Masterclass in Managing Risk and Maximizing Returns

Warren Buffett, the legendary “Oracle of Omaha,” is renowned not only for his long-term investment strategy but also for his conservative approach to option trading. Despite the potential for substantial profits, Buffett exercises caution in navigating this complex financial instrument, prioritizing risk management and measured gains over aggressive speculation.

Image: www.timesnownews.com

Understanding Buffett’s Option Trading Strategy

Buffett believes that options should primarily serve as a defensive tool rather than a means of speculative investing. He typically uses protective put options to hedge against potential losses in his stock portfolio. By purchasing put options, Buffett sets a price floor below which his investments cannot fall, thus limiting downside risk.

In essence, Buffett employs options as a safety net, ensuring that his investments maintain a certain level of value even during market downturns. This approach reflects his philosophy of preserving capital above all else, acknowledging that minimizing losses is as important as maximizing gains.

Key Principles of Buffett’s Option Strategy

- Purchase protective puts: Buffett favors buying out-of-the-money put options, which have a lower premium but provide downside protection.

- Short-term duration: He typically holds options for a short period, usually less than a year. This limits the time premium erosion.

- Modest leverage: Buffett uses options sparingly as a supplement to his overall investment strategy, rather than as the primary driver of returns.

- Intrinsic value focus: He selects options with intrinsic value, meaning they represent the difference between the option’s strike price and the underlying asset’s current price.

- Patience and discipline: Buffett approaches option trading with a patient and disciplined mindset, focusing on long-term returns and avoiding short-term fluctuations.

Real-World Examples of Buffett’s Option Strategy

In 1987, the infamous Black Monday crash wiped out over 20% of the Dow Jones Industrial Average in a single day. Yet, Buffett’s Berkshire Hathaway emerged largely unscathed, largely due to his prudent use of option contracts. He had purchased protective put options on the S&P 500 index, offsetting the massive losses in the underlying stock market.

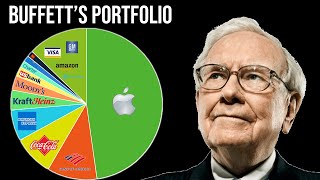

More recently, Buffett deployed his option strategy to hedge his substantial holdings in Apple stock. In April 2017, he purchased more than 16 million call options on Apple, granting him the right to purchase additional shares at a fixed price. By holding these options, Buffett protected his investment against potential declines in Apple’s stock price while still benefiting from its potential upside.

Image: kenyanwallstreet.com

Benefits and Considerations of Buffett’s Approach

Buffett’s option strategy offers several advantages, including:

- Risk mitigation: Protective puts provide a buffer against market volatility and potential losses.

- Diversification: Options can enhance diversification within an investment portfolio.

- Return enhancement: In some cases, options can generate additional income through premium payments.

However, it’s important to note that option trading also carries certain risks:

- Time decay: Options lose value over time, even if the underlying asset price remains unchanged.

- Complexity: Options can be complex and difficult to understand for beginners.

- Opportunity cost: Holding options can result in missed opportunities for more lucrative investments.

Warren Buffett Option Trading Strategy

Image: www.marketwatch.com

Conclusion

Warren Buffett’s option trading strategy represents a masterclass in risk management and long-term investment success. By utilizing protective puts sparingly and with a disciplined approach, Buffett has consistently safeguarded his investments against market volatility, preserving capital and maximizing returns over the long haul. While option trading can be a powerful tool, investors should carefully consider the risks and complexities involved before adopting Buffett’s strategy.