Equity option trading entails the exchange of contracts granting rights to purchase or sell stocks in the future at a predetermined strike price. Options trading has gained popularity among investors seeking financial growth while managing risk. This article will guide you through the world of equity option trading, offering expert tips and insights to maximize your returns.

Image: www.hindustantimes.com

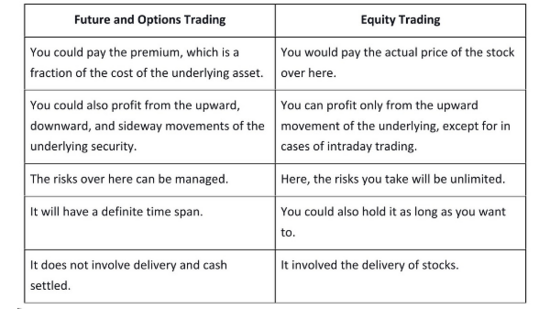

Options, unlike stocks, do not represent direct ownership in a company. Instead, they are derivative contracts that provide buyers with the prerogative to buy (call option) or sell (put option) the underlying stocks at a preset price on a specified date, known as the expiration date.

Choosing the Right Options for Your Portfolio

Discerning the appropriate options for your investment strategy is crucial. Consider the following factors:

- Underlying Stocks: Identify stocks exhibiting growth potential or anticipated market movements.

- Option Type: Determine whether a call option (right to buy) or a put option (right to sell) aligns with your market outlook.

- Strike Price: Select a strike price corresponding to your assessment of the stock’s future value.

- Expiration Date: Consider the time horizon for your investment and choose an expiration date that aligns with your expectations.

Maximizing Returns with Equity Options

To maximize your returns, embrace the following strategies:

- Time Decay: Options lose premium value over time, a phenomenon known as time decay. The closer to the expiration date, the faster the value depreciates.

- Volatility: Options with higher volatility are more susceptible to price fluctuations, representing both opportunities and risks.

- Option Spreads: Combining multiple options with different strike prices and expiration dates can create compound strategies, enhancing efficiency.

- Delta-Neutral Trading: This strategy seeks to minimize downside risk by balancing hedged positions, simultaneously holding long and short options with similar deltas.

Frequently Asked Questions

- Q: How do I get started with equity option trading?

- A: Open an account with a broker offering options trading and research trading principles before initiating transactions.

- Q: Is options trading risky?

- A: Yes, options trading involves inherent risks, especially for inexperienced traders. Understanding risks and employing proper strategies is crucial.

- Q: How much capital do I need to trade options?

- A: The capital required varies based on the specific options traded and risk tolerance, but it is generally advisable to start with a modest amount.

Image: www.cmcmarkets.com

Equity Option Trading Tips

Image: articles-junction.blogspot.com

Conclusion

Equity option trading presents an array of opportunities for savvy investors seeking to amplify returns. By understanding key concepts, implementing proven strategies, and managing risk effectively, you can harness the potential of options to grow your portfolio. Remember, knowledge, discipline, and a prudent approach are the keys to successful equity option trading. Are you ready to explore the world of options and unleash your investment prowess?