In the labyrinthine world of finance, options stand tall as versatile financial instruments that offer a tantalizing blend of risk and reward. They are akin to the unsung heroes of the investment realm, often overshadowed by their more illustrious counterparts—stocks and bonds. However, beneath their enigmatic facade lies a treasure trove of potential, capable of transforming financial strategies and unlocking hidden opportunities.

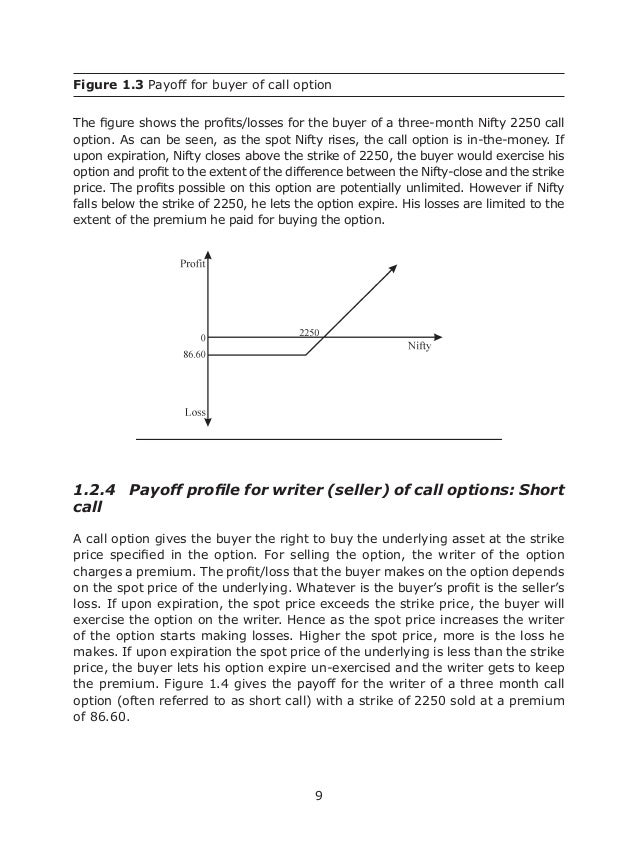

Image: www.slideshare.net

Peek into the Realm of Options

Options, in their essence, are derivative contracts that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. These versatile tools bestow upon investors the power to tailor their investments with precision, hedging risks and capitalizing on market movements. Options trading has become an integral component of sophisticated investment portfolios, empowering individuals to navigate the ever-changing financial landscape with greater finesse.

The Art of Understanding Option Theory

To master the art of option trading, a comprehensive understanding of option theory is paramount. This bedrock of knowledge encompasses the intricacies of option pricing models, the factors influencing option premiums, and the strategies employed by savvy investors to maximize their returns. Embracing these fundamental concepts is akin to donning a roadmap, guiding traders through the complexities of the options market.

Exploring Option Pricing Models

The Black-Scholes model reigns supreme as the cornerstone of option pricing theory. This mathematical marvel incorporates key variables—including the price of the underlying asset, time to expiration, volatility, and risk-free interest rates—to determine the fair market value of an option contract. Understanding the intricacies of this model empowers investors to make informed decisions, ensuring their trades are rooted in sound financial principles.

Image: www.slideshare.net

Unveiling the Mysteries of Option Premiums

Option premiums, the price paid for an option contract, fluctuate constantly, reflecting the dynamic interplay of market forces. Premium pricing considers factors such as intrinsic value, the difference between the market price and strike price of the underlying asset, and time decay, the erosion of value as expiration approaches. Delving into the factors driving option premiums provides traders with the foresight to make strategic decisions, optimizing their trading outcomes.

Mastering Option Trading Strategies

Option trading strategies are the tools in an investor’s arsenal, allowing them to craft bespoke investments tailored to their risk appetite and financial goals. From simple buy-write strategies to complex multi-leg combinations, the options market offers a vast array of possibilities. Trading strategies empower investors to hedge against risk, amplify potential returns, and exploit specific market scenarios. However, mastering these strategies requires a blend of analytical acumen and practical experience.

The Evolutionary Landscape of Option Trading

The world of option trading is in a constant state of flux, shaped by evolving market trends and technological advancements. The rise of online trading platforms has democratized access to options trading, while the advent of mobile trading apps has made it possible to execute trades on the go. Moreover, regulatory changes and technological innovations continue to reshape the options market, creating both opportunities and challenges for investors.

Expert Insights and Tips for Success

To succeed in option trading, it is prudent to seek guidance from market experts. Their insights, forged in the crucible of experience, can illuminate the path to prudent investment decisions. Here are a few valuable tips:

- Understand the Risks: Options trading carries inherent risks, and a clear understanding of these risks is crucial before venturing into this arena.

- Start Small: Begin with a small amount of capital, allowing you to gain experience without risking significant losses.

- Choose the Right Options: Select options that align with your risk tolerance, investment objectives, and market outlook.

- Manage Your Risk: Implement risk management techniques, such as stop-loss orders and position sizing, to safeguard your investments.

- Seek Professional Advice: If you are unsure of your abilities, consider consulting a financial advisor who specializes in option trading.

Frequently Asked Questions

To provide further clarity, here are answers to some commonly asked questions:

- What is the difference between a call option and a put option?

Call options grant the buyer the right to buy an underlying asset, while put options give the buyer the right to sell. - When do options expire?

Options typically expire on the third Friday of each month. - What is the cost of an option contract?

The cost of an option contract is known as the premium and can vary depending on several factors, including the underlying asset’s price, strike price, time to expiration, volatility, and interest rates. - How can I learn more about option trading?

Numerous resources are available, including books, articles, online courses, and webinars, to enhance your knowledge of option trading.

Option Theory And Trading Pdf

Conclusion

Option theory and trading undoubtedly offer a fascinating and potentially lucrative avenue for investors seeking to amplify their financial potential. By comprehending the fundamentals of option pricing models, understanding the factors driving option premiums, and mastering option trading strategies, individuals can unlock the gateway to informed and strategic investing. The tips and insights presented in this article serve as a valuable compass, guiding you towards the path of successful option trading. Embrace the knowledge and embrace the opportunities presented by options; the potential rewards that await are well worth the journey.

Are you ready to delve into the captivating realm of option theory and trading? Share your thoughts in the comments section below, and let us embark on this financial adventure together.