Image: www.projectfinance.com

Introduction

The allure of options trading has enticed investors seeking to multiply their profits and hedge against market fluctuations. Yet, navigating this complex realm can be daunting, especially for the uninitiated. This definitive guide will dissect options trading, empowering you with the knowledge and insights to make informed decisions.

Options, financial instruments that confer the right but not the obligation to buy or sell an underlying asset, offer immense potential for both profit and loss. Understanding their intricacies is paramount to maximizing your chances of success.

Delving into Options Trading

Options emerged in the 17th century as a means to mitigate risks in the agricultural industry. Today, they encompass a vast array of asset classes, including stocks, commodities, and currencies.

At the heart of options trading lies the concept of “call” and “put” options. Call options grant the right to buy an asset at a specified price (strike price), while put options confer the right to sell an asset at the strike price. The expiration date determines the timeline within which these rights can be exercised.

Understanding the Risk and Reward

Options trading is not without its risks. Your potential profit or loss is capped by the premium you pay for the option. This premium decays over time as the option approaches its expiration date.

The outcome of an options trade hinges on the underlying asset’s price movement relative to the strike price. If the asset price rises, call options gain in value, while put options lose value. Conversely, if the asset price declines, the reverse occurs.

Expert Insights and Actionable Tips

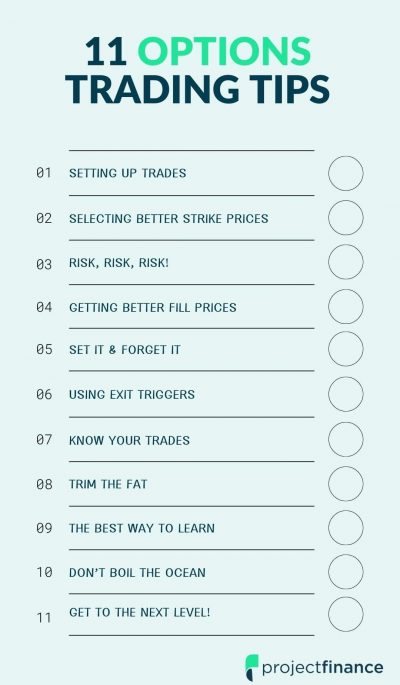

To navigate the complexities of options trading, insights from experienced professionals are invaluable. Here are invaluable tips to guide your journey:

- Embrace education: Diligently study the foundational concepts, risks, and rewards associated with options trading.

- Start small: Begin with small trades to gain a hands-on understanding and manage your risk exposure.

- Choose liquid options: Focus on options with high trading volume to ensure liquidity and minimize slippage.

- Set stop-loss orders: Establish preset limits to manage potential losses.

- Consult financial advisors: Seek guidance from reputable financial advisors who can tailor strategies to your specific needs.

Conclusion

Mastering options trading requires a blend of knowledge, market acumen, and strategic planning. This comprehensive guide has laid the groundwork for your journey into this dynamic investment arena, equipping you with essential insights and actionable tips.

Remember, the allure of options trading lies in its potential to amplify profits, but it is not a path for the faint of heart. Embrace the learning process, collaborate with experts, and always trade with informed decision-making to maximize your chances of success.

Image: www.asktraders.com

Options Trading Reviews

Image: www.pinterest.com