Introduction:

Image: www.options-trading-system.com

Options trading has emerged as a powerful tool for traders seeking to enhance their returns and manage risks in the Nasdaq, the world’s second-largest stock market by market capitalization. Options contracts provide investors with a unique opportunity to participate in the market’s volatility without the obligation to buy or sell the underlying security. In this article, we will delve into the intricacies of options trading in the Nasdaq, exploring its mechanics, strategies, and the latest trends shaping this rapidly evolving market.

Understanding Options Trading:

An option contract grants the holder the right, but not the obligation, to buy (call option) or sell (put option) a specified number of shares of an underlying security at a predetermined price (strike price) on or before a designated date (expiration date). Options provide traders with flexibility and leverage, allowing them to speculate on price movements, hedge against risk, or generate income through premiums.

Listed Options on the Nasdaq:

The Nasdaq offers a wide range of listed options on individual stocks, indices, and exchange-traded funds (ETFs). These publicly traded options are standardized, ensuring liquidity and facilitating efficient trading. Options on the Nasdaq are regulated by the United States Securities and Exchange Commission (SEC), providing investors with confidence in the market’s integrity.

Basic Options Strategies:

Options traders can employ various strategies to achieve their investment objectives. Common strategies include:

- Buying Call Options: Gives the holder the right to buy the underlying security if the price rises above the strike price.

- Selling Call Options: Grants the right to sell the underlying security if the price rises above the strike price, collecting a premium.

- Buying Put Options: Gives the holder the right to sell the underlying security if the price falls below the strike price.

- Selling Put Options: Grants the right to buy the underlying security if the price falls below the strike price, collecting a premium.

Advanced Options Strategies:

Beyond basic strategies, there are numerous advanced options strategies that offer sophisticated traders greater flexibility and potential returns. These strategies involve combinations of multiple options contracts, creating more complex risk-reward profiles.

Factors Influencing Options Premiums:

The premium paid for an option contract is determined by several factors, including:

- Underlying Security Price: The current price of the underlying security significantly influences the option’s value.

- Time to Expiration: The longer the time until expiration, the higher the premium, as there is more time for the underlying price to fluctuate.

- Volatility: Higher volatility in the underlying security price leads to higher premiums, as there is greater uncertainty about future movements.

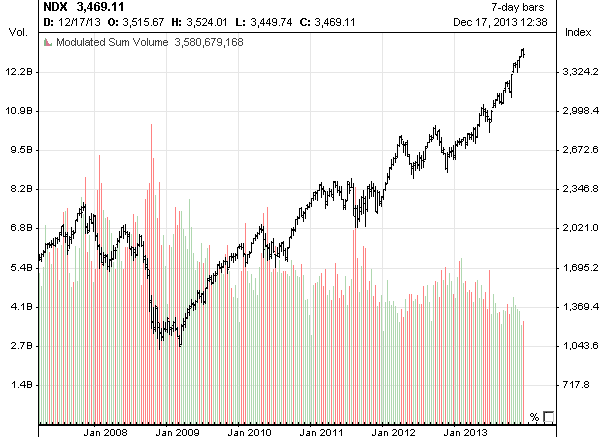

Options Trading Trends in the Nasdaq:

The Nasdaq options market has witnessed several notable trends in recent years:

- Growth in Retail Investing: Individuals and smaller investors have increasingly participated in options trading, attracted by the potential for high returns and low capital requirements.

- Rise of Algorithmic Trading: Computer-based algorithms are widely used in options trading, providing traders with faster execution and more sophisticated strategies.

- Increased Use of Options for Hedging: Institutional investors have embraced options as a valuable tool for managing portfolio risk and enhancing returns.

Conclusion:

Options trading in the Nasdaq offers traders a dynamic and versatile way to participate in the market. With a thorough understanding of options mechanics, strategies, and the latest trends, traders can harness the power of options to enhance their returns, manage risks, and navigate the ever-changing market landscape. As the Nasdaq continues to evolve, options trading will undoubtedly remain an integral part of the investment strategies for both individual and institutional investors.

Image: www.youtube.com

Options Trading Nasdaq