As an options trader, meticulous record-keeping is paramount for refining your strategies and maximizing returns. Introducing the Options Trading Journal Spreadsheet, an indispensable tool meticulously designed to help you track, evaluate, and enhance your trading decisions. This article will serve as a comprehensive guide, unlocking the secrets of this indispensable tool.

Image: db-excel.com

The Significance of Journaling in Options Trading

Options trading, by nature, is intricate and necessitates a high level of discipline. Without proper journaling, traders may grapple with fragmented insights, making it challenging to identify patterns, learn from mistakes, and devise effective strategies. The Options Trading Journal Spreadsheet empowers traders with a structured approach, ensuring meticulous documentation of every trade executed.

Components of an Options Trading Journal Spreadsheet

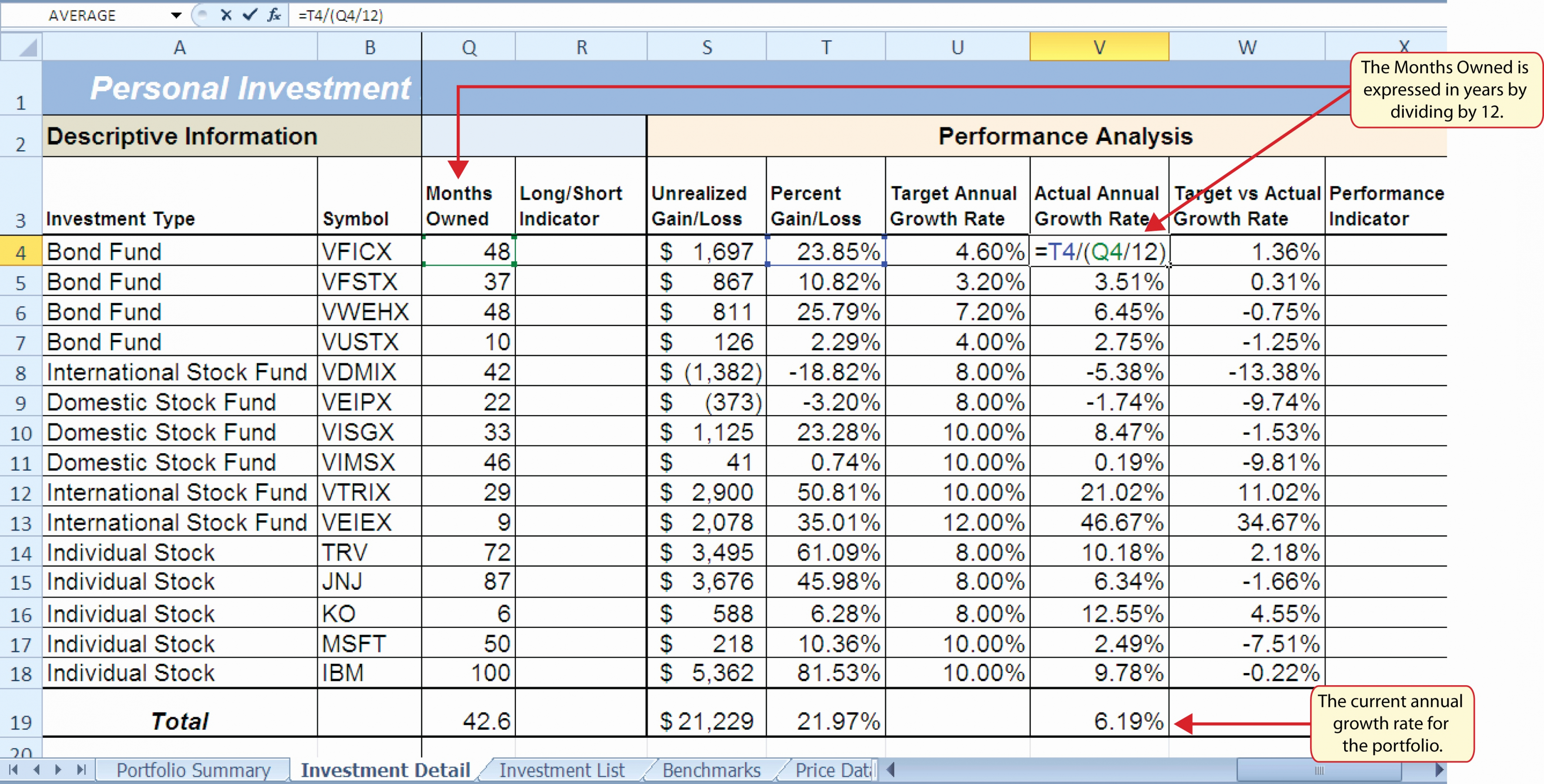

An effective Options Trading Journal Spreadsheet should encompass key components such as:

- Trade Details: Date, underlying asset, option type, strike price, expiration date, quantity, premium.

- Market Data: Underlying asset price at trade execution, implied volatility, realized volatility.

- Trader Sentiments: Reasons for entering and exiting the trade, initial hypothesis, risk tolerance.

- Trade Performance: Actual profit/loss, annualized return, risk/reward ratio.

- Analysis: Reflections on the trade’s performance, factors that contributed to success or failure, lessons learned.

Benefits of Journaling with Options Trading Spreadsheets

By diligently maintaining an Options Trading Journal Spreadsheet, traders gain access to numerous advantages:

- Objective Evaluation: Facilitates a dispassionate assessment of trading decisions, enabling traders to pinpoint strengths and weaknesses.

- Performance Improvement: Enables traders to identify recurring patterns, refine strategies, and optimize risk management.

- Market Analysis: Provides a historical context for market conditions, helping traders anticipate future trends.

- Accountability: Encourages discipline and accountability by promoting a structured approach to trading.

Image: db-excel.com

Maximizing Your Journaling Routine

To fully harness the power of the Options Trading Journal Spreadsheet, consider the following tips and expert advice:

- Be Consistent: Dedicate time each trading day to meticulously record all trades executed.

- Reflect Regularly: Set aside time to analyze past trades and draw valuable insights from both successful and unsuccessful ventures.

- Use Technology: Utilize software applications or online platforms that automate the journaling process, streamlining record-keeping.

- Seek Feedback: Engage with experienced traders or mentors to gain valuable perspectives and enhance your journaling techniques.

Frequently Asked Questions

- Q: What is the primary purpose of an Options Trading Journal Spreadsheet?

A: To provide a comprehensive record of trading activities, facilitating performance evaluation and strategy refinement.

- Q: How can I optimize my journaling routine?

A: Consistency, regular reflection, leveraging technology, and seeking feedback are key to maximizing the benefits of journaling.

- Q: What key components should an Options Trading Journal Spreadsheet include?

A: Essential components include trade details, market data, trader sentiments, trade performance, and analysis.

Options Trading Journal Spreadsheet

Conclusion

The Options Trading Journal Spreadsheet is an invaluable asset that empowers traders with the insights necessary to navigate the complexities of the markets. By embracing the principles outlined in this article, traders can transform their journaling practices, enhancing their understanding of market dynamics, refining their strategies, and unlocking unparalleled profit potential. Are you ready to embark on a journey of trading excellence with the Options Trading Journal Spreadsheet as your trusted companion?