Introduction

Futures contracts made their debut in the financial markets in the 19th century. They have evolved into a vital tool for trading various assets, including commodities and currencies. Yet it is futures options that have gained notoriety for their accessibility, conferring the flexibility of trading futures contracts. Delving into the universe of futures options, we embark on a comprehensive exploration to unravel their mechanisms, strategies, and significance in contemporary trading practices.

Image 1: A visual exposition of a futures contract.

Source: Investopedia

Image: tradebrains.in

Futures Contracts: Unveiling the Foundation

To grasp the essence of futures options, a rudimentary understanding of futures contracts is paramount. Futures contracts are agreements that obligate the buyer to purchase a specified quantity of an underlying asset at a predetermined price on a future date. In essence, they are standardized contracts traded on exchanges, facilitating price discovery and risk management for market participants.

Futures Options: Empowering Traders with Flexibility

Futures options, in contrast, are financial instruments that grant traders the choice to buy or sell futures contracts at a specified price before their expiration date. This bestows upon traders a potent tool to mitigate risk and potentially profit from price fluctuations in the underlying asset. Unlike futures contracts, options are not obligatory; the holder is endowed with the right, not the obligation, to exercise the option. This flexibility empowers traders to speculate on price movements without the burden of owning the underlying asset.

Mechanics of Futures Options Trading

Engaging in futures options trading requires a comprehensive understanding of the underlying mechanics. Options are characterized by two fundamental components: the strike price and the option premium. The strike price is the predetermined price agreed upon in the futures contract. The option premium is the price paid upfront by the buyer of the option to acquire the right to buy or sell the underlying asset at the strike price.

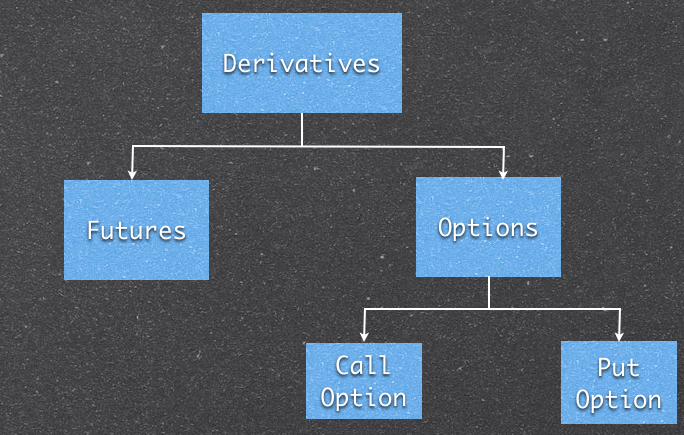

Two primary types of options exist: call options and put options. Call options confer the right to buy the underlying asset, while put options confer the right to sell. For the buyer of an option, the maximum profit potential is limited to the difference between the strike price and the underlying asset’s price at expiration, minus the premium paid. The seller of an option, on the other hand, can potentially profit from the decay of the option’s value over time or from a favorable price movement that renders the option worthless.

Image: kosowekavorut.web.fc2.com

Strategies for Futures Options Trading

The realm of futures options trading presents traders with a plethora of strategies to navigate market dynamics effectively. One common strategy is the “covered call.” In this strategy, a trader simultaneously buys the underlying asset and sells a call option with the same strike price and expiration date. This limits the trader’s potential profit but also provides downside protection against price declines.

Another popular strategy is the “protective put.” This involves buying a put option with a strike price below the current market price of the underlying asset. By doing so, the trader hedges against the risk of a decline in the asset’s price. If the asset’s price falls, the trader can exercise the put option to sell at a price higher than the current market value, thereby limiting potential losses.

What Category Futures Options Normal Trading

Image: www.pinterest.com

Conclusion

Futures options, with their inherent flexibility and strategic advantages, have emerged as indispensable instruments in the contemporary trading landscape. These instruments empower traders to actively engage in price speculation and risk management, enhancing opportunities for potential profit. Whether you envision your future as a seasoned options trader or seek to further augment your existing knowledge, delving into the intricacies of futures options trading offers a rich path toward professional growth and financial empowerment.