Options Trading: Navigating the Battleground of Webull vs. Robinhood

Image: thedollarguide.com

Introduction

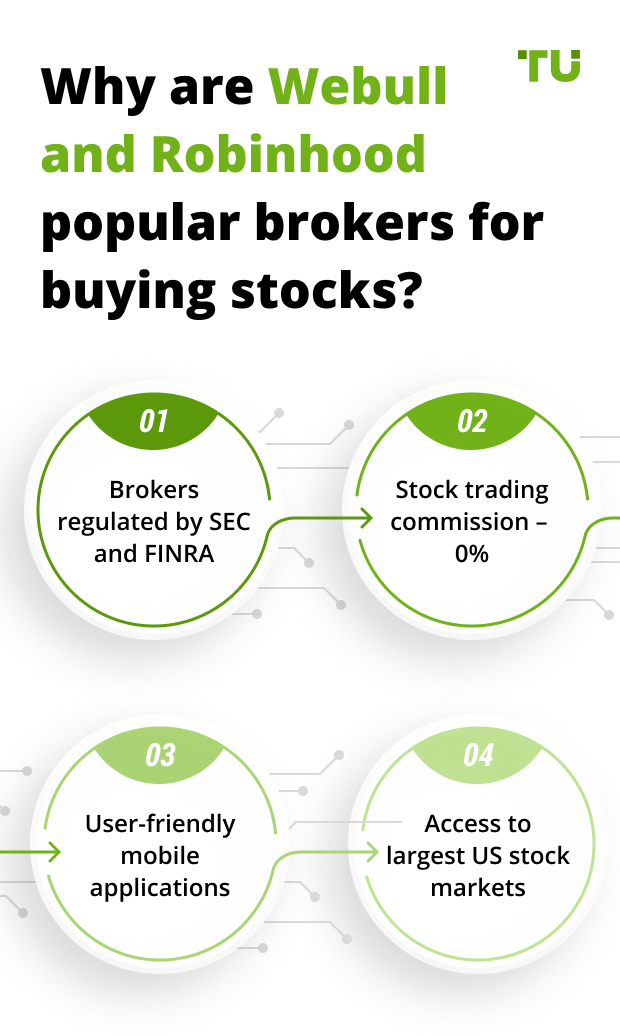

In the realm of financial markets, options trading has emerged as a formidable force, offering investors a potent tool for risk management and potential profit generation. However, with countless options trading platforms vying for your attention, navigating the landscape can be a daunting task. Two platforms that have consistently stood out in the battle for dominance are Webull and Robinhood. In this comprehensive guide, we will delve into the depths of each platform, comparing their offerings, fees, and suitability for different trading styles, empowering you with the knowledge to make an informed decision for your trading journey.

Deep Dive: Webull vs. Robinhood

Platform Highlights:

Webull:

- User-friendly interface designed for both beginners and experienced traders

- Advanced charting tools with technical indicators and drawing capabilities

- Access to a comprehensive library of educational resources and market analysis

Robinhood:

- Intuitive mobile-based platform with a clean and minimalist design

- Focus on commission-free trading for stocks and ETFs

- Social trading features allow users to interact and share ideas

Trading Features:

Webull:

- Extensive options trading capabilities, including advanced order types and margin trading

- Multiple account types tailored to different trading needs, including paper trading accounts

- Real-time market data and customizable watchlists

Robinhood:

- Limited options trading features, focusing primarily on standard contracts

- No margin trading or complex order types

- Basic charting capabilities with limited technical analysis tools

Fees Comparison:

Webull:

- No account maintenance fees or platform costs

- Variable option contract fees based on volume and complexity

- Margin rates vary depending on account type

Robinhood:

- No commission fees for stock and ETF trades

- Options trading incurs a flat fee per contract($0.65)

- No account maintenance or inactivity fees

Suitability:

Webull:

- Suitable for both beginners looking for a comprehensive platform and experienced traders seeking advanced trading tools

- Ideal for investors interested in complex options strategies and margin trading

Robinhood:

- Excellent platform for novice traders prioritize commission-free trading and a user-friendly interface

- Suitable for investors with limited capital or those primarily interested in basic options trading

Expert Insights and Actionable Tips:

From the Trading Guru:

“For serious traders seeking a robust, feature-rich platform, Webull is the clear choice. Its advanced charting tools and comprehensive trading capabilities provide the power and flexibility required for sophisticated trades. However, Robinhood’s user-friendly interface and zero commission fees make it an attractive option for beginners and those focused on value trading.”

Actionable Tip:

Before committing to a platform, consider your trading style and needs. If you’re a beginner or prefer a streamlined experience, Robinhood may be a better fit. For traders seeking advanced features and flexibility, Webull is a superior choice.

Conclusion

Choosing the right options trading platform is crucial for your trading success. By understanding the strengths and limitations of Webull and Robinhood, you can make an informed decision that aligns with your trading aspirations. Whether you’re a seasoned veteran or just embarking on your trading journey, this comprehensive guide equips you with the knowledge and insights to navigate the options trading landscape with confidence. Remember, the path to financial empowerment is paved with continuous learning and informed decisions.

Image: www.tun.com

Options Trading Webull Vs Robinhood

Image: tradersunion.com