A Comprehensive Guide to Establishing a Profitable Trading Enterprise

Greetings, tax-savvy traders! Embark on a transformative journey as we delve into the intricacies of establishing a robust option trading business for tax optimization. Prepare to unlock the potential of treating your trading endeavors as a legitimate enterprise, maximizing deductions, offsetting gains, and reaping the rewards of tax-efficient investing.

Image: truyenhinhcapsongthu.net

Defining Option Trading as a Business

The key to unlocking the business designation for option trading lies in demonstrating a consistent and substantial pursuit of profit. This involves meeting specific criteria, including regular trading activities, record-keeping, and the intention to generate income. By establishing a methodical approach and documenting your trades meticulously, you can solidify your status as a bonafide trader.

Elements of a Successful Trading Business

- Professional Trading Plan: Outline your trading strategy, risk management protocols, and profit targets to provide a roadmap for your operations.

- Dedicated Trading Space: Establish a designated area exclusively for trading activities, separating it from your personal space.

- Business Structure: Consider forming an LLC or S-Corp to enhance liability protection and tax benefits.

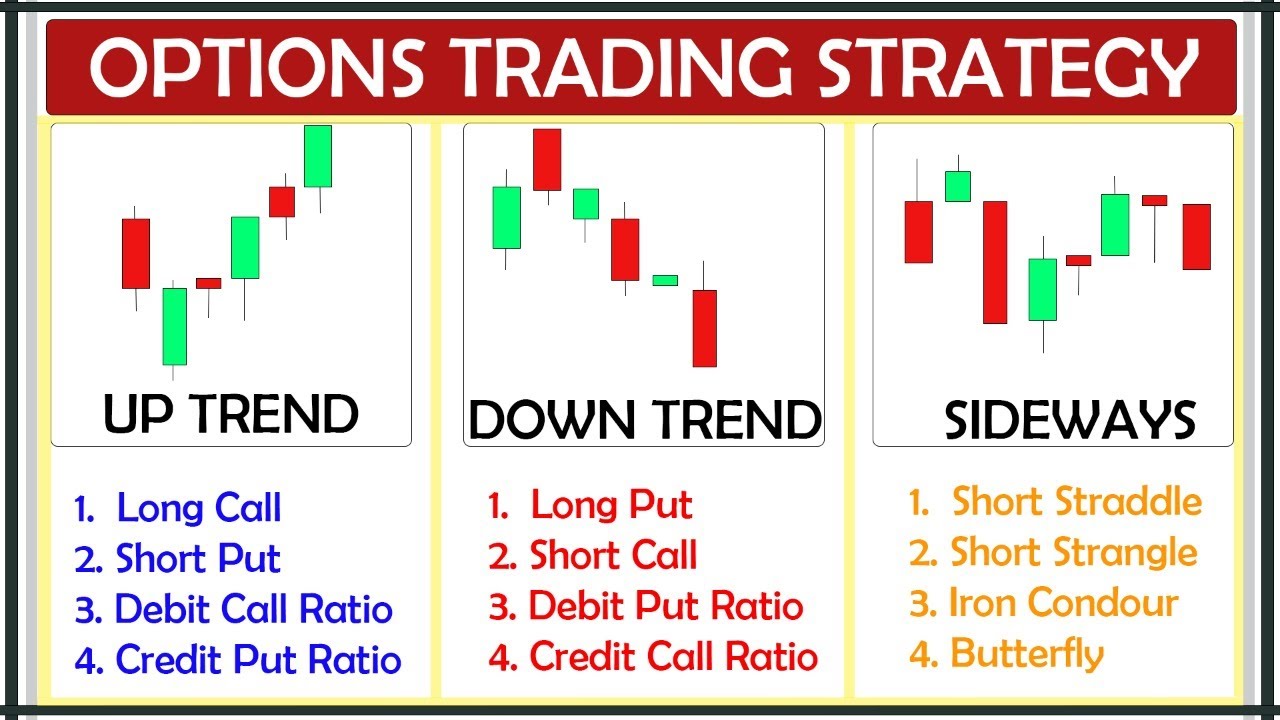

Tax-Smart Trading Strategies

As a business trader, you gain access to a suite of tax advantages. Harness these strategies to amplify your profits:

Image: unbrick.id

Section 475 Mark-to-Market Gains/Losses

For traders meeting certain criteria, short-term option trades (held less than one year) can qualify for mark-to-market taxation. This permits traders to recognize gains and losses on open positions at the end of the tax year, potentially offsetting other income and reducing tax liability.

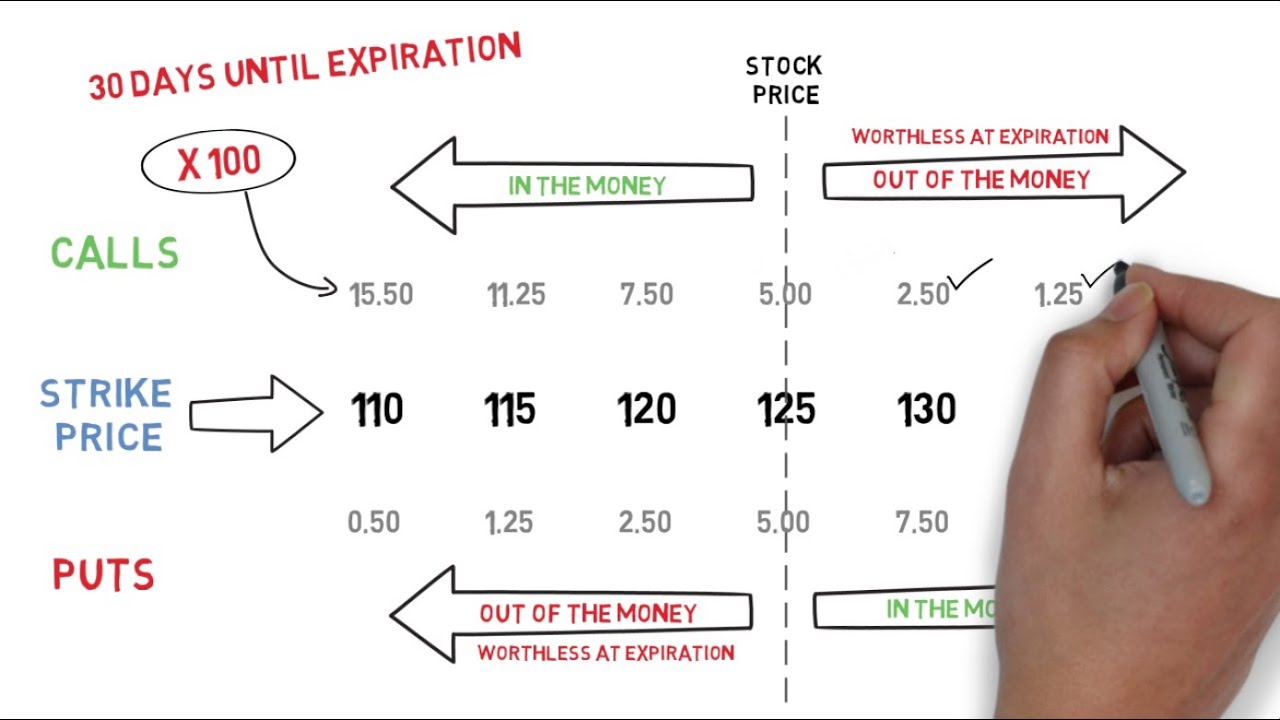

Capital Gains Tax Optimization

Long-term option trades held for more than one year are taxed at more favorable capital gains rates. By establishing a holding period of over a year, you can minimize your tax burden on these trades.

Business Deductions

As a business trader, you can deduct expenses directly related to your trading activities, such as commissions, subscriptions to trading platforms, and travel expenses.

Expert Advice and Tips for Success

Leverage the wisdom of seasoned traders:

Diversify Your Trading

Don’t put all your eggs in one basket! Diversify your portfolio by trading a range of options, including calls, puts, and spreads.

Manage Risk Prudently

Risk management is paramount. Implement stop-loss orders, limit orders, and position sizing strategies to protect your capital.

Continuous Education

Stay abreast of market developments and trading techniques. Attend webinars, read industry publications, and engage in online forums to enhance your knowledge.

FAQs for Option Trading as a Business

Q: How can I determine if option trading is a business for me?

A: Assess your trading frequency, record-keeping practices, and primary intent. If you trade regularly, maintain detailed records, and aim to generate profit, you may qualify.

Q: What records should I keep for my trading business?

A: Maintain comprehensive records of trades, including buy/sell dates, strike prices, premiums, expiration dates, and realized gains/losses.

Q: Can I offset trading losses against other income?

A: Under the mark-to-market election, short-term trading losses can offset your overall income, including wages, dividends, and interest. However, long-term losses are not deductible against non-trading income.

How To Make Option Trading A Business For Tax Purposes

Image: www.youtube.com

Conclusion

Transform option trading into a thriving business enterprise, unlocking tax optimization strategies that amplify your investment returns. By meeting the criteria for a business trader and implementing sound trading practices, you can fully harness the potential of this lucrative endeavor. Are you ready to elevate your trading journey to the next level? Explore the myriad opportunities available to business traders, establish your trading enterprise today, and unleash the power of tax-advantaged investing.