Navigating the Dynamics of Option Trading for Maximum Returns

In the fast-paced world of financial markets, options trading has emerged as a powerful tool for investors seeking to amplify their potential gains. Options provide versatile instruments that can be leveraged to harness market trends and mitigate risks. However, understanding when to sell options is crucial for capitalizing on market fluctuations and securing optimal returns.

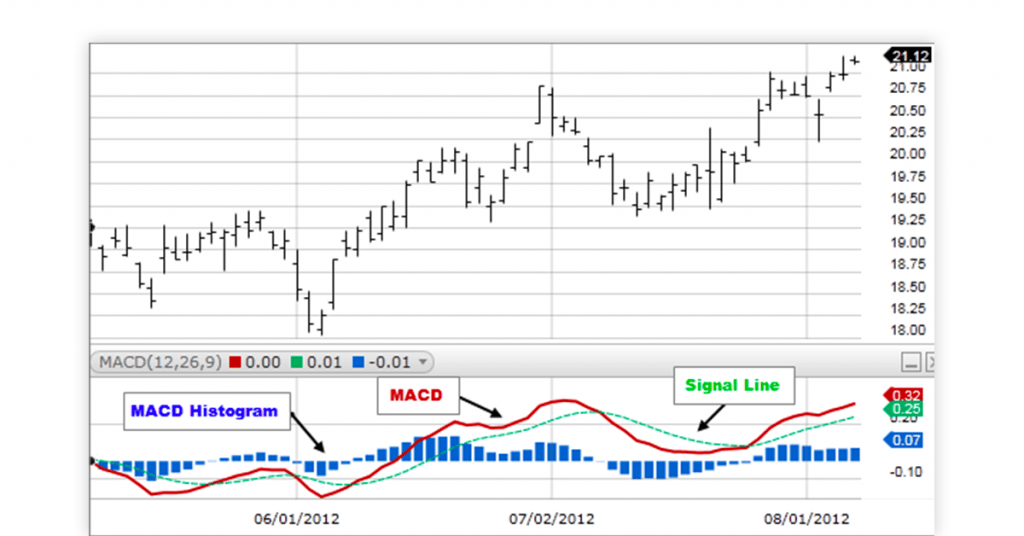

Image: github.com

Defining the Idle State in Option Trading

When an option contract remains dormant, without any significant price changes or trading activity, it is said to be in an idle state. This period of market neutrality presents a unique opportunity for option sellers to contemplate their next move. The decision of whether to hold onto the contract or liquidate it depends on various factors that need to be carefully evaluated.

Factors to Consider When Assessing the Idle State

-

Option Premium Decay: Options lose their intrinsic value over time, as the expiration date approaches. This phenomenon is known as time decay, and it works against the option seller as the contract value gradually diminishes. Holding an idle option for an extended period without noticing significant price fluctuations can result in substantial premium decay, ultimately eroding the seller’s potential returns.

-

Volatility Changes: Volatility is a crucial factor that influences option pricing. When volatility spikes, option premiums tend to increase, providing sellers with an opportunity to capture higher returns by offloading their contracts. Conversely, a decline in volatility can lead to a decrease in option premiums, reducing the seller’s potential profits. Monitoring market volatility levels is essential for determining the optimal time to sell an idle option.

-

Market Trends: Understanding the broader market context is essential for making informed trading decisions. A strong bull market favors option buyers, as the underlying asset’s price is likely to rise, increasing the value of their call options. In such a scenario, option sellers may want to consider holding onto their contracts or selling them at a premium. Conversely, a bear market poses challenges for option sellers, as the underlying asset’s value is expected to decline, potentially leading to losses if the options are not sold promptly.

-

Time to Expiration: The time remaining until the option’s expiration date significantly influences its value. As the expiration date nears, the option’s intrinsic value decays rapidly, making it less valuable to potential buyers. Option sellers should monitor the time to expiration and make a decision based on their risk tolerance and market conditions.

Strategies for Selling Idle Options

-

Sell at a Profitable Premium: If market conditions are favorable, and the option’s premium has increased substantially, option sellers can consider liquidating their contracts to lock in their profits. This strategy is particularly suitable when volatility spikes, leading to a rise in option premiums.

-

Roll Over the Option: Instead of selling an idle option, investors may choose to roll it over to a later expiration date. This strategy allows sellers to maintain their position and potentially benefit from future price fluctuations. However, it is essential to consider the additional premium that needs to be paid to extend the option’s life.

-

Close the Option: If market conditions are unfavorable, and the option’s premium has declined, option sellers may consider closing their position by buying back the contract from the market. This strategy allows sellers to cut their losses and avoid further financial erosion due to time decay.

Image: www.angelone.in

When Trading Options What Is The Idle

Image: www.techjockey.com

Conclusion

When trading options, identifying the ideal time to sell idle contracts is crucial for maximizing returns and minimizing losses. By carefully assessing factors such as premium decay, volatility changes, market trends, and the time to expiration, option sellers can make informed decisions that align with their risk tolerance and investment goals.