Introduction

In the ever-evolving financial landscape, traders and investors seek ingenious strategies to harness the power of market fluctuations. One such strategy that has captivated the attention of savvy traders is option volatility trading. With the help of this remarkable technique, traders aim to capitalize on the dynamic behavior of stock prices and the uncertainty surrounding their future movements. This comprehensive guide will delve into the intricacies of option volatility trading, providing a roadmap to unlock its potential while managing risk.

Image: www.sampletemplates.com

Understanding Option Volatility

Option volatility, a crucial concept in finance, measures the implied variability of an underlying asset’s price. The higher the volatility, the more significant the expected price swings. Traders leverage this information to make informed decisions about trading options, which confer both rights and obligations. Options provide the flexibility to speculate on an asset’s future price movement without the upfront capital requirement of purchasing the underlying asset directly.

Option Volatility Trading Strategies Unveiled

The world of option volatility trading encompasses a diverse range of strategies tailored to various market conditions and risk appetites. Here are several popular techniques that have gained traction among traders:

-

Long Volatility: This strategy involves buying options with high implied volatility in anticipation of heightened market volatility. When the underlying asset experiences significant price fluctuations, the value of these options tends to rise, leading to potential profits.

-

Short Volatility: Conversely, short volatility strategies involve selling options with high implied volatility. This approach capitalizes on periods of market stability or low volatility, where the value of these options often depreciates, resulting in gains for the seller.

-

Straddles and Strangles: These strategies employ a combination of call and put options with different strike prices and expirations. Straddles involve purchasing both a call and a put option at the same strike price, profiting from significant price movements in either direction. Strangles, on the other hand, involve buying options with different strike prices but the same expiration, capturing profits from moderate price movements.

Mastery Through Expert Insights

To further enhance your understanding of option volatility trading, seek guidance from renowned experts in the field:

-

Nassim Nicholas Taleb: A prominent voice in the finance industry, Taleb advocates for strategies that mitigate the perils of extreme market events. His concept of “black swans” highlights the importance of preparing for unexpected events and constructing robust trading strategies.

-

Mark Spitznagel: Acclaimed for his expertise in volatility trading, Spitznagel emphasizes the importance of risk management and position sizing. His “wheel” strategy involves rotating between selling and buying options while adjusting the strike prices and expirations to capture market fluctuations.

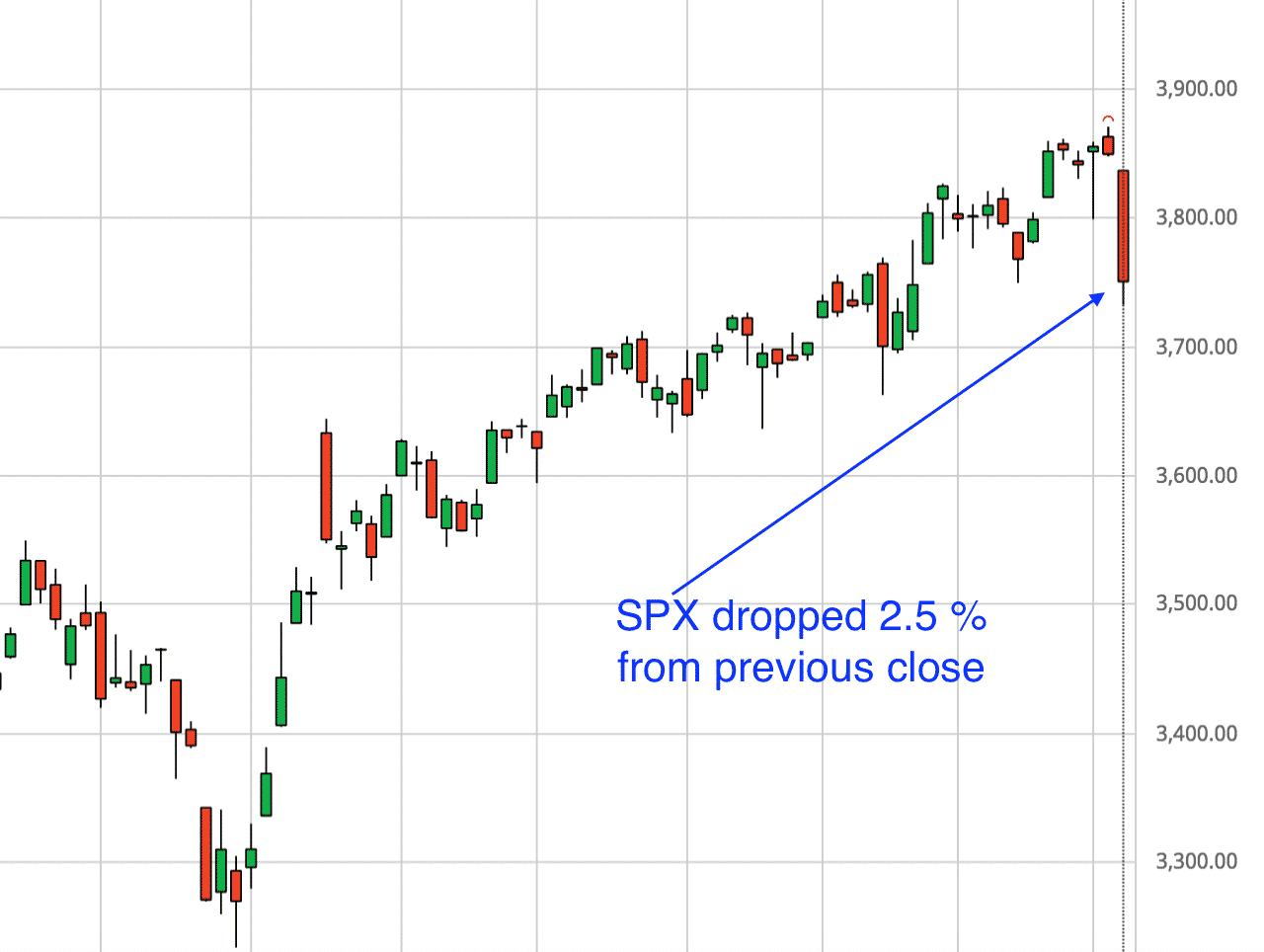

Image: optionstradingiq.com

Harnessing Option Volatility Trading

The potential benefits of option volatility trading are undeniable; however, it is imperative to exercise caution. Before diving into these strategies, traders should possess a thorough understanding of options trading, risk management techniques, and market dynamics.

-

Identify Market Trends: Determine the prevailing market sentiment and look for indicators of heightened or suppressed volatility.

-

Select Appropriate Strategies: Choose strategies that align with your risk tolerance and market outlook.

-

Manage Risk Effectively: Implement robust risk management strategies, including position sizing, stop-loss orders, and hedging techniques.

-

Monitor Market Conditions: Volatility is a dynamic concept that can shift rapidly. It is crucial to monitor market conditions and adjust your strategies accordingly.

Option Volatility Trading Strategies Pdf

Conclusion

The allure of option volatility trading lies in its potential to capture profits in both bullish and bearish markets. By mastering these strategies and adhering to prudent risk management practices, traders can unlock the power of this sophisticated trading technique. Remember, the key to success in option volatility trading is not merely in finding the right strategy but in cultivating a deep understanding of market behavior and embracing a disciplined approach. As you venture into this exciting realm, let this guide serve as your compass, guiding you towards informed decisions and potentially lucrative outcomes.