Robinhood has revolutionized the world of investing, making it accessible to millions of individuals. Among its many offerings is option trading, a powerful financial tool that allows investors to speculate on the future direction of stocks, commodities, and other assets. In this comprehensive guide, we will delve into the world of option trading on Robinhood, exploring its advantages, strategies, and potential risks.

Image: bethanblakely.blogspot.com

Understanding Options: A Key to Robinhood’s Option Trading

Options are financial contracts with a unique twist: they grant buyers the right (but not the obligation) to buy (in the case of call options) or sell (in the case of put options) an underlying asset at a specified price on or before a set expiration date. The allure of options lies in their potential for both substantial gains and losses.

Benefits of Trading Options on Robinhood

-

Low Barriers to Entry: Robinhood offers commission-free option trading, significantly reducing the costs associated with this form of investment. This makes it an attractive platform for new and experienced traders alike.

-

Simplicity and User-friendliness: Robinhood’s user interface has been praised for its simplicity, enabling even beginners to navigate option trading with ease. Their straightforward platform guides users through the process, reducing the learning curve.

-

Advanced Tools and Research: Despite its simplicity, Robinhood provides advanced tools and research to support sophisticated trading strategies. Users can access real-time market data, charts, and analysis to make informed decisions.

Diving into Option Strategies: Unleashing the Potential

Option trading can be implemented using various strategies tailored to different market scenarios and risk appetites. Let’s explore a few popular approaches:

-

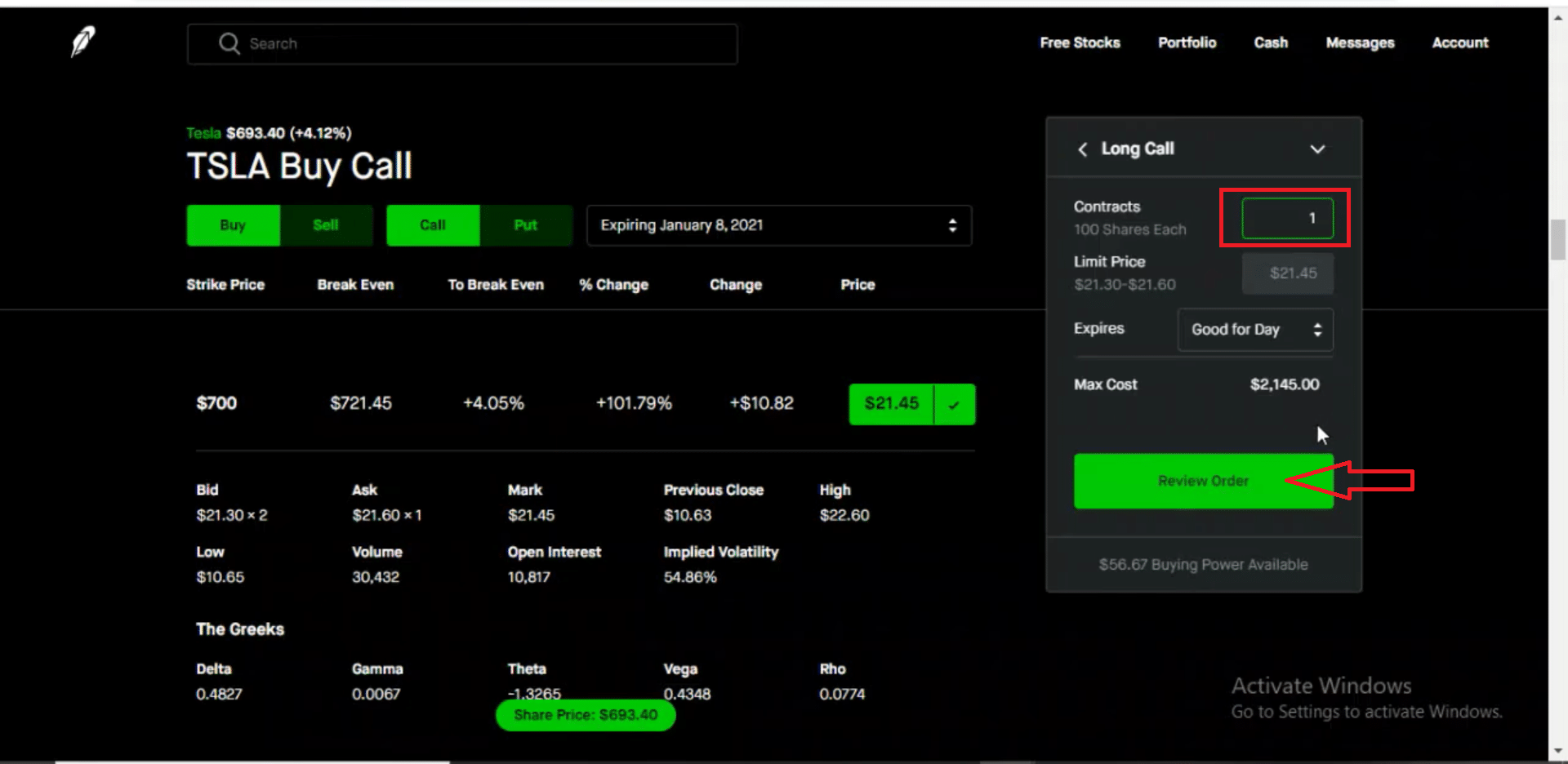

Long Calls: These options allow traders to profit from rising prices. By purchasing a long call option, the trader has the right to buy an asset at a predetermined price and time. If the asset’s value soars, the trader can exercise the option to purchase the asset at the lower contract price, capturing the difference as profit.

-

Short Puts: In contrast to long calls, short puts oblige traders to sell an asset at a certain price by a specified date. Traders may employ this strategy in anticipation of falling asset prices. If the asset’s value declines, the trader can fulfill their obligation to sell at a higher price than the market value, pocketing the premium paid by the buyer.

-

Covered Calls: This hybrid strategy combines option selling with the ownership of underlying assets. Traders sell covered calls when they own stocks or other assets and anticipate modest growth. By selling a call option, the trader receives a premium payment, and if the underlying asset’s price rises modestly, they can hold their position and profit from both the price appreciation and the premium received.

![Robinhood Day Trading Rules [2022]](https://www.ira-reviews.com/images/1/RobinHood/robinhood-stock-trading-review.png)

Image: www.ira-reviews.com

Understanding the Risks of Option Trading

While option trading presents the alluring potential for gains, it also carries inherent risks. Being aware of these risks is crucial before venturing into this arena.

-

Limited Upside: Unlike stocks, options have limited profit potential. The maximum profit for a long option is the difference between the underlying asset’s price and the strike price, plus the premium paid.

-

Unlimited Loss Potential: There is a real possibility of significant losses when trading options. If the underlying asset’s price moves against a trader’s expectations, they can potentially lose their entire investment and any premiums paid.

-

Time Decay: The value of options erodes with time. As the expiration date draws near, the option loses its value due to time decay, potentially leading to losses for the holder.

-

Complexity: Option trading can be a complex activity, particularly for novice traders. It is recommended to thoroughly understand the risks and intricacies involved before starting to trade options.

Does Robinhood Have Option Trading

Conclusion: Options Trading for the Robinhood Generation

Robinhood has opened the doors of option trading to a vast audience, offering both potential rewards and risks. By equipping themselves with knowledge, employing sound strategies, and being cognizant of the inherent risks, traders can harness the power of options to enhance their investment portfolios. Whether seeking to speculate, hedge investments, or generate income, Robinhood’s option trading platform offers a compelling opportunity for savvy investors to explore the world of financial derivatives.