Introduction:

Image: dhan.co

Embarking on the realm of options trading can be an exhilarating yet daunting endeavor. To navigate this intricate landscape successfully, it is paramount to equip yourself with the foundational knowledge and strategies. This comprehensive guide will serve as your compass, illuminating the path towards establishing and thriving in your options trading enterprise. By delving into the intricacies of this dynamic market, you will uncover the potential to unlock financial freedom and cultivate a fulfilling career.

Understanding Options Trading: A Primer

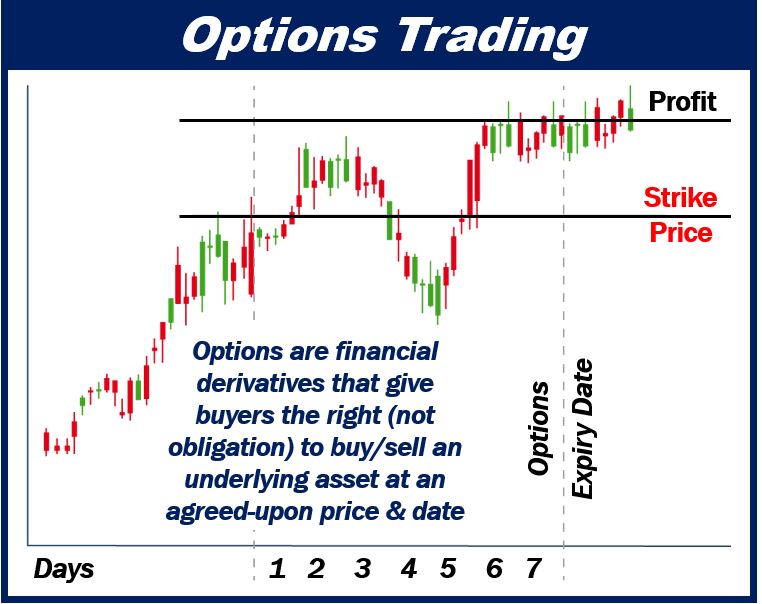

Options trading offers traders the ability to speculate on the potential price movements of an underlying asset, such as stocks, commodities, or currencies, without the obligation to purchase or sell it outright. This flexibility grants traders a wide array of strategies, from speculating on market direction to mitigating risk. However, it is essential to recognize that options trading also carries inherent risks, and traders should only venture into this domain with a thorough understanding of these risks and a robust risk management strategy.

Laying the Foundation: Education and Practice

Before embarking on your options trading journey, it is imperative to invest in education and practice. Immerse yourself in books, articles, online courses, and forums to grasp the fundamentals of options trading. Attend webinars and seminars led by experienced traders to gain practical insights and sharpen your analytical skills. Additionally, allocate ample time to practicing on paper trading platforms, simulating real-world market conditions without risking any capital.

Choosing the Right Broker and Platform

Selecting a reputable and reliable broker is crucial for successful options trading. Conduct thorough research, considering factors such as commission fees, trading platform functionality, educational resources, and customer support. Once you have identified a suitable broker, explore their trading platform to familiarize yourself with its features and ensure it aligns with your trading preferences and risk tolerance.

Developing a Trading Plan: Your Roadmap to Success

In the realm of options trading, a well-defined trading plan acts as a compass, guiding your decisions and ensuring discipline. Determine your trading objectives, risk appetite, and time frame. Research and identify trading strategies that complement your goals and risk tolerance. Establish entry and exit points, as well as stop-loss and profit-taking levels, to safeguard your capital and maximize your profit potential.

Executing Your Trades: Skill and Precision

Executing options trades requires precision and a keen understanding of market dynamics. Familiarize yourself with the different order types and their implications. Position sizing is also crucial; determine the appropriate number of contracts to trade based on your account size and risk tolerance. Continuously monitor your trades and make adjustments as needed, adhering to your trading plan and managing risk effectively.

Mastering Risk Management: Protecting Your Capital

Risk management is the cornerstone of successful options trading. Implement stop-loss orders to limit potential losses and prevent catastrophic outcomes. Additionally, consider employing hedging strategies, such as protective puts or calls, to mitigate the impact of adverse price movements. Diversify your trades across different assets and strategies to minimize concentration risk.

Analyzing the Market: Unlocking Trading Opportunities

Becoming an adept options trader necessitates a thorough comprehension of market dynamics. Study technical and fundamental analysis techniques to identify trading opportunities and forecast market movements. Stay informed about economic data, earnings reports, and geopolitical events that can influence market behavior. Utilize charting tools and indicators to identify trends, support, and resistance levels.

Continuous Learning and Adaptation: The Path to Mastery

The world of options trading is constantly evolving, demanding continuous learning and adaptation. Stay abreast of market trends, new strategies, and regulatory changes. Attend industry conferences and webinars, and engage with experienced traders to expand your knowledge base. Enhance your analytical skills and refine your trading strategies over time to keep pace with the ever-changing market landscape.

Conclusion:

Venturing into options trading presents a unique blend of rewarding opportunities and inherent risks. By embracing the principles outlined in this comprehensive guide, you can establish a solid foundation for your options trading business. Through meticulous research, disciplined execution, and unwavering risk management, you will unlock the potential for financial growth and establish yourself as a proficient trader. Remember, the pursuit of mastery in the realm of options trading is an ongoing journey, one that requires continuous learning and adaptation. With unwavering dedication and a commitment to excellence, you will navigate the complexities of this dynamic market with confidence and achieve your financial aspirations.

Image: marketbusinessnews.com

How To Start An Options Trading Business

Image: www.pinterest.com