Introduction

The thrill of trading options can be exhilarating, with the potential for substantial profits. However, it’s crucial to understand the tax implications of your trading activities, particularly when it comes to losses. In the realm of option trading, the Internal Revenue Service (IRS) treats certain losses as “wash sale losses.” This classification has significant consequences that can affect your tax deductions and overall financial planning. Let’s delve deeper into why option trading losses may be considered wash sale losses and the impact it has on your tax situation.

Image: www.youtube.com

Understanding Wash Sales

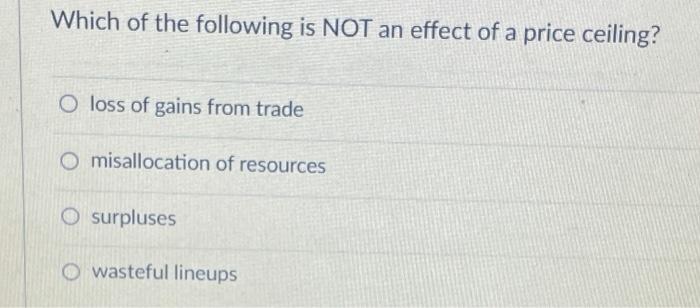

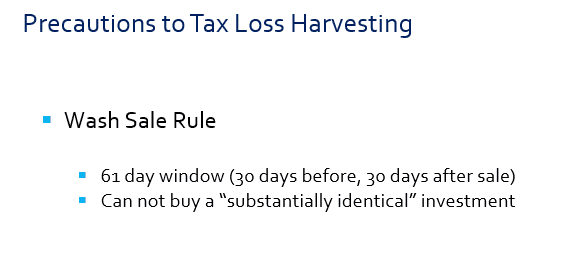

A wash sale occurs when you sell a security at a loss and acquire substantially identical securities within 30 days before or after the sale. The IRS disallows deductions for wash sale losses, viewing it as a way to artificially reduce taxable income. To determine whether your option trading losses qualify as wash sale losses, you need to consider the underlying security of the option contracts.

Underlying Security in Option Contracts

When trading options, the underlying security refers to the stock, bond, commodity, or other financial instrument on which the option is based. For instance, if you trade an option on Apple stock, the underlying security is Apple stock itself. If you happen to sell the option contract at a loss and later purchase Apple stock within the 30-day window, it will be considered a wash sale and the loss will not be considered a deductible loss on your tax return.

Substantially Identical Securities

Not all securities are treated as substantially identical for wash sale purposes. In general, the IRS considers options on the same underlying security to be substantially identical, regardless of the strike price or expiration date. This means that if you sell an option contract with a specific strike price and expiration date at a loss and buy another option contract on the same underlying security with a different strike price or expiration date within the 30-day period, it will be treated as a wash sale.

Image: www.chegg.com

Exceptions to the Wash Sale Rule

While the wash sale rule applies to most option trading losses, there are some exceptions. If you can show that you had a bona fide intention to make a profit on the option trade and that the subsequent purchase was not made with the intent to avoid the wash sale rule, the loss may be deductible. Additionally, the wash sale rule doesn’t apply if the option contracts are part of a straddle, which involves simultaneously buying and selling options with different strike prices and expiration dates on the same underlying security.

Impact of Wash Sale Losses

Classifying option trading losses as wash sale losses has several consequences. The primary impact is that you cannot deduct the loss from your taxable income. Instead, the loss is added to the cost basis of the replacement securities, effectively deferring the loss until the replacement securities are sold. This can affect your overall tax liability and planning, as you may miss out on potential tax savings.

Why Option Trading Loss Classified As Wash Sale Loss

Image: arnoldmotewealthmanagement.com

Conclusion

Understanding the wash sale rule and how it applies to option trading is essential for accurate tax reporting and maximizing your deductions. If you have experienced losses while trading options, it is crucial to assess whether they may be classified as wash sale losses. Consulting with a tax professional can provide additional guidance and ensure that you are meeting your tax obligations while optimizing your financial outcomes. By staying informed about tax regulations, you can navigate the complexities of option trading and make informed decisions that align with your financial goals.