In the fast-paced world of financial markets, options trading offers investors a powerful tool to amplify their potential returns. Pre-market trading, a special window of opportunity before the official market open, presents traders with unique advantages and the chance to seize valuable opportunities. Let’s dive into the intricacies of options pre-market trading, empowering you with the knowledge to leverage this pivotal juncture for maximum strategic gains.

Image: creditwritedowns.com

A Pre-Market Primer: Delving into Early Opportunities

Pre-market trading commences as early as 7 AM EST, granting traders an exclusive head start before the regular market session. This privileged access to liquidity enables them to react swiftly to overnight developments and capitalize on market movements before most participants join the trading fray. Whether seeking to establish positions, adjust strategies, or manage risk, pre-market trading serves as an arena for proactive traders to shape market outcomes.

Deciphering the Pre-Market Options Landscape

The pre-market options trading landscape is a realm of volatility, where prices can sway dramatically as liquidity remains relatively thin compared to normal market hours. These price fluctuations present both risks and rewards, demanding a keen understanding of market dynamics and an ability to interpret pre-market signals effectively. By carefully monitoring market news, economic data releases, and technical indicators, traders can form informed decisions and position themselves accordingly as the regular trading session approaches.

Pre-Market Reconnaissance: Uncovering Market Sentiment

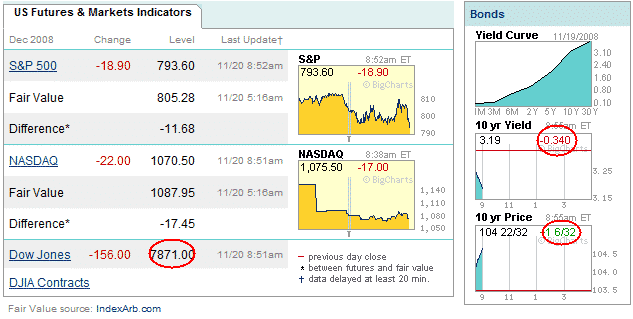

The pre-market session offers a testing ground for investors to gauge market sentiment before the wider market joins the trading fray. By observing the behavior of futures contracts and analyzing pre-market volume patterns, traders can glean insights into the upcoming direction of the equity, commodity, and index markets. Additionally, monitoring the performance of exchange-traded funds (ETFs) can further illuminate broader market sentiment and help traders make judicious pre-market options trading decisions.

Image: www.brokerage-review.com

Strategies for Pre-Market Options Advantage

The pre-market trading arena provides fertile ground for deploying a range of options trading strategies. One popular approach involves utilizing pre-market volatility to establish or adjust positions at favorable prices. By identifying stocks or indices poised for a significant move, traders can initiate trades and potentially capture price swings before a wider market consensus emerges. The inherent liquidity constraints of pre-market trading also favor strategies that employ smaller position sizes and precise execution.

Capitalizing on Earnings Announcements: A Pre-Market Edge

Earnings announcements can unleash significant market volatility, and savvy traders can leverage the pre-market session to position themselves for these potential market-moving events. By meticulously researching upcoming earnings releases, traders can identify stocks likely to witness substantial price action and execute pre-market options trades to capitalize on anticipated post-announcement volatility.

Risk Management in the Pre-Market Arena

While pre-market trading offers opportunities, it is imperative to approach this volatile landscape with a well-defined risk management strategy. Strict adherence to position sizing, careful monitoring of market dynamics, and the utilization of stop-loss orders are crucial for preserving capital and mitigating potential losses. By understanding the risks associated with pre-market options trading and implementing sound risk management protocols, traders can navigate this challenging environment with enhanced confidence.

Options Pre Market Trading

Pre-Market Options: A Gateway to Trading Mastery

Options pre-market trading is an arena reserved for proactive and informed traders who possess a keen understanding of market dynamics and a tolerance for volatility. By embracing the unique opportunities and nuances of this early trading window, traders can seize an edge, refine their strategies, and ultimately enhance their overall trading performance. As you delve deeper into the intricacies of pre-market options trading, you will gain the skills to unlock the full potential of this invigorating and rewarding market realm.