Introduction:

Image: optionstradingiq.com

The allure of options trading lies in its tantalizing potential to generate substantial profits. While the promises of overnight riches may be exaggerated, there is indeed potential to earn significant amounts through this derivative strategy. This comprehensive guide will delve into the complexities of options trading, exploring the factors that influence earnings and providing insights into maximizing returns.

Defining Options Trading:

Options trading involves contracts that confer the right, but not the obligation, to buy or sell an underlying asset at a preset price on or before a specific date. These contracts essentially provide option buyers and sellers with leverage to speculate on future price movements.

Factors that Impact Earnings:

The amount of money made in options trading depends on various factors, including:

- Market Conditions: Favorable market conditions, such as increased volatility, can amplify profit potential but also heighten risks.

- Underlying Asset: The value and volatility of the underlying asset, such as stocks, commodities, or bonds, significantly influence option pricing and earnings.

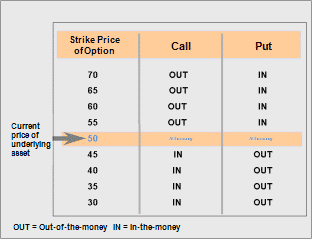

- Option Type: Different types of options, including calls, puts, and spreads, carry varying degrees of risk and profit potential.

- Strike Price: The strike price of an option directly affects its value and the potential for profits or losses.

- Time to Expiration: The time remaining until an option’s expiration date influences its price and earning potential.

- Trading Strategy: Employing effective trading strategies, such as selling naked options or implementing hedging techniques, can increase earnings but also involve higher risks.

Maximizing Returns:

To maximize earnings in options trading, consider the following strategies:

- Research and Understand: Thoroughly research the underlying asset, market conditions, and option strategies to make informed decisions.

- Control Risk: Manage risks by setting stop-loss orders, limiting option positions, and diversifying trades.

- Focus on Long-Term: Short-term options trading can be highly volatile, increasing the likelihood of losses. Consider holding options for longer periods to mitigate fluctuations.

- Execute Disciplined Trading: Stick to pre-determined trading plans, avoid emotional decision-making, and continuously monitor market conditions.

Conclusion:

Options trading offers the potential for significant earnings but also carries inherent risks. Understanding the factors that influence profitability, employing effective strategies, and maintaining discipline are crucial for maximizing returns in this dynamic market. By weighing potential gains against risks and embracing a prudent approach, investors can harness the power of options trading to enhance their financial portfolios.

Image: limitsofstrategy.com

How Much Money Can Be Made In Options Trading

Image: www.youtube.com