Introduction: Unlocking the Secrets of Profitable Options Trading

The enigmatic world of options trading holds immense potential for savvy investors seeking above-average returns. Unlike stocks, options represent contracts granting the buyer the right (but not the obligation) to buy or sell an underlying asset at a predetermined price within a specified timeframe. This unique construct gives options traders unparalleled flexibility and the potential to generate substantial profits. Join us on an immersive journey to unravel the intricate strategies and techniques that empower you to thrive in this thrilling domain.

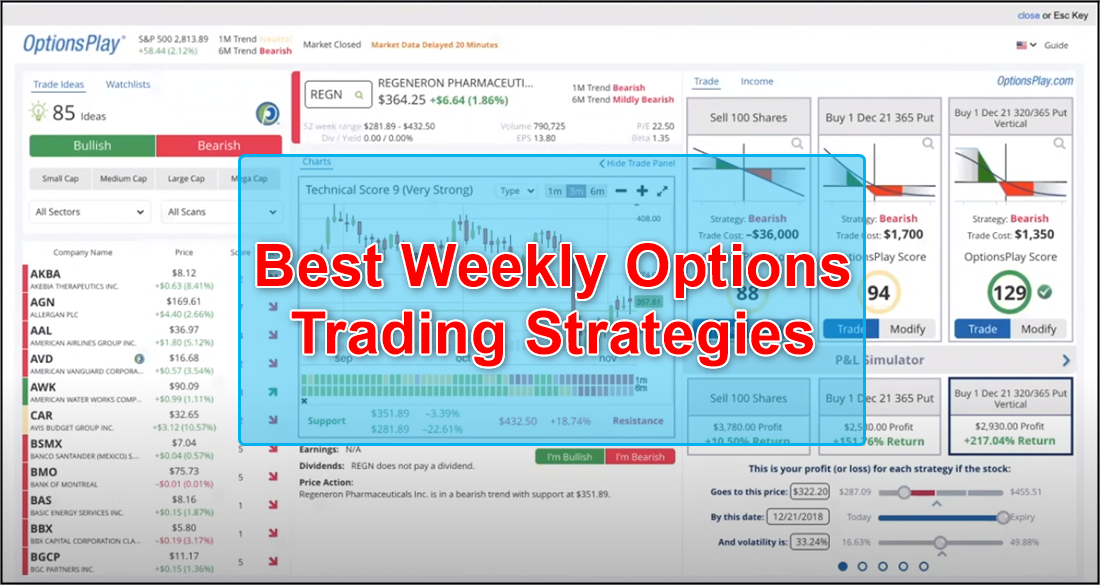

Image: www.youtube.com

Navigating the Options Landscape: A Foundational Understanding

Options trading is an advanced investment strategy that warrants a thorough grasp of its underlying mechanisms. Firstly, define options as agreements between two parties, granting the buyer the privilege to either purchase (call option) or divest (put option) a designated asset, such as a stock or commodity, at a specific price, referred to as the strike price. Options possess contingent value that fluctuates dynamically based on the interplay of time decay and asset price movements. As the expiration date approaches, the value of options erodes, potentially leading to significant losses if the trade does not favor the trader.

Empowering Strategies: Unlock the Potential of Options Trading

Entering the world of options trading demands a strategic approach, leveraging a repertoire of effective techniques tailored to different market conditions and financial goals. Covered calls, where you sell a call option while owning the underlying asset, are renowned for generating income when the asset’s price remains stable or rises modestly. Alternatively, cash-secured puts involve selling a put option with collateral in a margin account, offering a premium in exchange for the obligation to buy the underlying asset at the strike price if exercised.

For the adventurous seeking asymmetric returns, consider bull call spreads or bear put spreads. Bull call spreads entail buying a lower-strike call option and selling a higher-strike call option, enabling traders to capitalize on modest price increases while limiting the risk and potential return. Conversely, bear put spreads encompass the sale of a higher-strike put option and the purchase of a lower-strike put option, banking on a moderate decline in the asset’s price.

The Guiding Pillars: Maximizing Success in Options Trading

Knowledge and understanding are instrumental in options trading, yet discipline and risk management are equally paramount for enduring success. The lure of potentially lucrative returns should never overshadow the importance of calculated decision-making and unwavering discipline. Furthermore, options traders would be wise to harness the power of technology by utilizing advanced trading platforms that provide invaluable tools such as backtesting, charting, and real-time data analysis.

Embarking on a comprehensive study of options trading is highly recommended for those seeking to master this dynamic field. Seek guidance from reliable sources such as books, online courses, and webinars, and complement this theoretical knowledge with practical experience through the use of paper trading or simulated accounts. This holistic approach will foster a comprehensive understanding of options trading strategies, empowering you to navigate the complexities with increased confidence.

Image: pipsedge.com

The Importance of Risk Awareness and Mitigation: Safeguarding Your Trading Journey

Venturing into the world of options trading necessitates an unwavering acknowledgment of the inherent risks involved. The allure of substantial gains should never compromise the importance of understanding and managing the potential for losses. Always trade with capital you can afford to lose and meticulously consider the potential downside of any trade before committing. Employ stop-loss orders to limit losses, diligently monitoring market conditions and adjusting positions as needed. Unwavering vigilance and a disciplined approach to risk management are the hallmarks of successful options traders.

Winning With Options Trading

Image: stockscreenertips.com

Conclusion: Unveiling the Path to Options Trading Mastery

Options trading presents a captivating realm of financial exploration, offering investors the potential for substantial returns. By comprehending the intricacies of options contracts and employing a well-defined strategy, you can harness the power of leverage and market fluctuations to generate financial success. Always prioritize knowledge, discipline, and risk management, as they are the guiding principles that pave the way to consistent profitability in this thrilling and rewarding investment journey. Embark on this adventure with an open mind and a commitment to continuous learning, and the world of options trading will reveal its limitless possibilities.