Introduction

Warren Buffett, the legendary investor, has been hailed as the “Oracle of Omaha” for his unparalleled success in value investing. While Buffett is primarily known for his long-term investment strategy, he has also been known to dabble in options trading. In this article, we will delve into the world of Buffett’s options trading, exploring his strategies, perspectives, and the lessons we can learn from his approach.

Image: www.investmentwatchblog.com

Buffett’s Early Encounters with Options

Buffett’s initial foray into options trading occurred in the 1950s, when he was a young investor. Options were still a relatively new concept at the time, and Buffett was skeptical of their potential. However, after some initial losses, he began to appreciate the power of options as a tool for managing risk and enhancing returns.

Buffett’s Strategies for Options Trading

Buffett’s options trading strategies are characterized by their simplicity and risk mitigation. He primarily employs two main approaches:

-

Covered calls: This involves selling call options against stocks he already owns. By doing so, he can generate additional income while limiting his potential downside risk.

-

Protective puts: Buffett uses protective puts to protect his long-term stock investments from sudden market downturns. By purchasing put options, he can set a floor below which the stock price cannot fall, effectively limiting his losses.

Buffett’s Perspective on Options Trading

Buffett views options trading as a useful tool, but he emphasizes caution and discipline. He believes that options should only be used by sophisticated investors who fully understand the risks involved and have a long-term investment horizon.

In his book, “The Intelligent Investor,” Buffett cautions against “excessive overconfidence” in using options. He advises investors to avoid speculative trading and to focus instead on using options responsibly for risk management and occasional profit enhancement.

Image: wealthfit.com

Buffett’s Lessons for Options Traders

From Buffett’s approach to options trading, we can glean several valuable lessons:

-

Prioritize risk management: Options can be a powerful tool for mitigating risks, but they should not be used recklessly. Always ensure that your options strategies align with your risk tolerance and investment objectives.

-

Avoid excessive speculation: Options trading is not a get-rich-quick scheme. Avoid buying options simply because you think the stock price will rise. Instead, use options for strategic purposes within a larger investment plan.

-

Educate yourself thoroughly: Options trading can be complex. Before you dive into the market, take the time to understand the different types of options, their uses, and the risks involved.

-

Emphasize patience and discipline: Options trading requires patience and adherence to your strategies. Don’t let market fluctuations distract you from your long-term goals.

Buffett Trading Options

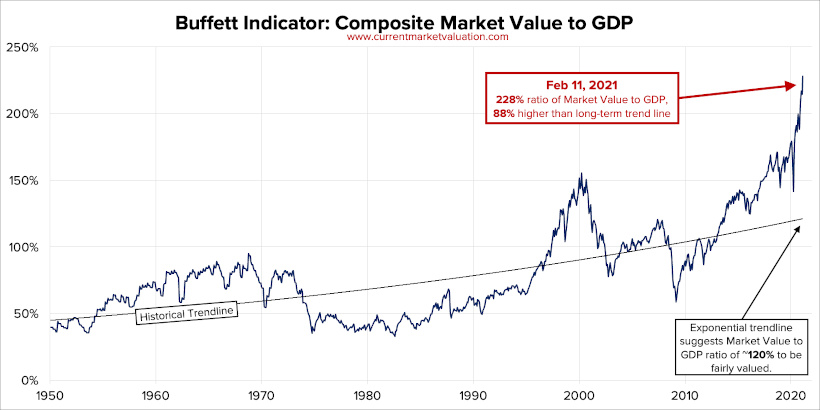

Image: kimblechartingsolutions.com

Conclusion

Warren Buffett’s use of options trading provides valuable insights into the mind of one of the world’s most successful investors. By understanding Buffett’s strategies, perspectives, and lessons, we can learn to navigate the complexities of options trading with greater confidence and potentially enhance our investment returns. However, it is crucial to approach options trading with prudence and discipline, ensuring that it aligns with our overall investment objectives and risk tolerance.