Grasping the Essence of Insider Trading

Insider trading, a clandestine practice shrouded in controversy, involves the illicit use of nonpublic information for financial gain in the stock market. It occurs when an individual in possession of material, nonpublic information about a company trades on that information before it becomes publicly available, exploiting their advantage over other investors who lack access to such knowledge.

Defining Insider Trading

Image: www.studocu.com

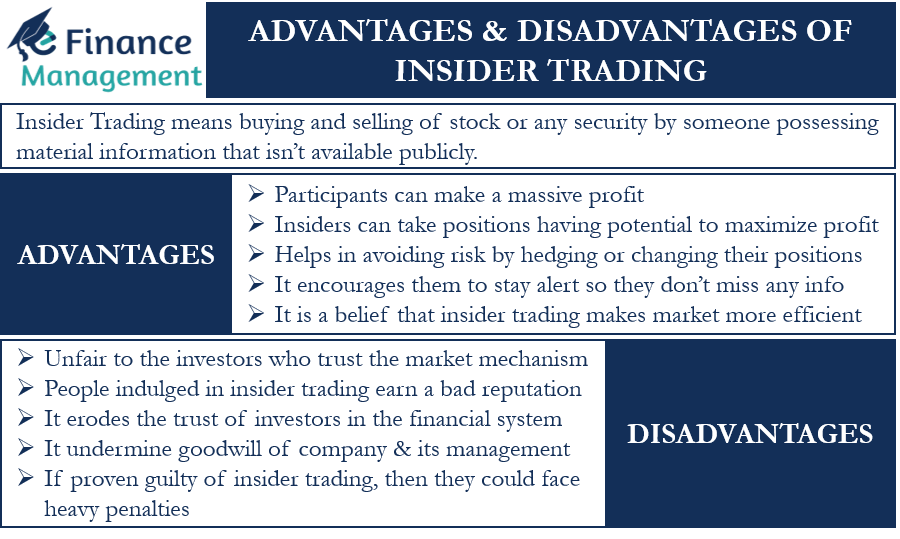

Insider trading encompasses any trade conducted by an individual with material, nonpublic information about a company that could significantly affect its stock price. This information can range from upcoming mergers and acquisitions to impending financial results or changes in company strategy. The crux of insider trading lies in the use of this privileged knowledge for personal financial benefit, even if the trader does not directly benefit from the specific transaction.

Consequences and Legal Framework

Insider trading is a serious offense with severe consequences. Governments worldwide have enacted stringent laws to deter such practices, recognizing the detrimental impact they have on market integrity and investor confidence.

Penalties for Insider Trading

- Civil Penalties: Regulatory bodies can impose substantial fines on individuals involved in insider trading. These fines can amount to three times the profits gained or losses avoided as a result of the illicit activity.

- Criminal Prosecution: In many jurisdictions, insider trading is considered a crime and can result in imprisonment. Individuals convicted of insider trading may face jail terms ranging from several years to decades.

Identifying Insider Trading Options

Insider trading options encompass a range of tactics employed by individuals to capitalize on nonpublic information:

1. Trading on Inside Information

This involves directly trading in the stock of a company after acquiring material, nonpublic information about the company, such as upcoming financial results or major announcements.

Image: efinancemanagement.com

2. Tipping

Tipping refers to the act of disclosing material, nonpublic information to someone outside the company, who then trades on that information.

3. Misappropriation

Misappropriation occurs when an individual obtains material, nonpublic information from a source outside the company and then trades on that information.

Recent Trends and Developments

Insider trading remains a pervasive issue, and regulatory authorities are constantly adapting their approaches to combat new and emerging tactics. Recent trends include:

1. Use of Social Media

Social media platforms have become a breeding ground for insider trading activity, with individuals using encrypted messaging apps and anonymous accounts to disseminate nonpublic information.

2. Technological Advancements

Advancements in technology have made it easier for individuals to access and disseminate nonpublic information, creating new challenges for regulators.

3. Increased Global Cooperation

Regulatory bodies worldwide are collaborating more closely to combat insider trading, sharing information and best practices to strengthen enforcement efforts.

Expert Advice and Tips

Combating insider trading requires vigilance and cooperation from all stakeholders. Here are some tips for investors and market participants:

1. Due Diligence

Always conduct thorough research before investing in any company. Pay attention to public disclosures and news sources to stay informed about company developments.

2. Question Unusual Price Movements

Be wary of sudden or unexplained price fluctuations in a stock. It could be a sign of insider trading activity.

3. Report Suspicious Conduct

If you suspect insider trading, do not hesitate to report it to the appropriate regulatory authorities. Your cooperation can help protect market integrity.

Frequently Asked Questions

1. What is the penalty for insider trading?

Penalties can include substantial fines, imprisonment, and disgorgement of profits.

2. How can I avoid insider trading?

Always trade on publicly available information and avoid trading on tips or rumors.

3. What are some common tactics used in insider trading?

Tactics include trading on inside information, tipping, and misappropriation.

Insider Trading Occurs When Question 15 Options

:max_bytes(150000):strip_icc()/Term-Definitions_Insider-trading-011fefceee344ef293501421ed12f39a.jpg)

Image: www.wlp.com.sg

Conclusion

Insider trading undermines the fairness and integrity of the stock market. By understanding the definition, penalties, and tactics involved in insider trading, investors can protect themselves and contribute to a more equitable market environment. It is imperative that we all play a role in combating this illegal practice, ensuring the trust and confidence of investors.

Are you interested in how insider trading affects the overall economy?