In the dynamic world of options trading, risk management is paramount. A stop-loss order serves as a crucial safety net, allowing traders to limit potential losses by automatically selling an option contract when it falls below a predetermined price. However, not all trading platforms offer stop-loss capabilities for options. This article delves into the essential information you need to know about which trading platforms provide stop-loss features for options, empowering you with the knowledge to make informed decisions and safeguard your investments.

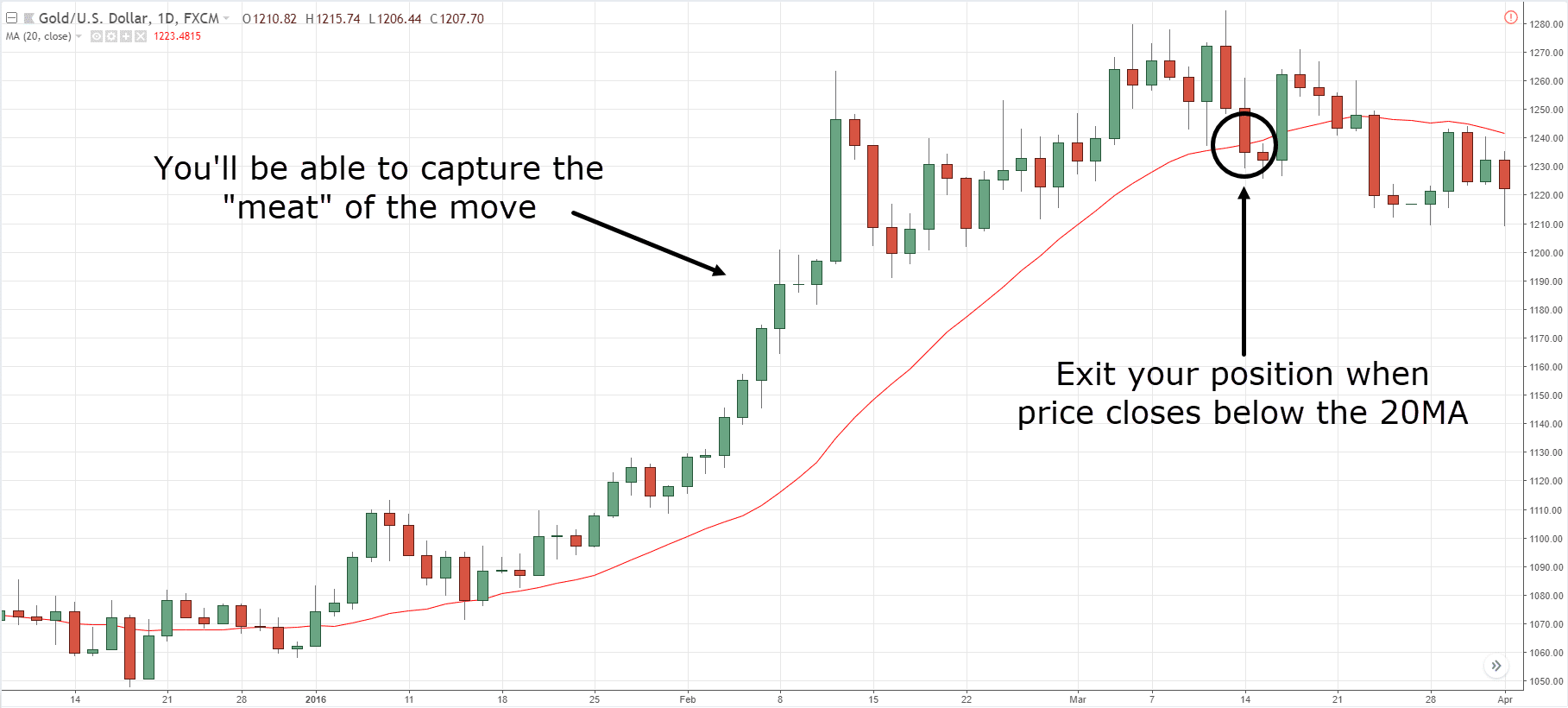

Image: www.tradingwithrayner.com

Understanding Stop-Loss Orders for Options

A stop-loss order is a conditional order that triggers a sale when the underlying asset’s price reaches a specified level, known as the “stop price.” Once the option’s market value drops to or below the stop price, the order is executed, preventing further losses. For example, suppose you own a call option for $100 and place a stop-loss order at $90. If the option’s value falls to $90, the stop-loss order will automatically sell the option, locking in a loss of $10.

Trading Platforms with Stop-Loss for Options

Various trading platforms offer different features and functionalities. To ensure you have access to stop-loss protection for options, consider the following platforms:

- TD Ameritrade: TD Ameritrade provides comprehensive options trading services, including stop-loss orders for both long and short option positions.

- *ETRADE:* ETRADE offers a user-friendly platform with advanced options trading capabilities, featuring stop-loss functionality for protecting against market downturns.

- Fidelity: Fidelity’s robust trading platform supports a wide range of options strategies, including the ability to place stop-loss orders at various levels of the underlying asset’s price.

- Interactive Brokers: Interactive Brokers is renowned for its professional-grade trading tools, providing sophisticated stop-loss execution for options traders.

- Tastyworks: Tastyworks is a specialized options trading platform that offers intuitive tools, including stop-loss orders, for managing options positions.

Selecting the Right Platform for Your Needs

When choosing a trading platform, it’s essential to consider your trading style, risk tolerance, and specific requirements. Some platforms may offer additional features or specialized tools that align with your preferences. Thoroughly research and compare different platforms to find the one that best meets your needs.

Image: iranbroker.org

Which Trading Platform Has Stop Loss For Options

Image: tradamaker.com

Conclusion

Stop-loss orders are indispensable tools for options traders who seek to mitigate risk and protect their investments. By understanding which trading platforms provide stop-loss capabilities for options and selecting the one that matches your trading preferences, you can confidently navigate the volatile options market and enhance your chances of success. Always remember to approach trading with discipline, utilize risk management strategies, and continuously educate yourself to make informed decisions and achieve your financial goals.