Vanguard, the renowned investment management company, offers various financial products and services to its valued clients. Among these, options trading has gained considerable attention as a powerful investment strategy. However, aspiring options traders face the inevitable question: how long does it take Vanguard to approve options trading on my account?

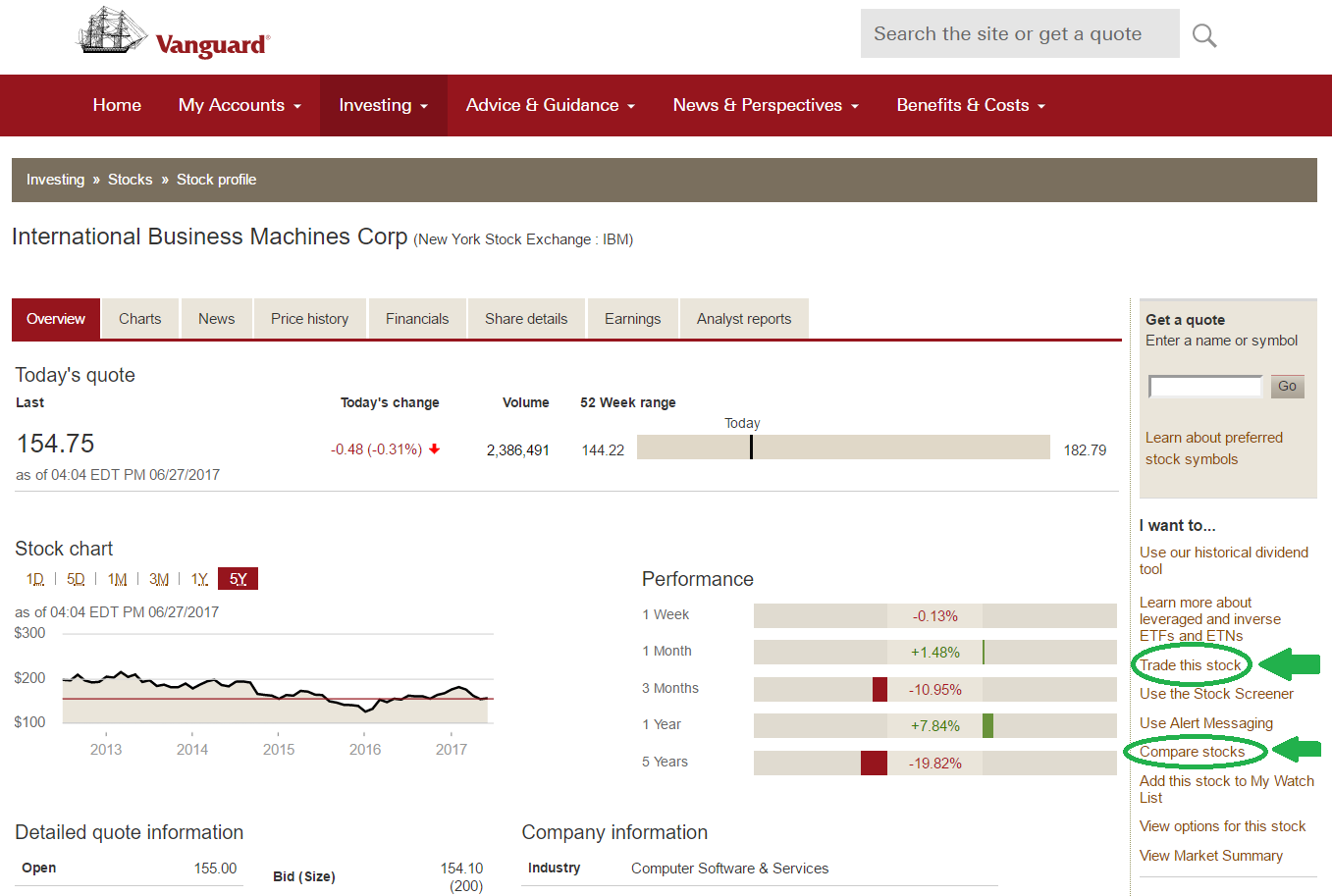

Image: topdollarinvestor.com

To unravel this pivotal question, it is essential to understand the options approval process at Vanguard. Options trading involves the ability to buy or sell underlying assets at a predetermined price, which necessitates a higher level of risk tolerance and thorough understanding of this complex form of investment. Consequently, Vanguard implements a comprehensive review process to assess an investor’s suitability for options trading.

The Application Process

Initiating the options trading approval process at Vanguard is a straightforward endeavor. Investors can request an application form from their financial advisor or download it directly from the Vanguard website. The application requires applicants to provide personal information, such as their investment objectives, risk tolerance, and investment experience. Additionally, Vanguard will scrutinize an investor’s trading history and overall financial situation.

Assessment Timeframe

The duration of the options trading approval process at Vanguard varies based on several factors, including the completeness and accuracy of the application, the current workload of the approval team, and the individual applicant’s circumstances. Generally, investors can anticipate a turnaround time of two to three weeks. However, in certain complex cases, the assessment may extend beyond this typical timeframe.

Tips to Accelerate Approval

To expedite the options trading approval process, applicants are advised to meticulously complete the application, ensuring all required information is accurately provided. Promptly submitting supporting documentation, such as trading statements or investment account summaries, can also facilitate a more efficient review. Moreover, maintaining open communication with the Vanguard approval team and inquiring about the status of the application can help keep the evaluation moving forward smoothly.

Image: www.pinterest.com

Reasons for Delays

In some instances, the Vanguard options trading approval process may experience delays due to unforeseen circumstances. These may include incomplete applications, discrepancies in the information provided, or complex financial situations that require additional verification. In such cases, Vanguard may reach out to the applicant for further clarification or documentation to ensure a comprehensive assessment.

How Long Does Vanguard Take To Approve Options Trading

Image: www.ira-reviews.com

Conclusion

The options trading approval process at Vanguard serves as a protective measure designed to ensure that investors fully comprehend the risks and complexities associated with this investment strategy. By comprehensively evaluating an investor’s suitability, Vanguard helps minimize potential losses and ensures clients are equipped with the necessary knowledge and experience before venturing into options trading. Patience and a proactive approach can contribute to a more streamlined approval process, enabling investors to seize trading opportunities promptly.