Image: rupeedeskshares.blogspot.com

In the fast-paced and dynamic world of finance, options trading has emerged as a versatile and potentially lucrative strategy. Understanding its fundamentals is paramount for aspiring investors seeking to navigate this realm effectively. This comprehensive guide will delve into the basics of options trading, empowering you with the knowledge and confidence to make informed decisions.

What is Options Trading?

An option contract grants the holder the right, but not the obligation, to buy or sell an underlying asset (such as a stock, index, or commodity) at a specified strike price on or before an expiration date. These contracts offer investors unique opportunities to mitigate risk, speculate on price movements, and enhance portfolio performance.

Types of Options Contracts

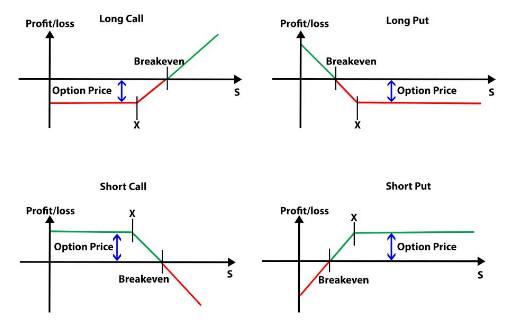

There are two main types of options contracts: calls and puts. Call options give the holder the right to buy the underlying asset at the strike price, while put options provide the right to sell. Depending on market conditions and investment goals, investors can choose between buying or selling options (known as going long or short).

Understanding the Language of Options

Options contracts use specific terminology that can be daunting for beginners. Here are some key terms:

- Strike Price: The pre-determined price at which the holder can buy (call option) or sell (put option) the underlying asset.

- Expiration Date: The day on which the option contract expires, after which it becomes worthless.

- Premium: The price paid to purchase an option contract, which represents the amount of money the investor is willing to risk.

- Intrinsic Value: Amount by which an option is in-the-money (i.e., profitable), calculated as the difference between the strike price and current asset price.

- Time Decay: Gradual decline in an option’s premium as the expiration date approaches.

Benefits and Risks of Options Trading

Options trading offers several potential benefits, including:

- Enhanced risk management

- Potential for higher returns

- Speculation on asset price movements

However, it also carries significant risks that potential investors must be aware of:

- Loss of premium if the option expires out-of-the-money

- Unlimited potential losses on short options

- Time decay, which gradually reduces the option’s premium

Expert Insights and Actionable Tips

Seasoned options traders have developed valuable insights that can inform your investment decisions. Here are some tips:

- Set Realistic Expectations: Options trading involves substantial risk and potential rewards. Avoid chasing unrealistic returns.

- Manage Risk Effectively: Use hedging strategies or consider selling options to offset potential losses.

- Trade with Discipline: Develop a trading plan that includes clear entry and exit points, and stick to it.

- Continuous Learning: Stay updated on market trends, options strategies, and expert insights.

Conclusion

Options trading provides a versatile tool for investors looking to navigate the complexities of financial markets. By understanding its basics, you can make informed decisions and harness its potential for risk management, enhanced returns, and speculative gains. Remember to proceed with caution, manage risk diligently, and continuously refine your knowledge. With careful consideration and a commitment to learning, you can harness the power of options trading and pursue your financial goals.

Image: blog.quantinsti.com

Options Trading Basics Video