In the realm of financial markets, options have long been the domain of experienced investors and sophisticated traders. But with the advent of Robinhood’s groundbreaking platform, options trading has become accessible to a much broader audience, including those new to the world of investing. This article delves into the intricacies of Robinhood option trading, empowering readers with the knowledge to navigate this exciting and potentially lucrative arena.

Image: bethanblakely.blogspot.com

What is Option Trading?

An option contract grants you the right, but not the obligation, to buy or sell an underlying asset at a specific price (the strike price) on or before a certain date (the expiration date). There are two types of options: calls and puts. With calls, you have the right to buy the asset, while with puts, you have the right to sell it.

Example: Let’s say you believe Apple’s stock will rise. You could purchase a call option with a strike price of $150 expiring in one month. If Apple’s stock price exceeds $150 by the expiration date, you can exercise your call option and buy the stock at $150, regardless of its market price. This can lead to substantial profits if the stock price continues to rise.

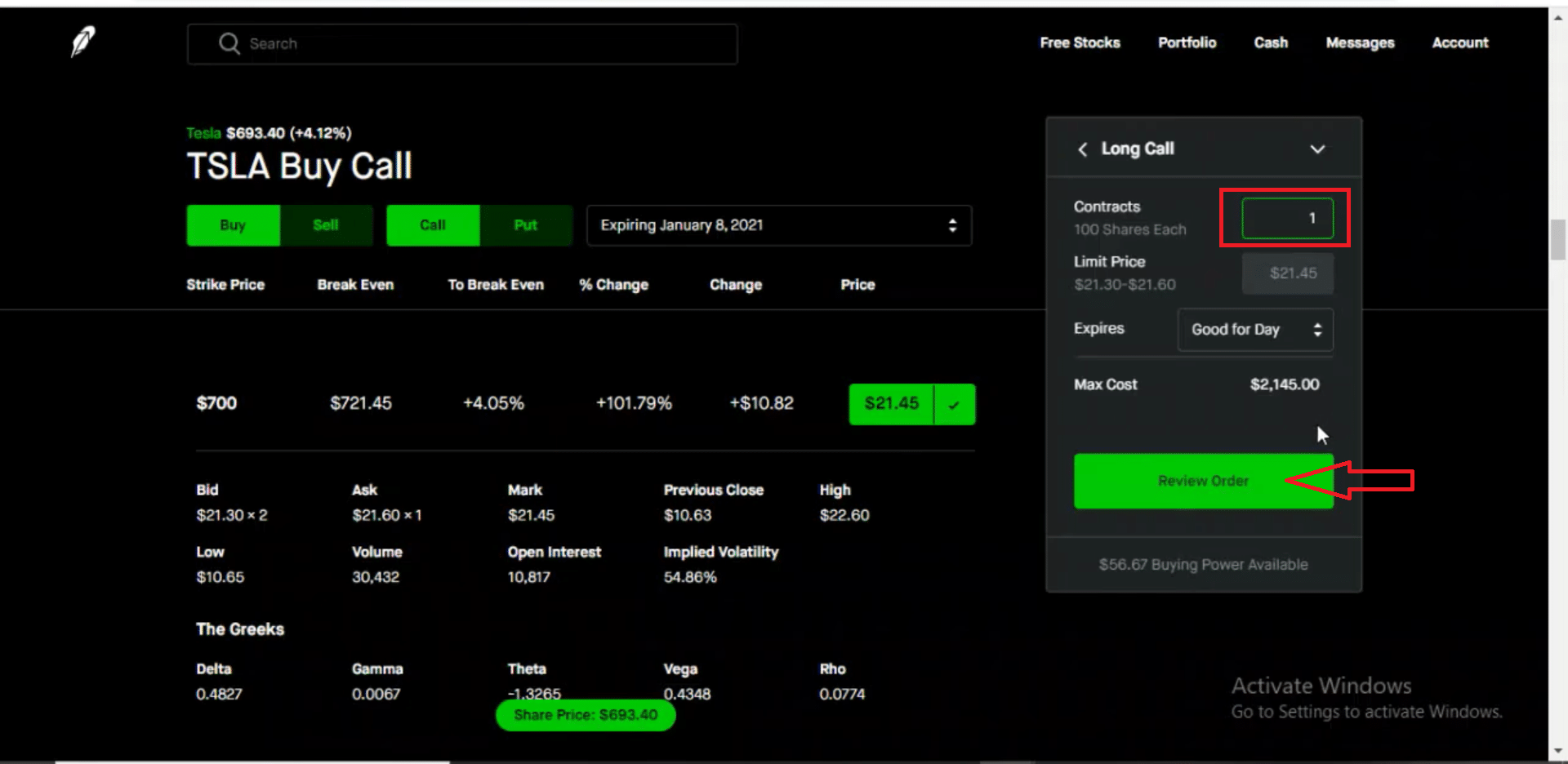

Robinhood’s Option Trading Platform

Robinhood’s user-friendly interface simplifies options trading for both beginners and seasoned investors alike. The platform provides real-time data, intuitive charting tools, and educational resources to facilitate informed decision-making. Moreover, Robinhood offers extended trading hours and competitive pricing that make options trading more accessible and affordable than ever before.

Understanding the Risks

While options trading has the potential for significant returns, it also carries inherent risks. It’s crucial to understand the following:

Time decay: The value of an option gradually declines over time, especially as the expiration date approaches.

Leverage: Options can amplify your profits and losses since they control a larger number of shares than you actually own.

Volatility: The higher the volatility of the underlying asset, the greater the potential for profit and loss.

Image: www.warriortrading.com

Getting Started with Robinhood Option Trading

Before venturing into options trading, it’s essential to:

Educate yourself: Familiarize yourself with the concepts, strategies, and risks associated with options.

Open an account: Create a Robinhood account and select an account type that supports options trading.

Choose a strategy: Determine whether to buy calls or puts based on your market outlook.

Determine your risk tolerance: Assess your financial situation and determine how much you’re willing to risk.

Expert Insights for Success

Choose high-probability trades: Opt for options with a high chance of success by considering factors like historical trends, volatility, and market conditions.

Manage your risk: Use stop-loss orders to limit your losses and prevent catastrophic outcomes.

Don’t overtrade: Avoid excessive trading, as it can lead to impulsive decisions and poor outcomes.

Seek professional advice: Consult with a financial advisor if you’re unsure or need guidance on specific trading strategies.

What Is Robinhood Option Trading

Image: 1000logos.net

Conclusion

Robinhood’s option trading empowers investors with the opportunity to enhance their financial potential and diversify their portfolios. By understanding the fundamentals, managing risks, and utilizing expert advice, traders can navigate this complex arena with confidence. Whether it’s pursuing short-term gains or long-term strategies, Robinhood’s platform makes options trading accessible and potentially transformative.