Introduction:

Image: www.pinterest.com

Have you ever pondered the mysteries of options trading? Or perhaps you’re already dabbling in it but seeking a reliable guide? Look no further than Robinhood App, where the world of options trading unfurls at your fingertips. In this comprehensive breakdown, we’ll delve into the nitty-gritty of options trading with Robinhood, empowering you with knowledge and confidence to navigate this exciting financial landscape.

Demystifying Options Trading:

Options, simply put, are contracts that give you the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset like a stock or ETF at a specified price, known as the strike price, before a particular date, referred to as the expiration date.

The Robinhood Advantage:

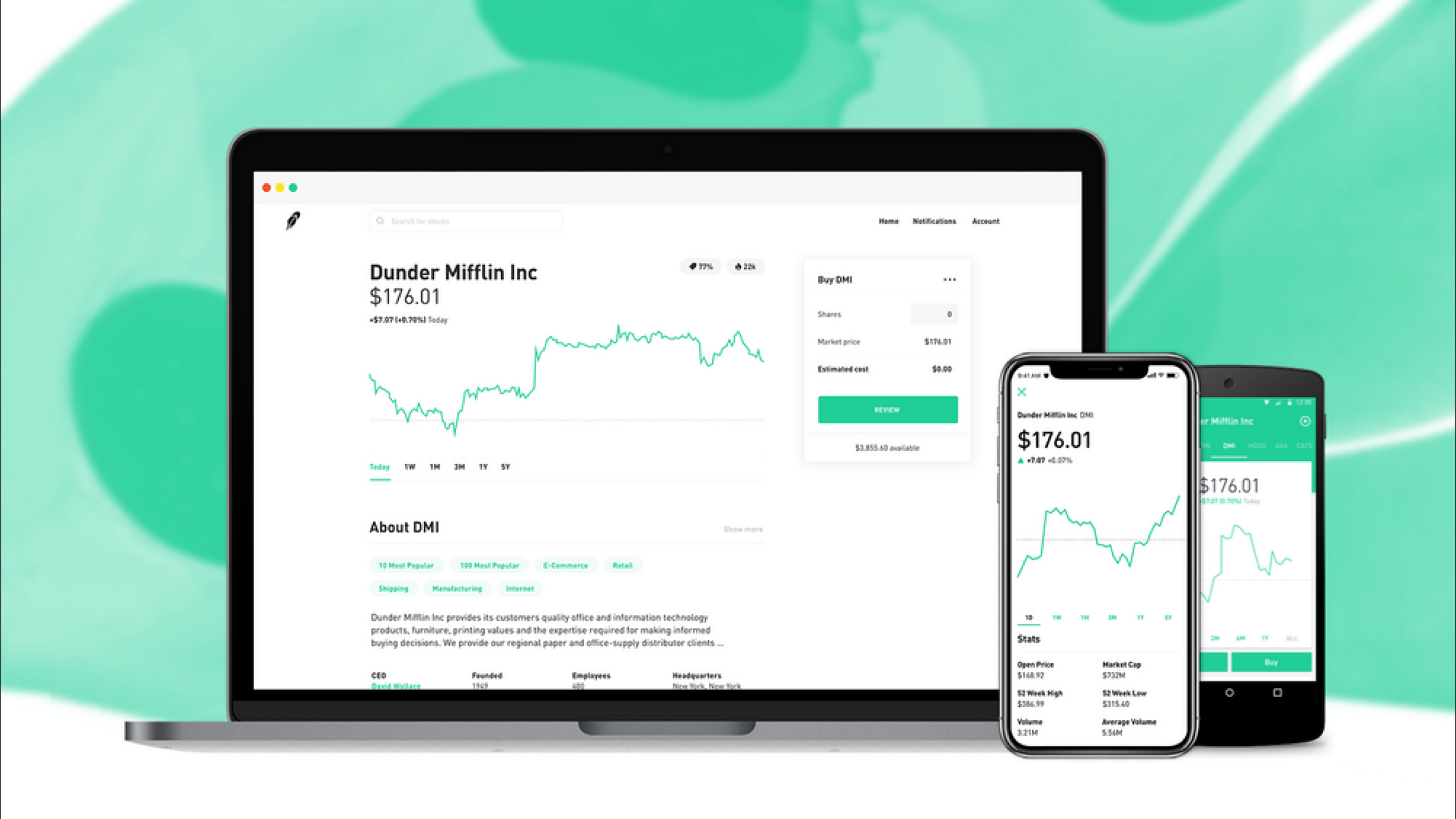

Robinhood App has revolutionized options trading, making it accessible to everyone. With no account minimums or commissions, you can start trading options with as little as you like. Its intuitive interface simplifies navigation, and educational resources guide you every step of the way.

Delving Deeper into Options lingo:

- Call Option: The right to buy a stock at the strike price

- Put Option: The right to sell a stock at the strike price

- Expiration Date: The day the option expires, after which it becomes worthless

- Premium: The price you pay for an option contract

Understanding Option Greeks:

To fully grasp options trading, you need to familiarize yourself with Option Greeks—factors that impact option pricing. These include:

- Delta: Measures the sensitivity of the option price to changes in the underlying asset’s price

- Gamma: Quantifies the rate of change in Delta

- Theta: Represents the decay in option value as time passes

- Vega: Indicates the impact of volatility on option prices

Using Options Strategically:

Options offer a versatile range of strategies:

- Covered Calls: Sell a call option against shares you own to generate income

- Covered Puts: Sell a put option against shares you own to protect against a drop in value

- Bull Call Spread: Profit from a rise in the underlying asset’s price

- Bull Put Spread: Profit from a limited increase in the underlying asset’s price

- Iron Condor: A combination strategy designed to profit from low volatility

Expert Insights:

“Options trading can be a powerful tool for managing risk and enhancing returns,” says Mark Cuban, entrepreneur and investor. “Robinhood App simplifies the process, making it a viable option for both seasoned traders and beginners.”

Practical Tips for Success:

- Understand your risk tolerance and trade accordingly

- Research and analyze the underlying asset thoroughly

- Choose appropriate strike prices and expiration dates

- Monitor your trades closely and make adjustments as needed

- Consider seeking guidance from a financial advisor if necessary

Conclusion:

Options trading with Robinhood App unlocks a world of potential for financial empowerment. By harnessing the app’s user-friendly features, educational resources, and strategic implementation, you can navigate the complexities of options trading with confidence. Remember, knowledge and preparation are key to maximizing your investment journey.

Image: blog.prototypr.io

Options Trading Robinhood App

Image: www.youtube.com