As an investor navigating the constantly evolving landscape of the financial world, it’s crucial to stay informed about the intricate nuances of insider trading. One term that often arises in this context is “option disposition,” and understanding its implications can significantly impact your investment decisions.

Image: stewdiostix.blogspot.com

In the realm of insider trading, option disposition refers to the process of disposing of or transferring outstanding options that are either owned or controlled by an individual with material, non-public information. This action, known as “unloading,” is a common strategy to profit from insider information without directly trading the underlying security.

The Mechanics of Option Disposition

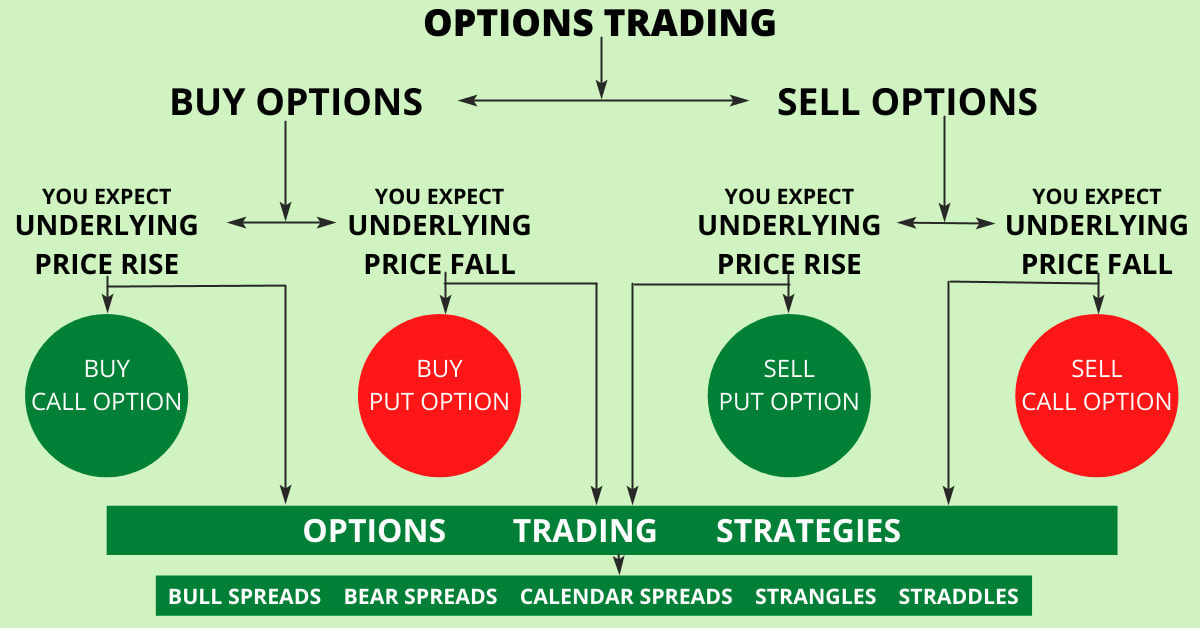

When an individual possesses insider knowledge about an impending event or information that is likely to impact the price of a security, they may choose to acquire options (contracts giving the holder the right to buy or sell an underlying asset at a specified price) on that security. If the confidential information favors a price increase, they may purchase call options, giving them the right to buy at a fixed price below the market value. Conversely, if they anticipate a decline in price, they might acquire put options, granting them the right to sell at a price above the market value.

Upon the release of the material non-public information, the price of the underlying security is expected to adjust rapidly, and those who hold the options can exercise their rights to buy or sell at a significant profit. However, to avoid suspicion, insiders may opt for option disposition rather than directly trading the security itself. By transferring or selling their options to another party before the price movement occurs, insiders can indirectly profit without triggering red flags.

Legal Implications and Ethical Concerns

Insider trading, including option disposition, is a serious violation of federal securities laws. The Securities and Exchange Commission (SEC) and other regulatory bodies have stringent rules and regulations to prevent individuals from exploiting confidential information for personal gain.

Insider trading erodes investor confidence in the fairness of the marketplace, as non-insiders are at a distinct disadvantage when making investment decisions. Additionally, it can distort the true value of securities and undermine the integrity of the financial system.

Detection and Enforcement

Regulatory authorities employ a range of sophisticated measures to detect and combat insider trading. They analyze trading patterns, monitor communication channels, and closely scrutinize financial transactions to identify suspicious activity.

Insider trading cases can result in severe penalties, including hefty fines, imprisonment, disgorgement of ill-gotten profits, and a ruined reputation. The SEC and other law enforcement agencies have successfully prosecuted numerous individuals and entities for insider trading offenses.

Image: fintrakk.com

Tips for Investors

As a vigilant investor, it’s essential to be aware of insider trading red flags and take steps to protect yourself from unscrupulous actors. Here are some crucial tips to consider:

Frequently Asked Questions

- What is considered material non-public information?

Information that is likely to have a significant impact on the price or value of a security when publicly disclosed. - How long do I have to hold options before I can exercise them?

The duration of time varies depending on the type of option contract. Check the option’s expiration date to determine the deadline. - What are the penalties for insider trading?

Penalties range from fines and disgorgement of profits to imprisonment and a damaged reputation. - How can I report suspected insider trading?

Contact the SEC or other relevant regulatory authorities to provide evidence or information that may indicate insider trading activity.

What Does Option Disposition Mean In Insider Trading

Image: www.pinterest.com

Conclusion

Understanding the concept of option disposition is paramount for investors navigating the complexities of the financial market. By staying vigilant, utilizing reputable information sources, and educating yourself about the laws and regulations, you can help protect yourself from falling prey to insider trading scams. If you suspect insider trading activity, reporting it to the appropriate authorities can contribute to upholding the integrity of the marketplace and deterring dishonest practices.

Are you interested in learning more about the nuances of insider trading? Join our exclusive webinar or visit our blog for in-depth insights and expert perspectives on this critical topic.