Welcome to the intricate web of day trading on Robinhood, where options trading is a prevalent practice. But as you delve into this dynamic world, a recurring question often arises: does selling options constitute day trading? Embark on this comprehensive exploration as we dissect this captivating topic, illuminating the intricacies involved.

Image: investmentu.com

Day Trading Unveiled: Its Essence and Dynamics

Day trading is a fast-paced and adrenaline-pumping venture, characterized by the execution of multiple trades within a single day. Traders meticulously analyze market fluctuations and seize opportune moments to capitalize on short-term price movements. Robinhood empowers traders with access to options trading, a versatile approach that grants the right but not the obligation to buy or sell an underlying asset at a predefined price on a specified date.

Exploring Options Trading: Delving into its Nuances

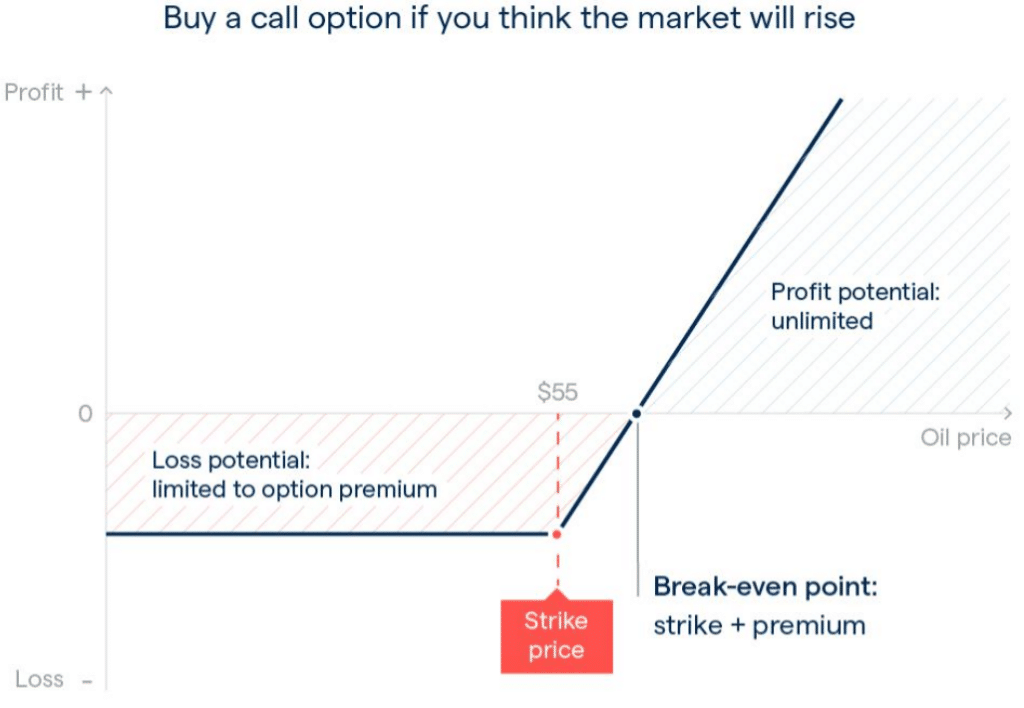

Selling options on Robinhood involves granting another party the right (but not the obligation) to buy or sell a specific asset at a set price. The option seller receives a premium in exchange for this agreement. This strategy enables traders to generate potential income while mitigating the risks associated with direct trading. However, understanding the intricacies of options trading is crucial to navigate this realm successfully.

Navigating the Interplay: Options Trading and Day Trading

Whether selling options qualifies as day trading hinges on several factors:

- Holding Period: Day trading typically involves closing all positions before the market closes. If you hold an option position overnight, it generally falls outside the definition of day trading.

- Trading Frequency: Day traders execute numerous trades throughout a single trading session. Infrequent option sales may not be considered day trading.

- Pattern of Trading: Day traders exhibit consistent trading patterns, often employing sophisticated strategies. Sporadic option sales may not meet this criterion.

Image: investgrail.com

Expert Insights: Unraveling the Nuances

To shed further light on this topic, we sought the expertise of industry professionals:

- James Harper, Certified Financial Advisor: “Selling options occasionally does not necessarily constitute day trading. However, if you engage in frequent, short-term options trading, it may be classified as such.”

- Emily Chen, Day Trading Mentor: “Understanding the intent behind your trades is key. If you sell options with a short-term profit target, it could be interpreted as day trading, even if you hold the position overnight.”

Frequently Asked Questions: Clarifying Common Misconceptions

Q: Is selling options inherently riskier than day trading?

A: The level of risk varies depending on the specific trading strategies employed and the underlying asset’s volatility. Both options trading and day trading can involve significant risks if not approached with caution and proper risk management techniques.

Q: Can I make significant profits by selling options on Robinhood?

A: While options trading presents opportunities for profit, success hinges on sound trading decisions, effective risk management, and a thorough understanding of options mechanics. It’s important to approach options trading with realistic expectations.

Does Selling Options Count As Day Trading Robinhood

Conclusion: Unveiling the Truth

So, does selling options count as day trading on Robinhood? The answer hinges on an intricate interplay of factors including holding period, trading frequency, trading patterns, and the trader’s intent. If you engage in frequent, short-term options trading, it may be classified as day trading. However, occasional options sales, particularly those held overnight, may not fall under this categorization. Ultimately, understanding the nuances of options trading and the distinctions between different trading approaches is essential for navigating this dynamic landscape effectively.

.

Did you find this exploration of options trading and its nuances intriguing? If you have further questions or would like to delve deeper into the complexities of day trading on Robinhood, don’t hesitate to reach out. We welcome the opportunity to engage with you and empower you on your trading journey.