Unveiling the Reality of Options Trading: Exploring Success Rates and Strategies

Options trading, a volatile yet potentially lucrative financial instrument, has long captivated the imaginations of investors seeking to amplify returns. However, beneath its allure lies a lingering question: what is the success rate of options trading? Navigating the intricate options landscape demands a clear understanding of the inherent risks and a comprehensive analysis of historical outcomes. In this comprehensive guide, we delve into the depths of options trading, dissecting its complexities and empowering you with insights to make informed decisions.

Image: mscnordics.com

Understanding the Nature of Options

Options contracts represent a unique financial tool that confers upon its holder the right, not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. These contracts come in two flavors: calls and puts. Call options grant the right to buy, while put options empower the holder to sell. The price at which the underlying asset can be bought/sold is known as the strike price, and the date on which the option expires is the expiration date.

The Allure of Options Trading

Options trading entices investors with the prospect of substantial returns, even with minimal capital outlay. When an investor correctly predicts the direction of the underlying asset’s price movement, they can reap significant profits. Moreover, options offer a degree of flexibility, enabling investors to tailor strategies to suit their risk tolerance and investment objectives.

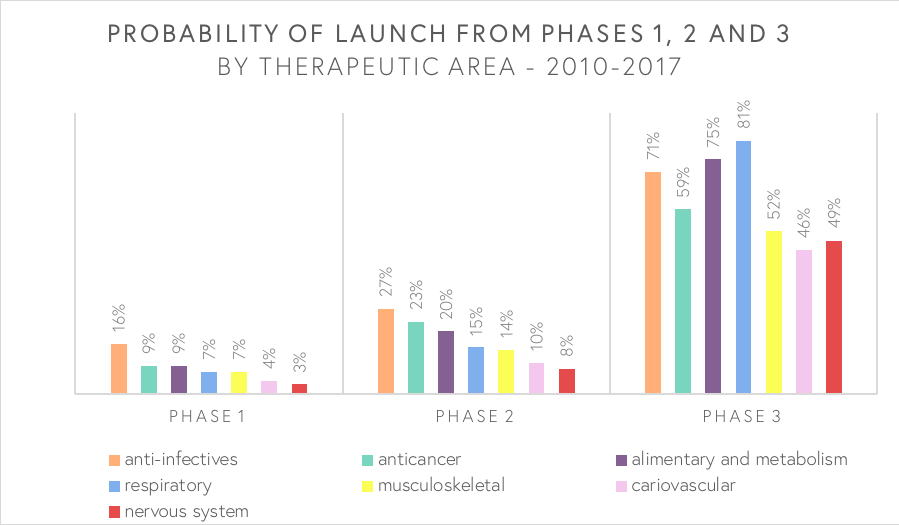

Gauging Success Rates: A Statistical Perspective

Estimating the success rate of options trading is akin to capturing a moving target. Success rates vary widely depending on factors such as the underlying asset, market conditions, and the trader’s skill level. Nonetheless, historical data provides valuable insights.

According to a study by the Securities and Exchange Commission (SEC), approximately 50% of options contracts expire worthless. This implies that half of all options traders lose their entire investment. However, it’s crucial to note that these statistics encompass all options traders, regardless of their experience or trading acumen.

More seasoned options traders boast higher success rates. A survey by the Options Clearing Corporation (OCC) revealed that experienced options traders achieve profitability rates between 60% and 80%. These traders possess a comprehensive understanding of options strategies, effective risk management techniques, and a disciplined approach to trading.

Image: www.superbgroup.in

Navigating the Options Landscape: Strategies for Success

While options trading harbors inherent risks, adhering to prudent strategies can bolster your chances of success. Here are some key tips to enhance your options trading prowess:

-

Educate yourself: Immerse yourself in the intricacies of options trading. Understand various strategies, risk management techniques, and market dynamics.

-

Start small: Begin with modest investments until you gain confidence and proficiency.

-

Manage risk wisely: Implement stop-loss orders to mitigate potential losses.

-

Employ discipline: Adhere to a predefined trading plan and avoid emotional decision-making.

-

Seek professional guidance: Consider consulting with an experienced options trader or financial advisor for personalized guidance.

What The Sucess Rate Pf Options Trading

Image: www.pinterest.com

Conclusion: Demystifying the Options Success Conundrum

The success rate of options trading is a multifaceted phenomenon influenced by myriad factors. While inherent risks exist, skilled traders with a comprehensive understanding of the market and a disciplined approach can enhance their odds of profitability. By embracing prudent strategies and continually honing their skills, options traders can navigate the volatile financial landscape with greater confidence and achieve their investment aspirations.