Embark on a Journey of Financial Literacy

In the dynamic and complex world of finance, options trading reigns as a captivating yet enigmatic avenue for investors. With the ability to both hedge risks and potentially generate substantial returns, options have become an integral part of modern investment strategies. However, a nagging question persists: do options trading count towards round trips? Delve into this insightful exploration as we shed light on this crucial topic, empowering you with knowledge and clarity.

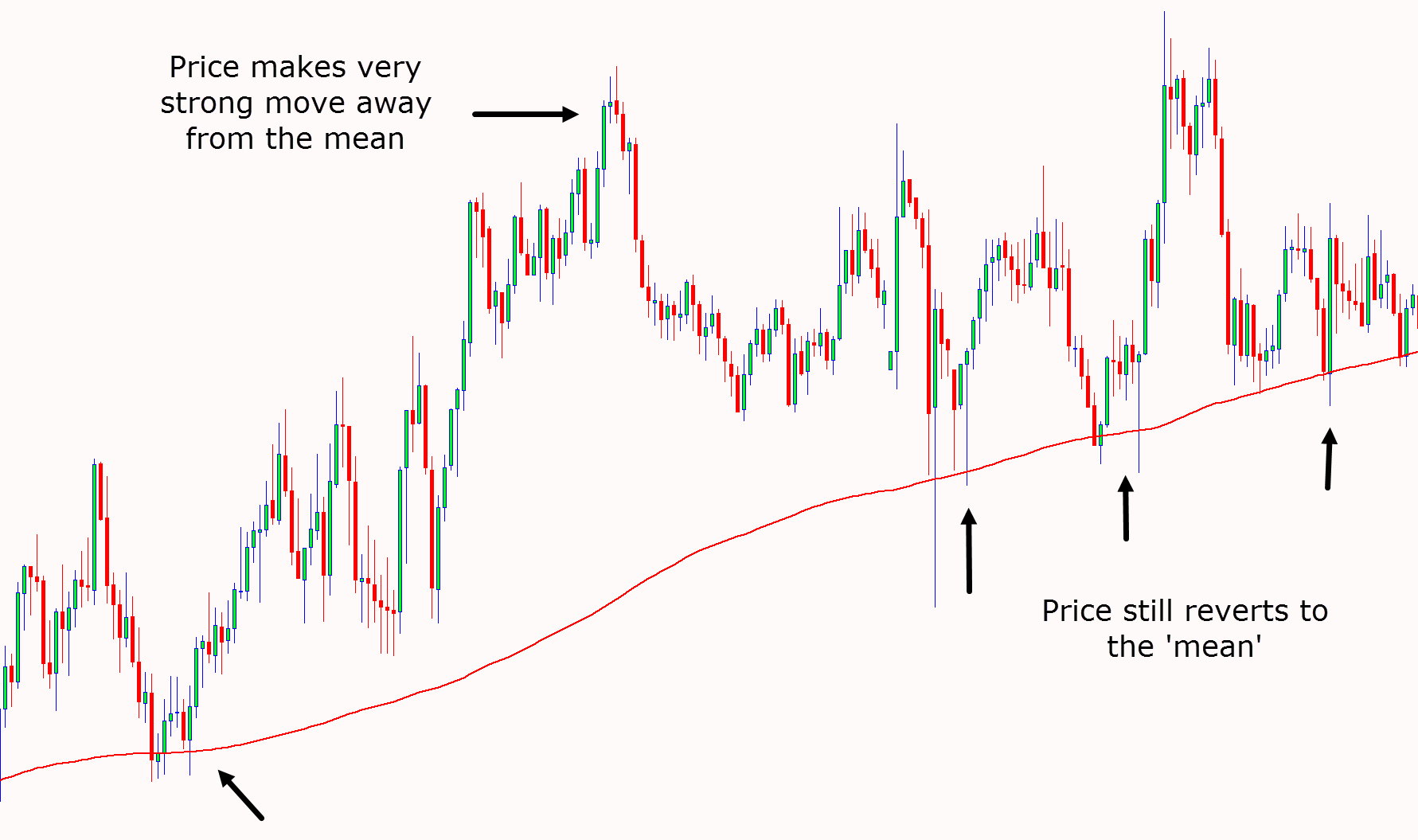

Image: tradingkit.net

Delving into the Mechanics of Round Trips

Round trips, a fundamental concept in the realm of investing, occur when an investor completes a transaction by buying or selling an asset and then engaging in the opposite action within a single tax year. This sequence of events is commonly employed to establish capital gains or losses for tax purposes. Understanding the treatment of options trading in this context is essential for maximizing returns and minimizing tax liability.

Unveiling the Treatment of Options Trading

To resolve the enigma, we must turn to the Internal Revenue Service (IRS), the governing authority on tax matters in the United States. According to the IRS, options trading, whether it involves buying or selling, does not qualify as a round trip. This distinction stems from the fact that options are considered derivative securities, distinct from the underlying assets they represent. Thus, they are treated separately for tax purposes.

Implications for Investors

Comprehending the unique tax treatment of options trading empowers investors to make informed decisions. Options can effectively serve as instruments to mitigate risks and enhance returns, yet they do not contribute directly to meeting round trip requirements. It’s crucial to recognize this distinction when planning investment strategies and tax implications.

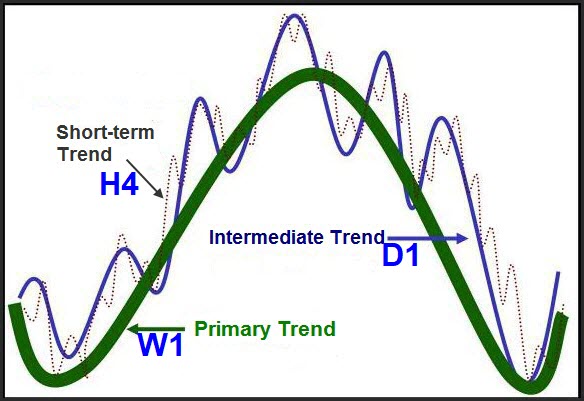

Image: www.forexfactory.com

Expert Insights and Practical Advice

Renowned financial analyst, James Grayson, underscores the significance of strategic thinking when it comes to options trading. “Options should be judiciously employed as tactical tools within an overall investment plan,” he advises. “Tailor your options strategies to meet specific financial objectives, whether it’s hedging positions, generating income, or optimizing portfolio performance.”

Tax attorney, Emily Carter, emphasizes the importance of consulting with a qualified professional. “Seek guidance from a tax advisor to meticulously navigate the complexities of options trading,” she advises. “A comprehensive understanding of tax implications will ensure compliance and maximize financial returns.”

Unlocking the Value

Options trading presents a compelling avenue for investors seeking to navigate market complexities. While they do not directly count towards round trips, options remain powerful tools for achieving a range of investment goals. By embracing a holistic approach, investors can harness the potential of options while optimizing their financial strategies and minimizing tax liability.

Do Options Trading Count Towards Roun Tri Ps

Image: www.stockalphabets.com

A Call to Action

Embark on a journey of financial literacy and delve deeper into the intricacies of options trading. Explore credible resources, engage with experts, and empower yourself with knowledge. Embrace the transformative power of options as you navigate the dynamic landscape of investments, unlocking its potential while safeguarding your financial well-being.