Title: Unveiling the Thrilling World of Options Trading: A Beginner’s Guide to Harnessing Market Opportunities

Image: www.pinterest.co.uk

In the ever-evolving realm of finance, options trading emerges as an enigmatic yet potentially lucrative avenue for savvy investors seeking to amplify their financial prospects. However, delving into the intricacies of this multifaceted market can be daunting for those unfamiliar with its complexities. This comprehensive guide aims to unravel the mysteries surrounding options trading, empowering you with the knowledge and confidence to embark on this exhilarating adventure.

From understanding the fundamental principles of options to mastering advanced strategies, we will delve deep into every facet of this dynamic market. Along the way, you’ll gain insights from seasoned experts and discover practical tips that will equip you to navigate the options landscape with precision. With each chapter, we’ll ignite your investment acumen and unveil the secrets to harnessing the power of options trading for financial success.

Step 1: Understanding the Basics of Options Trading

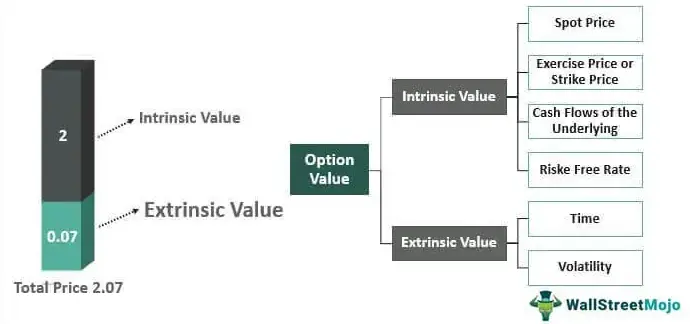

At its core, options trading involves the exchange of contracts that grant the owner the right, but not the obligation, to buy (in the case of “call” options) or sell (in the case of “put” options) an underlying asset at a predetermined price (the “strike price”) on or before a specific date (the “expiration date”). These versatile contracts offer investors the potential to capitalize on market movements while limiting their risk exposure.

Step 2: Call Options vs. Put Options

Call options bestow upon the holder the right to purchase the underlying asset at the strike price, regardless of whether its market value exceeds that price. Put options, on the other hand, provide the holder with the right to sell the underlying asset at the strike price, even if its market value falls below that price.

Image: www.warriortrading.com

Step 3: Navigating the Greeks: Understanding Options Metrics

The world of options trading is guided by a lexicon of Greek letters that represent key metrics used to quantify the behavior and risk of each contract. The “delta” measures the sensitivity of the option’s price to changes in the underlying asset’s price. The “gamma” gauges the change in delta for each unit change in the underlying asset’s price. Other Greeks, such as theta (time decay) and vega (volatility), play equally important roles in defining the option’s characteristics.

Step 4: Striking a Deal: Types of Option Trading Strategies

The options market presents a vast tapestry of strategies tailored to different investment goals and risk appetites. Some of the most commonly employed strategies include covered calls, naked puts, and straddles. Covered calls involve selling a call option while owning the underlying asset, while naked puts entail selling a put option without owning the underlying asset. Straddles capitalize on volatility by simultaneously buying both a call and a put option with the same strike price and expiration date.

Step 5: Master Trader Insights: Lessons from the Experts

To excel in the realm of options trading, it’s imperative to seek guidance from those who have scaled the heights of this financial Everest. Seasoned experts offer invaluable insights that can refine your trading, enhance your decision-making, and mitigate risk. From managing emotions to mastering technical analysis, their wisdom will serve as a guiding compass on your trading journey.

Step 6: Risk Management: The Key to Trading Success

In the high-stakes game of options trading, risk management is not merely an afterthought but an integral part of every decision. Prudent traders meticulously consider their position sizing, leverage, and stop-loss levels before executing any trade. They recognize that safeguarding capital is paramount for long-term success.

How To Invest In Trading Options

Image: redot.com

Conclusion

Embarking on the path of options trading can be an exhilarating adventure filled with both potential rewards and risks. Armed with the knowledge imparted in this comprehensive guide, you’ll have the foundation to confidently navigate the complexities of this dynamic market. Remember, mastery requires dedication, perseverance, and a willingness to embrace the lessons learned along the way. As you continue to explore the world of options trading, never forget that your success lies not only in executing trades but in managing risk and controlling your emotions. Embrace the thrill of the market, learn from your experiences, and strive for financial triumph.