Trading binary options can be a lucrative endeavor, but it’s essential to develop sound money management strategies to maximize profits and minimize losses. In this comprehensive guide, we delve into the intricacies of money management trading binary options, equipping you with the knowledge and techniques to navigate the financial markets effectively.

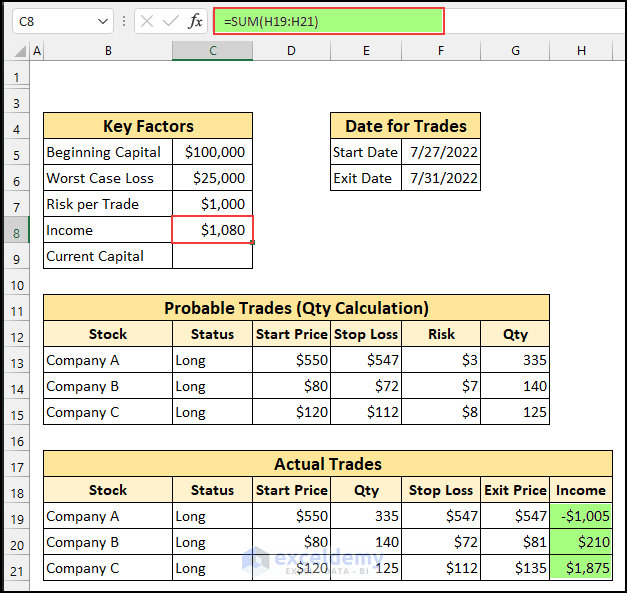

Image: www.exceldemy.com

Understanding Money Management

Money management encompasses a set of practices that govern the allocation, preservation, and growth of financial capital. It involves establishing guidelines for risk exposure, determining trade size, and managing emotional impulses during trading. Effective money management is the cornerstone of successful binary options trading, enabling traders to optimize their chances of profitability.

Historical Evolution of Money Management

The concept of money management has been a vital aspect of financial markets for centuries. Early traders utilized methods such as the Martingale System, which involved doubling the trade size after each loss. However, these systems often resulted in unsustainable losses.

Modern money management techniques emerged in the 20th century with the advent of risk management theories and statistical analysis. These techniques emphasized the need for discipline, risk assessment, and diversification.

Basic Principles of Money Management

There are several fundamental principles that underpin effective money management in binary options trading:

Image: winprofitbinary.blogspot.com

1. Risk Tolerance Assessment:

Determine your risk appetite and allocate capital accordingly. Avoid taking on excessive risk that could jeopardize your financial stability.

2. Position Sizing:

Calculate the optimal trade size based on your risk tolerance and account size. This ensures that a single trade cannot deplete your account.

3. Stop-Loss and Take-Profit Orders:

Predefine exit points for your trades. Stop-loss orders limit potential losses, while take-profit orders lock in profits.

4. Risk-Reward Ratio:

Ensure that the potential reward outweighs the risk for each trade. A favorable risk-reward ratio compensates for trades that may result in losses.

Advanced Money Management Techniques

As traders gain experience, they often adopt more advanced money management strategies:

1. Martingale System with Adjustments:

Modify the traditional Martingale System by doubling the trade size after a loss but limiting the number of doubling attempts. This reduces the risk of catastrophic losses.

2. Fibonacci Money Management:

Use Fibonacci ratios to determine position sizes and target profits. This method aligns with natural market patterns and helps traders identify optimal entry and exit points.

3. Kelly Criterion:

A mathematical model that calculates the optimal trade size based on the historical probability of winning and the risk-reward ratio. It provides a data-driven approach to money management.

Tips for Effective Money Management

To enhance your money management skills, consider the following tips:

- Keep a trading journal to track your progress and identify areas for improvement.

- Avoid chasing losses and let go of bad trades.

- Stay disciplined and follow your pre-determined money management rules.

- Continuously educate yourself and stay updated on market trends and trading techniques.

Money Management Trading Binary Options

Image: www.youtube.com

Conclusion

Money management is a critical aspect of binary options trading that can make the difference between success and failure. By understanding the basic principles, utilizing advanced techniques, and adhering to effective tips, traders can establish a solid foundation for maximizing profitability and minimizing financial risk.

Remember, discipline, patience, and a commitment to sound money management practices are the keys to long-term trading success. Embrace these principles, and you’ll be well-equipped to navigate the financial markets with greater confidence and achieve your trading goals.