Introduction

Image: www.brightwoodventures.com

In the dynamic realm of investing, options trading presents tantalizing opportunities for potential gains. TD Ameritrade, a renowned financial services giant, offers traders a comprehensive platform to navigate the options market with competitive pricing and a wealth of resources. Embark on an enlightening journey as we delve into the intricacies of TD Ameritrade’s options trading cost structure, empowering you to make informed decisions and maximize your returns.

Understanding Options Trading Cost

Options contracts, financial instruments that convey the right but not the obligation to buy or sell an underlying asset at a predetermined price, incur specific transaction fees. These fees typically comprise two components:

-

Per-Contract Premium: This non-refundable fee is paid to the seller of the option and represents the cost of acquiring the right to exercise it. The premium varies depending on factors such as the underlying asset, strike price, and time to expiration.

-

Trading Commissions: TD Ameritrade charges a commission for each option trade executed on its platform. The commission structure is tiered, with lower rates for higher trading volumes. Additionally, certain account types and subscription plans may qualify for reduced or commission-free trading.

TD Ameritrade’s Options Trading Cost

TD Ameritrade’s options trading cost is highly competitive compared to the industry average. Its commission structure, outlined below, provides traders with a transparent and flexible pricing model:

- Standard Option Commission: $0.65 per contract, capped at $4.95 per trade.

- TD Ameritrade thinkorswim Platform Commission: $0.50 per contract, capped at $4.95 per trade for subscribers.

- Above 20+ Contracts Discount: $0.50 per contract for trades exceeding 20 contracts.

- Per-Leg Pricing: Commissions are charged on a per-leg basis for multi-leg strategies, such as spreads.

Factors Influencing Options Trading Cost

Beyond TD Ameritrade’s base pricing structure, several factors can influence the overall cost of options trading:

-

Contract Size: The number of underlying shares represented by each option contract affects the total premium and commission incurred.

-

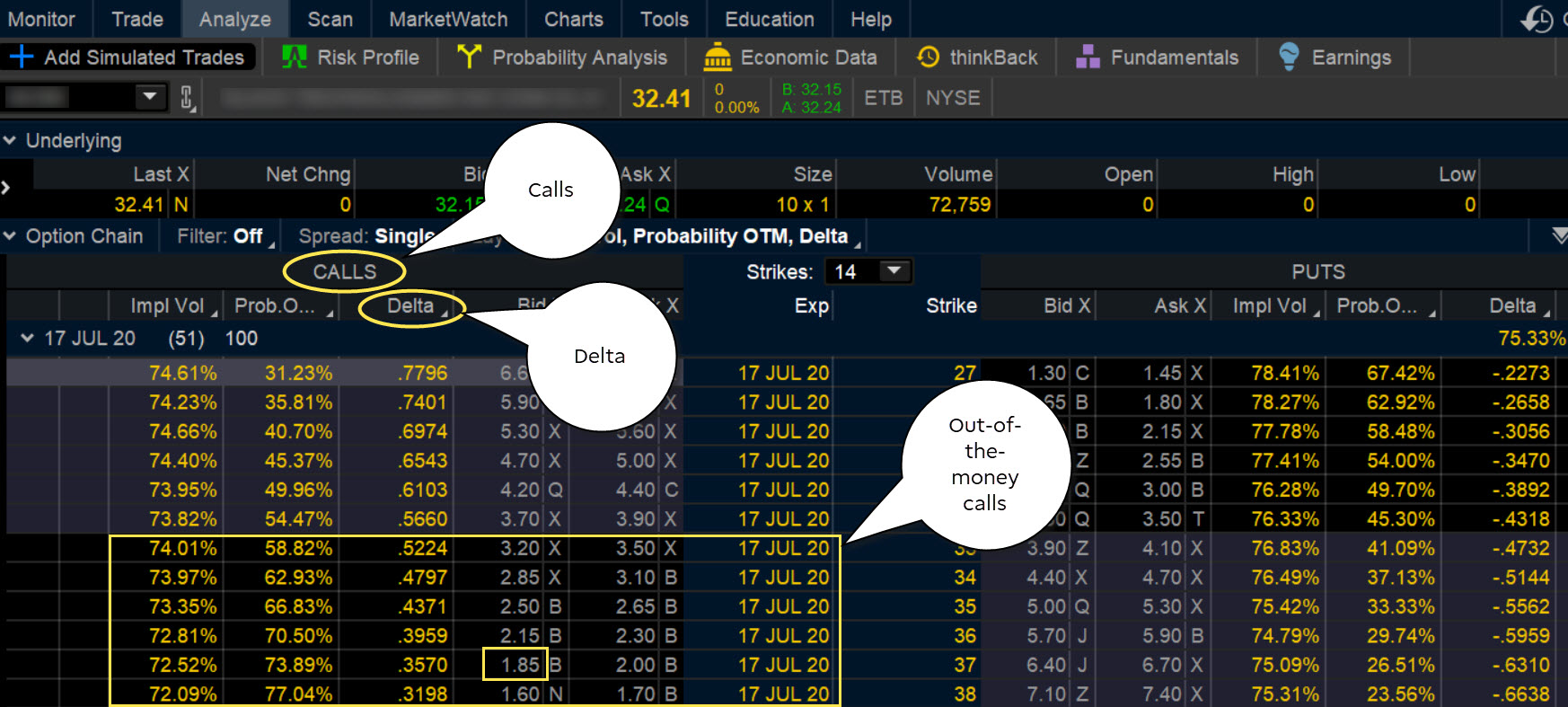

Strike Price: The relationship between the strike price and the underlying asset’s current price impacts the premium. Options that are significantly in-the-money or out-of-the-money typically carry higher premiums.

-

Time to Expiration: As the expiration date of an option approaches, the remaining time value decays, resulting in reduced premiums. This time decay factor plays a crucial role in determining the overall cost.

Minimizing Options Trading Cost

Savvy traders can employ strategic approaches to minimize their options trading cost:

-

Negotiate Commissions: High-volume traders may negotiate reduced commission rates with TD Ameritrade based on their trading volume and account balance.

-

Consider Bulk Discounts: Accumulating trades to exceed 20 contracts qualifies for discounted per-contract rates.

-

Take Advantage of Free Options Trading Platforms: TD Ameritrade offers free options trading on its thinkorswim platform, providing cost savings for active traders.

-

Sell Options to Generate Income: Generating premium income by selling covered calls or cash-secured puts can offset the cost of buying options.

Expert Insights: Maximizing Returns

Renowned options trading expert, Dr. Chris Perruna, emphasizes the importance of comprehensive education and risk management when trading options. He advises traders to:

-

Develop a Trading Plan: Define clear goals, risk tolerances, and trading strategies to guide decision-making.

-

Conduct Thorough Research: Analyze the underlying asset, market conditions, and option pricing models to make informed trades.

-

Stay Disciplined: Emotional trading can lead to costly errors. Maintain discipline and adhere to your trading plan to avoid impulse trades.

-

Pay Attention to Risk Management: Use stop-loss orders, calculate risk-to-reward ratios, and consider both potential profits and losses before entering trades.

Conclusion

TD Ameritrade’s competitive options trading cost structure, combined with its robust platform and educational resources, empowers traders to navigate the options market with confidence. By understanding the factors influencing option costs, implementing cost-minimizing strategies, and adhering to expert advice, traders can maximize their returns while effectively managing risk. Embrace the world of options trading with TD Ameritrade and unlock a world of financial opportunities.

Image: ymevirumo.web.fc2.com

Td Ameritrade Options Trading Cost

Image: tickertape.tdameritrade.com