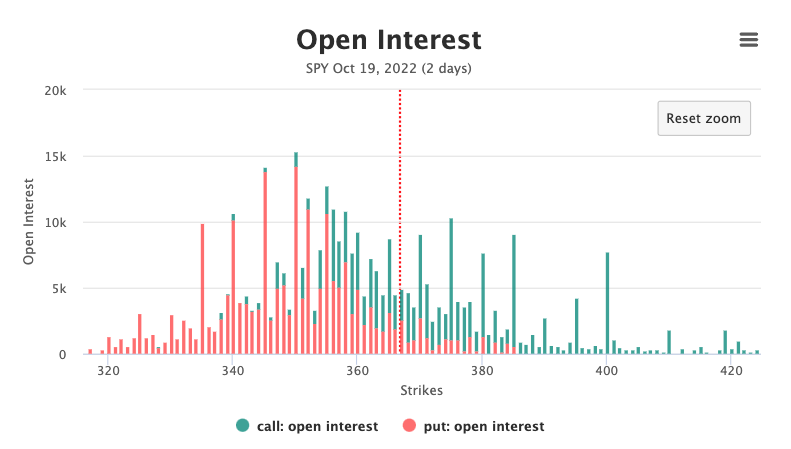

Open interest offers a unique perspective on the market by tracking the number of outstanding option contracts. Rising open interest suggests an accumulation of long (call options) or short (put options) positions, indicating increased bullish or bearish bets, respectively. Similarly, declining open interest implies the unwinding of positions or a reduction in market conviction. By monitoring open interest over time, traders can identify potential shifts in market positioning and risk appetite.

Image: optioncharts.io

Volume and Open Interest: A Synergistic Duo

Combining volume and open interest analysis provides a comprehensive view of market dynamics. A surge in volume accompanied by a corresponding increase in open interest typically indicates a strong directional bias in the underlying asset. This confluence suggests conviction and commitment among traders, supporting the notion of a potential trend or breakout. Conversely, high volume with declining open interest may signal a short-lived move or a shift in market sentiment.

Expert Insights: Harnessing the Power of Volume and Open Interest

Renowned trader Mark Douglas emphasizes the value of understanding crowd behavior in options trading. By studying volume and open interest, traders can align their strategies with market consensus and identify opportunities with higher potential for success. According to Douglas, “Successful traders learn to trade with the trend, which often means trading with the majority.”

Actionable Tips: Leveraging Volume and Open Interest in Your Trading

-

Monitor volume spikes before major market events or data releases to gauge potential volatility.

-

Analyze open interest trends to identify areas of accumulation or distribution, revealing potential price inflection points.

-

Pair volume and open interest analysis to confirm market direction and assess the strength of price movements.

-

Use volume as a risk management tool by exiting positions when volume dries up, indicating a potential reversal.

Options Trading Volume And Open Interest

Conclusion

In the ever-evolving realm of options trading, a deep understanding of volume and open interest is an invaluable asset. These metrics provide insights into market sentiment, potential price movements, and liquidity conditions, empowering traders to make informed decisions and maximize their trading potential. By embracing the strategies outlined in this guide, readers can harness the power of volume and open interest to navigate market fluctuations confidently and achieve their financial objectives.