Managing risk is of paramount importance in the world of option trading. I still remember my early trading days, where recklessness and overconfidence led me to bitter lessons. One trade in particular, an audacious straddle on a tech stock that seemed poised for a breakout, ended in disaster. I had failed to adhere to sound money management principles, and the consequences were significant.

Image: www.youtube.com

That painful experience became a catalyst for learning and growth. I delved into the intricacies of option trading money management, determined to master its complexities. Through diligent study and mentorship from seasoned traders, I developed a robust framework that has served me well ever since. In this comprehensive guide, I will share the key principles of option trading money management, arming you with the knowledge and strategies to navigate the markets with confidence.

Defining Option Trading Money Management

Option trading money management refers to the disciplined approach of allocating capital and managing risk in option trading. It involves techniques for determining position size, setting stop-loss orders, and managing overall portfolio risk. Effective money management helps traders preserve capital, maximize profits, and minimize losses.

Importance of Option Trading Money Management

There are numerous reasons why option trading money management is essential:

- Preserves Capital: By limiting position size and implementing stop-loss orders, traders can safeguard their capital from catastrophic losses.

- Minimizes Risk: Money management strategies help traders manage their overall portfolio risk, reducing exposure to market volatility.

- Improves Decision-Making: A clear money management framework enables traders to make sound decisions based on objective criteria rather than emotions.

- Boosts Confidence: When traders have confidence in their money management practices, they can execute trades with greater conviction and less fear.

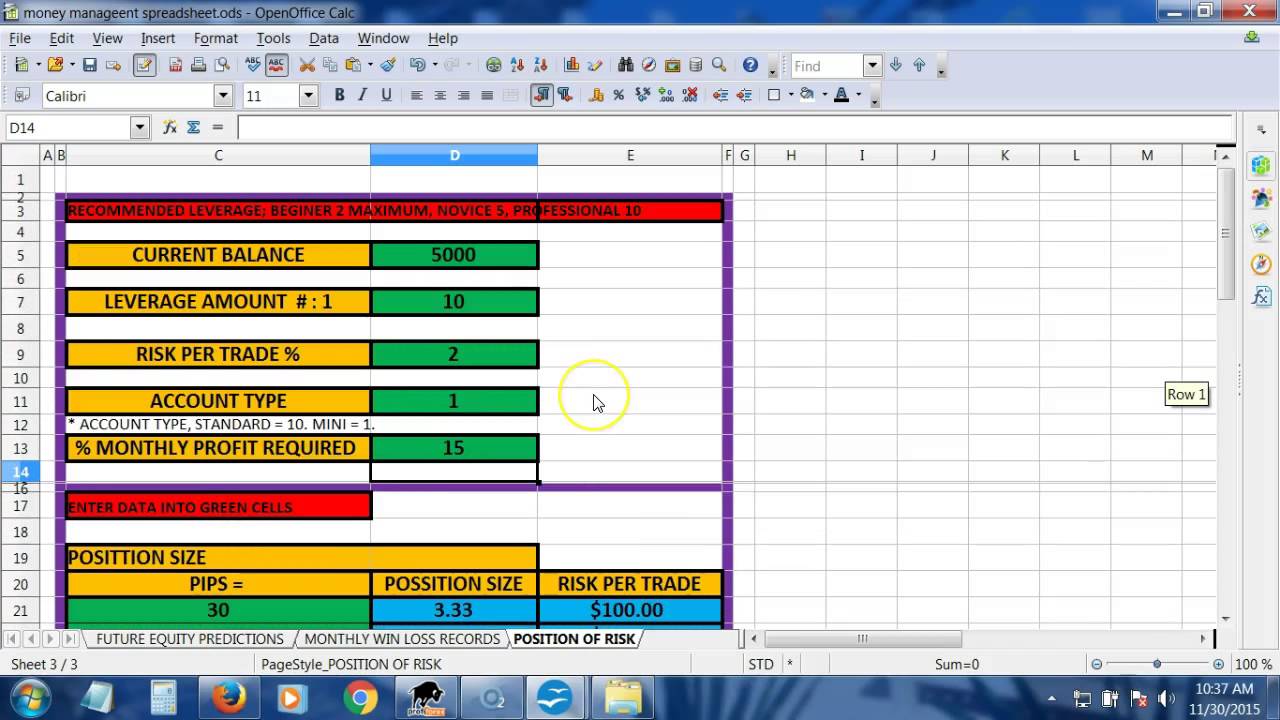

Determining Position Size

One of the cornerstones of option trading money management is position sizing. This refers to the number of contracts or shares that a trader holds in a particular position. Determining the appropriate position size depends on several factors, including:

- Account Size: Traders should never risk more than they can afford to lose, so position size should be proportionate to account size.

- Risk Tolerance: Traders with a high risk tolerance may choose larger position sizes, while those with a low risk tolerance will opt for smaller positions.

- Volatility: The volatility of the underlying asset influences position size. Higher volatility assets warrant smaller positions, while less volatile assets may allow for larger positions.

Image: www.pinterest.com

Stop-Loss Orders: A Critical Risk Management Tool

Stop-loss orders are an indispensable tool for managing risk in option trading. They are designed to automatically exit a trade when the price of the underlying asset reaches a predetermined level, limiting potential losses. Setting appropriate stop-loss orders involves considering:

- Target Profit: Traders should place stop-loss orders below (for long positions) or above (for short positions) their target profit levels.

- Volatility: The volatility of the underlying asset influences stop-loss placement. More volatile assets require wider stop-loss levels, while less volatile assets can have tighter stops.

- Risk Tolerance: Traders with a high risk tolerance may set wider stop-loss levels, while those with a low risk tolerance will prefer tighter stop-loss levels.

Effective Portfolio Risk Management

In addition to individual trade management, it is essential for option traders to manage their overall portfolio risk. This involves diversifying their positions across different underlying assets, strategies, and time horizons. By spreading risk across multiple trades, traders can reduce the impact of any single trade on their overall portfolio.

Aside from diversification, employing hedging strategies can also enhance portfolio risk management. Hedging involves entering into offsetting positions in related assets to reduce exposure to price movements. For example, a trader who holds a long position in a stock may purchase a put option on the same stock as a hedge against potential declines.

Tips for Successful Option Trading Money Management

Here are some practical tips for effective option trading money management:

- Start Small: Begin with modest position sizes until you gain confidence and experience.

- Set Realistic Expectations: Don’t expect to make consistent profits overnight. Trading involves both rewards and risks.

- Learn from Your Losses: Analyze your losing trades and identify areas for improvement in your money management practices.

- Seek Mentorship: Find an experienced trader who can guide you and provide valuable insights.

- Use Technology: Utilize trading platforms and tools that automate risk management tasks, such as position sizing calculators and trailing stop-loss orders.

FAQs on Option Trading Money Management

Q: What is the most important principle of option trading money management?

A: Preserving capital is the paramount principle, which involves limiting risk and protecting against potential losses.

Q: How do I determine the right position size?

A: Position size should be determined based on factors such as account size, risk tolerance, and the volatility of the underlying asset.

Q: When should I use stop-loss orders?

A: Stop-loss orders should be used to manage risk by automatically exiting trades when the price reaches a predetermined level.

Q: How can I manage my overall portfolio risk?

A: Diversification and hedging strategies can be employed to reduce overall portfolio risk and enhance the stability of returns.

Option Trading Money Management

Conclusion

Option trading money management is an essential aspect of trading success. By adopting sound money management principles, traders can preserve capital, minimize risk, and improve decision-making. Whether you are a seasoned trader or just starting out, it is never too late to refine your money management practices and enhance your trading performance.

Are you ready to take your option trading to the next level with effective money management? Embrace these principles and embark on a journey towards trading with confidence and financial success.